A week of mixed central banks’ interest rate decisions should see the European Central Bank (ECB) tapping the “pause” button amid ongoing trade uncertainty and inflation pressure hovering around the bank’s target. In the same line, the Hungarian central bank (MNB) would stay on the sidelines once again, alongside the People’s Bank of China (PBoC). Snapping the trend, the Central Bank of the Republic of Türkiye (CBRT) is widely anticipated to lower its rates.

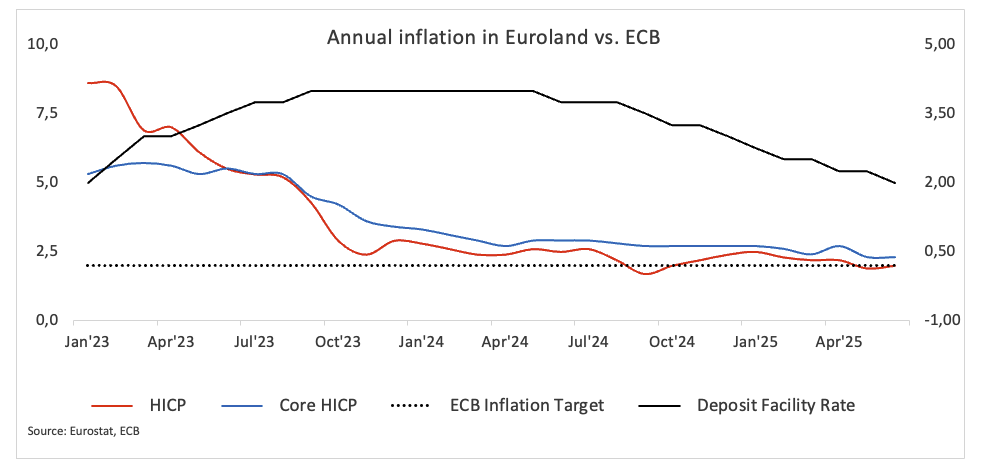

European Central Bank (ECB) – 2.00%

The ECB is seen keeping its Deposit Facility Rate unchanged at 2.00% at its July 24 event. Indeed, swap markets have effectively dismissed the likelihood of a July rate cut and are anticipating only a single 25-basis-point reduction in the upcoming year. This meeting will primarily depend on the ECB’s existing evaluation of inflation and growth, as there are no new economic projections expected until September.

Indeed, the threshold for additional easing has grown with the past few meetings. In June, services inflation was recorded at 3.3% over the past twelve months, indicating the need for it to consistently align more closely with the target.

Meanwhile, the most recent fundamental data points to a fragile recovery, amid investors’ expectations that the bank is nearing the end of its rate-cutting phase.

Given the ongoing uncertainty and the absence of new staff forecasts until September, it is probable that the Governing Council will adhere to its “meeting‑by‑meeting, data‑dependent” approach, which is a fundamental aspect of its recently established “agile” strategy.

Moving forward, the timing and scale of any further rate cuts would hinge on two pivotal questions: what effect the tug‑of‑war between US trade policy and European fiscal easing would have on inflation, and how much a firmer Euro (EUR) might weigh on price pressures.

Upcoming Decision: July 24

Consensus: Hold

FX Outlook: EUR/USD appears to have met some decent contention in the mid-1.1500s for the time being. The idea that the ECB’s easing cycle might be near its end could limit the downside potential, although trade jitters as well as the Fed’s plans could keep spot under further pressure.

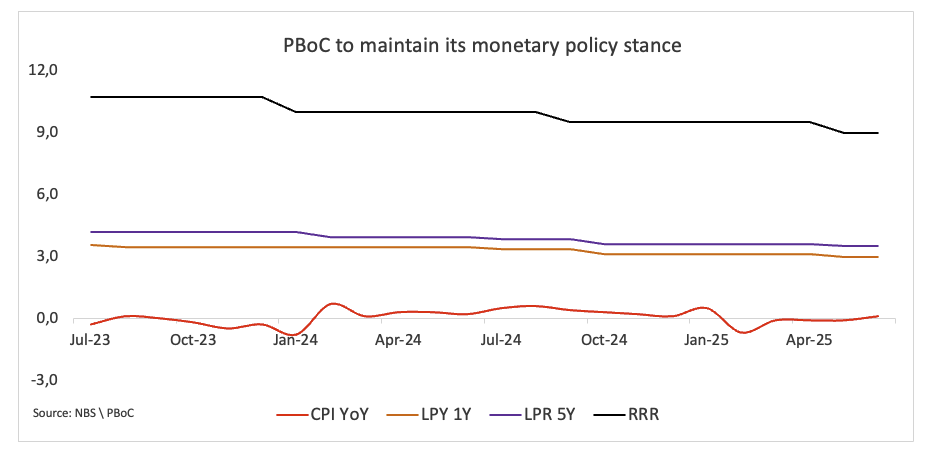

People’s Bank of China (PboC) – 3.00% / 3.50%

As Beijing readies for the PBoC meeting on July 21, policymakers are balancing external headwinds against the urgent need for a domestic rebound. Near‑term stability hinges on sealing a US trade deal, a breakthrough that must take precedence over fresh stimulus.

Spring data delivered a mixed signal. While Q2 GDP rose 1.1% QoQ and 5.2% YoY, roughly meeting Beijing’s 5% target, June’s headline CPI barely budged, up just 0.1% from a year earlier and stoking deflationary concerns.

Behind the scenes, the PBoC appears to be planning to reduce its key policy rate by an additional 10 basis points in Q4 2025. These slight changes highlight a prudent central bank, cautious about overextending until the uncertainty surrounding US-China trade subsides.

