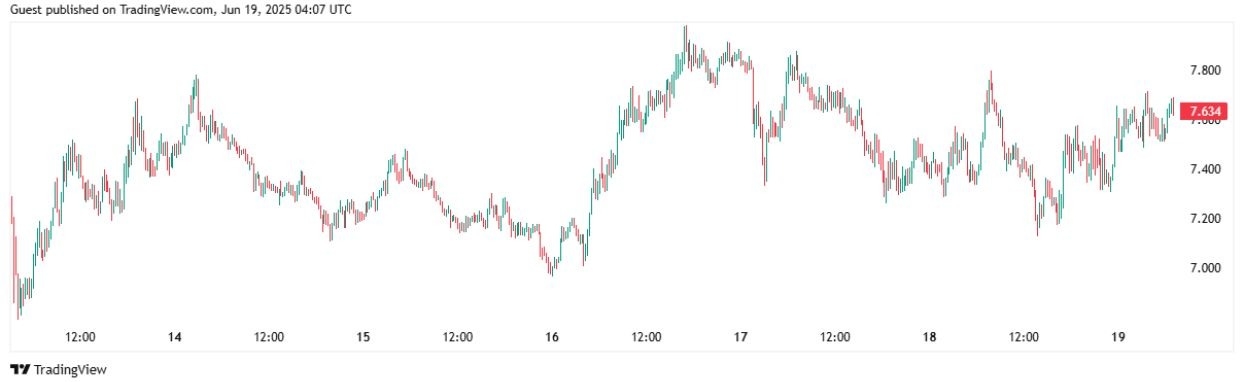

Uniswap (UNI) is trading at around $7.65, reflecting a modest 1.6% increase over the past 24 hours.

The cryptocurrency has oscillated within a tight range today, with intraday highs touching $7.76 and lows dipping to $7.16.

UNI’s recent price behavior suggests consolidation just beneath a critical resistance level at $7.70.

The Relative Strength Index (RSI) stands at approximately 57. This indicates mildly bullish momentum, but no clear overbought condition.

As for the Moving Average Convergence Divergence (MACD), it remains in positive territory following a recent bullish crossover. While not aggressive, the signal favors continuing upward pressure.

The Stochastic RSI hovers between 60 and 70, reinforcing the short-term positive bias. Meanwhile, the Average Directional Index (ADX) sits near 29.5, which confirms a trend that is gaining strength but not yet overextended.

UNI is trading above its 20-day, 50-day, and 100-day exponential moving averages, which currently cluster between $6.90 and $7.50. This alignment supports the bullish outlook.

However, the 200-day moving average, now near $7.60–$7.78, continues to act as resistance. A sustained break above this range would validate a longer-term bullish reversal.

Uniswap (UNI) Price Chart | Source: TradingView

The price is now approaching a decision point. A close above $7.70 would mark a decisive breakout and could trigger momentum toward $8.00 and beyond.

Otherwise, failure to hold the $7.14–$7.20 support zone may prompt a correction to the $6.90 level, where the 50-day average offers structural support.

While UNI-specific on-chain data remains relatively stable, broader DeFi metrics point to a strengthening environment.

Total value locked (TVL) on Uniswap has stabilized above $4.1 billion. Institutional wallets and DeFi aggregators have been accumulating UNI since early May, which shows confidence in the protocol’s long-term utility and governance value.

The uptick in user interaction with Uniswap smart contracts and rising protocol usage further supports a constructive outlook. These trends suggest the recent price action is driven more by fundamental participation than speculation.

Immediate support lies at $7.14, with stronger technical support near $6.90. If those levels break, deeper support can be found between $6.50 and $6.20.

On the upside, resistance is clearly defined at $7.70. A close above this level would open the door toward $8.70, $9.20, and potentially $10.30 based on Fibonacci extension levels.

Uniswap’s current consolidation near $7.65, supported by improving technical signals and steady protocol engagement, sets the stage for a potential breakout.

While the trend remains constructive, confirmation is needed. A decisive move above $7.70 could ignite a rally toward the $8.00–$9.00 range.

Until then, traders should monitor key support and resistance zones closely, as well as shifts in broader market sentiment.

Ready to trade with our crypto forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.