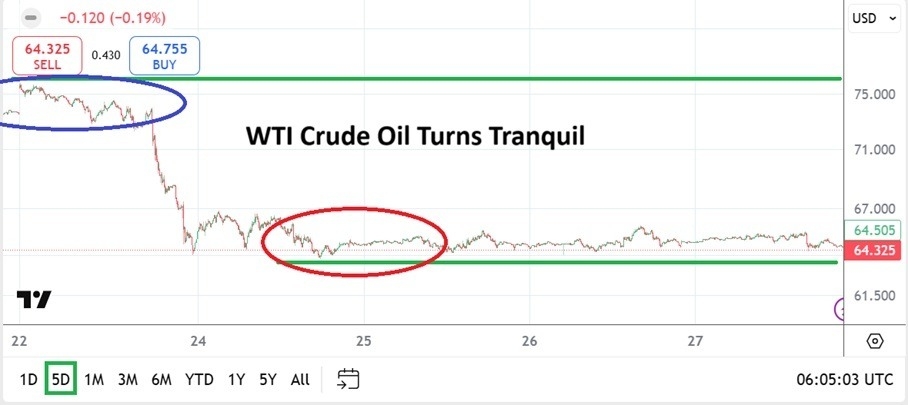

- WTI Crude Oil will start tomorrow’s trading below the 65.000 USD level unless there is a violent spike upwards upon the opening as the week begins.

- Last week and before saw price velocity and violent speculative action as WTI Crude Oil reacted to the conflict between Iran and Iran. WTI Crude Oil moved fast upon last Mondy’s opening jumping to nearly the 75.850 vicinity, but by the end of trading on the 23rd of June was hovering slightly above the 64.000 mark.

- Trading action on Tuesday did see some fast trading as values climbed above the 66.000 level. But within a handful of hours, the price of WTI Crude Oil began to trade almost sluggishly and a range between 64.050 and 65.500 became commonplace the remainder of the week.

- Large traders clearly felt comfortable with the announced ceasefire in the Middle East and risk premium evaporated from WTI Crude Oil. Friday’s close was near 64.330.

If day traders were pursuing WTI Crude Oil the past two weeks, they certainly had a taste for speculative adventure in the commodity. Traders anticipating that WTI Crude Oil would jump above 80.000 USD a barrel were likely disappointed. The fact that WTI Crude Oil remained relatively calm during the entire stretch of the Iranian and Israeli conflict showed that large institutions involved in the energy sector are experienced. They also had reasons to believe that Iranian oil production and supply would not be destroyed.

The ability of WTI Crude Oil to stay below the 76.000 ratio, and then stampede lower upon the announcement of a ceasefire shows that fast information available to large commercial traders helped create calm. WTI Crude Oil has returned to its known price range before hostilities broke out in the Middle East. Now traders can trade the commodity again relatively carefree.

Traders who remain unconvinced that the ceasefire will hold between Iran and Israel are free to try and search for outlandish moves upwards. However, it appears that tensions in the Middle East in the near-term between Iran and Israel are going to remain quiet.

- Traders should adjust their mindsets to the notion again of cheap WTI Crude Oil.

- The inability the past two weeks to not even trade at highs seen in the second week of January, when the commodity touched the 79.000 level shows large trading firms in WTI know there is plenty of supply.

- If conditions remain calm in the Middle East, looking for lower prices after perceived near-term resistance levels are touched may prove attractive.

- Trading this week in WTI Crude Oil will get attention, but likely be used as a barometer to show global investors calm has prevailed.

WTI Crude Oil offered speculators two full weeks of volatility and now the price of the commodity has returned to known values. Equilibrium will be tested certainly, but the past four days of trading in oil have been steady and traders should expect rather tranquil conditions to remain. Certainly if a trader is worried about potential conflict happening again in the Middle East they can wager on this notion, but it will be best done by using call options in the futures market to protect against what will likely remain rather undramatic days ahead.

The price of WTI Crude Oil will need risk management as always and speculators should not get overconfident about upside. The more interesting question in the coming days will be about support levels and seeing if the price of WTI Crude Oil can fall below 64.000 and begin to traverse lows seen in the second week of April until late May.

Ready to trade our weekly forecast? Here’s a list of some of the best Oil trading platforms to check out.