Meanwhile, talk of another 50‑basis‑point trim to the reserve requirement ratio persists. Such a move would unlock fresh liquidity for banks, but only once the PBoC is confident international headwinds have eased.

Upcoming Decision: July 21

Consensus: Hold

FX Outlook: USD/CNH appears somewhat stabilised in the lower end of the yearly range around the 7.1800 zone, always closely watching trade developments and policy decisions by the PboC. While below its 200-day SMA just beneath 7.2400, further selling pressure should not be ruled out.

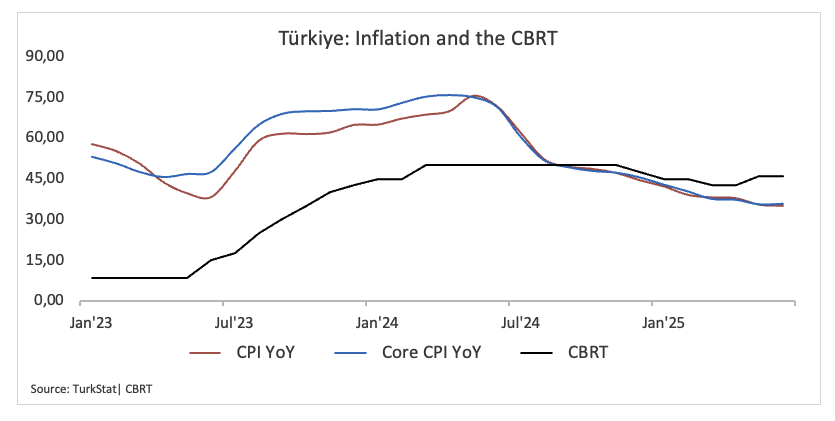

Central Bank of Türkiye (CBRT) – 46.00%

As Ankara gears up for the CBRT’s rate decision on July 24, all eyes are on whether policymakers will press the easing pedal once more. The consensus view is a hefty 250‑basis‑point cut, taking the benchmark rate down to 43.50%.

Yet the lira’s persistent slide and last month’s stalling in core inflation have injected fresh caution into the boardroom. If the bank opts for a second straight hold, it will underscore a growing tension between President Erdoğan’s appetite for lower rates and the hard reality of a currency under sustained selling pressure.

Looking beyond Thursday, swap markets are braced for far deeper cuts: analysts see a total of 1000 basis points of easing over the next six months and as much as 1600 basis points by this time next year.

Such aggressive expectations reflect the prevailing belief that Ankara will continue to lean into monetary stimulus, even if it comes at the expense of the lira.

Upcoming Decision: July 24

Consensus: 250 basis point cut

FX Outlook: There seems to be no stopping for the selling pressure on the Turkish Lira (TRY). Indeed, USD/TRY rose to fresh four-month highs on Friday, remaining firmly en route to challenge its all-time high near 40.5000 anytime soon. TRY has been on a sustained depreciation since 2020, with the trend gathering steam since late 2021.

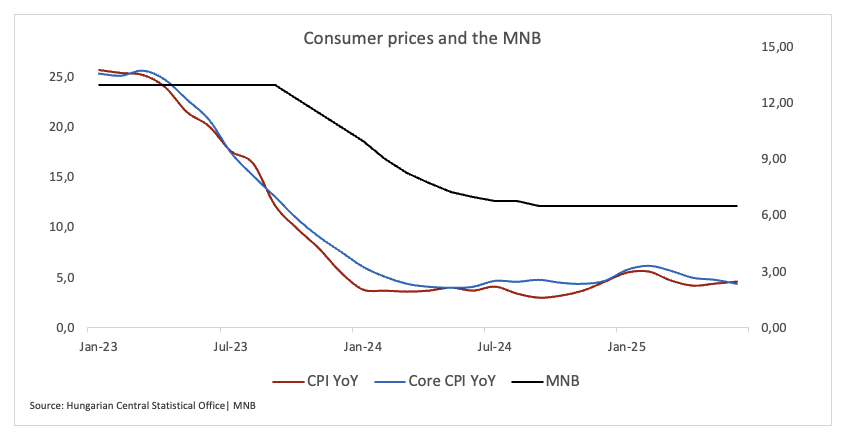

Hungarian Central Bank (MNB) – 6.50%

The MNB left its policy rate unchanged at 6.50% at its late June meeting. The decision followed the need for the central bank to maintain tight monetary conditions to control persistent inflation, which was expected to surpass its target band throughout the year, even as the economy struggled to achieve any growth for the third consecutive year.

Hungary’s headline inflation rebounded to 4.6% in June, while the core gauge eased a tad to 4.4% from a year earlier.

According to the latest Minutes, Hungary’s central bank has emphasised the need for tight monetary conditions to manage inflation, which is expected to exceed its target band for the year. In June, headline inflation rose to 4.6%, driven by rising food and services prices. The bank expects to reach its 3% inflation target in early 2027, with upside risks from tariffs, food, and services and downside risks to economic growth at 0.8% for this year.

In addition, most members of the council believed that a tight monetary policy was still required. Several decision makers had also highlighted that maintaining a positive real interest rate was vital for both reaching the inflation objective and keeping the financial markets stable.

Upcoming Decision: July 22

Consensus: Hold

FX Outlook: The Hungarian Forint (HUF) has been trading in a consolidative range vs. the European currency

since late June, motivating EUR/HUF to navigate between 401.00 and the low 397.00s. In the longer term, as long as the price remains below the key 200-day SMA around 404.50, further downside potential in the cross is likely.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.