The Antipodeans take centre stage this week, although their monetary policy decisions are seen diverging. On another page, the Malaysian central bank and the central bank of South Korea are expected to keep rates unchanged, deferring any potential rate cuts for later in the year.

Reserve Bank of Australia (RBA) – 3.85%

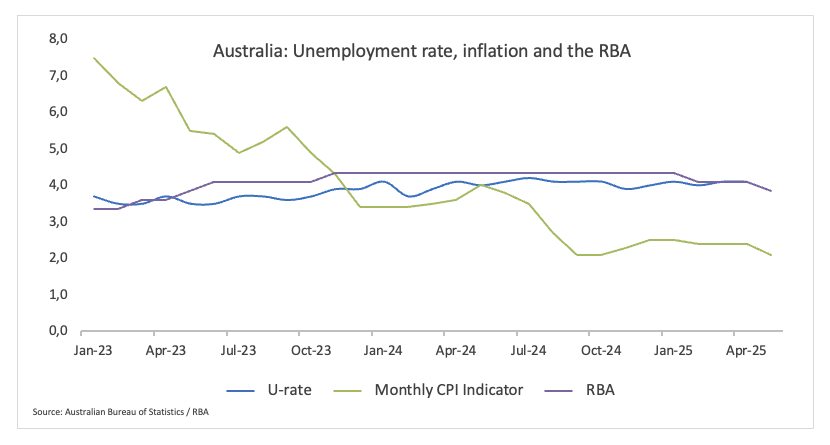

Market analysts anticipate that the Reserve Bank of Australia will reduce its benchmark interest rate by 25 basis points during the policy meeting scheduled for July 8.

As inflationary pressures continue to wane in the domestic economy and growth prospects are downgraded, the central bank may consider further easing measures following the interest rate cut implemented in June. Despite the recent signs of a cooling labour market, it continues to show resilience, which could pose a potential challenge for ongoing rate reductions.

Furthermore, in early June, RBA Assistant Governor Sarah Hunter expressed concerns that rising US tariffs could negatively impact the global economy and lead to decreased prices for traded goods in the short term. However, she noted that determining the precise effects is difficult due to ongoing policy uncertainties.

It is worth recalling that concerns regarding the potential impact on Australia’s economy and labour market played a significant role in the bank’s decision last month to lower its cash rate to a two-year low of 3.85%. The bank also indicated the possibility of further easing in the coming months.

Upcoming Decision: July 8

Consensus: 25 basis point cut

FX Outlook: AUD/USD is attempting to convincingly break above its multi-week consolidative phase. A break above its YTD peak at 0.6590 (July 1) should open the door to extra gains in the near term, with immediate target at the November 2024 top at 0.6687 (November 7).

Reserve Bank of New Zealand (RBNZ) – 3.25%

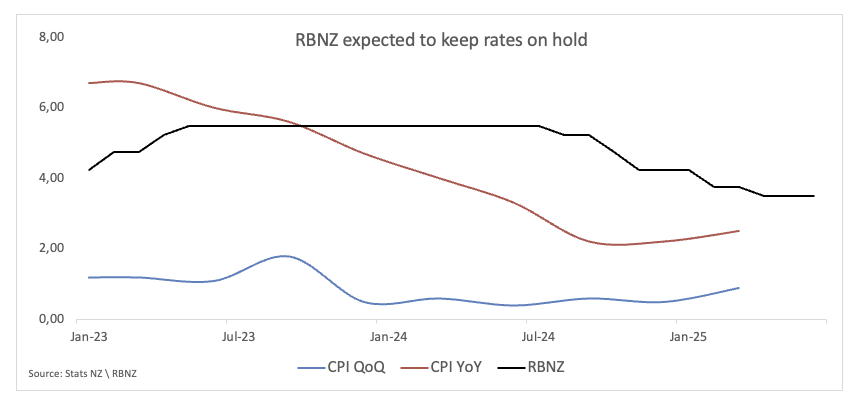

RBNZ Chief Economist Conway delivered dovish comments in early June. Conway stressed that “underlying inflation continues to ease” and that “the labour market’s a bit softer” than the unemployment rate suggests. Nevertheless, the RBNZ signalled at its May 28 meeting that the easing cycle is on pause for the time being.

Governor Hawkesby emphasised that a further cut in the OCR is not a certainty when they meet again in July. We’re really more in a phase where we are taking considered steps, data dependent.”

While the swaps market sees 20% odds of a July rate cut and 25 basis points of total easing over the next 12 months, a Reuters poll suggested the bank is set to maintain interest rates at their current level in July. The median projection is that this year there would only be one more 25 basis point reduction, down from the two cuts that were expected in a poll done in May.

The RBNZ has cut rates by 225 basis points since August, after one of the most severe tightening cycles in its history to keep inflation in check.

With inflation now safely inside the bank’s 1–3% goal zone and unemployment climbing to a more than four-year high of 5.1%, the bank seems to have leeway to continue its easing cycle amid signs of economic recovery following last year’s recession.

Upcoming Decision: July 9

Consensus: Hold

FX Outlook: NZD/USD advanced to fresh yearly peaks north of 0.6100 the figure at the beginning of July, albeit meeting some selling pressure afterwards. While above its key 200-day SMA near 0.5860, the pair’s outlook is predicted to remain constructive, with the immediate target at the September 2024 peak at 0.6379 (September 30).

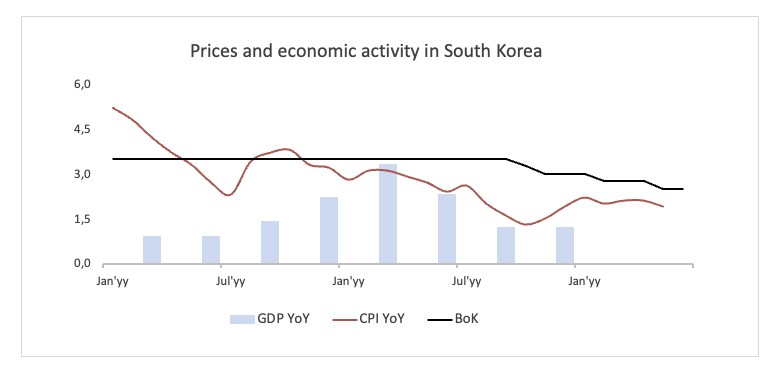

Bank of Korea (BoK) – 2.50%

The BoK lowered its policy rate by 25 basis points to 2.50% at its May 29 meeting in a context of persistent uncertainty surrounding the White House’s trade policies.

According to the Minutes of that policy meeting, board members expressed that it was necessary to continue easing monetary policy to support economic growth while also exercising caution regarding the associated risks.

One member highlighted the significance of evaluating the risks linked to additional rate cuts and adjusting the pace as necessary, referencing instability in housing prices.

In addition, members suggested that a well-calibrated policy mix was needed, which would combine continued monetary easing with focused fiscal and financial measures aimed at supporting the vulnerable sectors.

Members observed that it was important to take into account the changes in US tariff policies and adjustments in monetary policy, along with domestic economic policies under a new administration, when assessing the potential for any additional rate cuts.

Upcoming Decision: July 10

Consensus: Hold

FX Outlook: The South Korean Won (KRW) has given away some ground after reaching new highs vs. the US Dollar (USD) in late June. That said, USD/KRW has bounced off levels last seen in early October 2024 below the 1,350 level and revisited that 1,370 zone earlier on Monday. Rising anxiety over US trade policy has been almost entirely responsible for the notable increase in Asian FX as of late, leaving the door open for extra appreciation of the KRW in the short-term horizon.

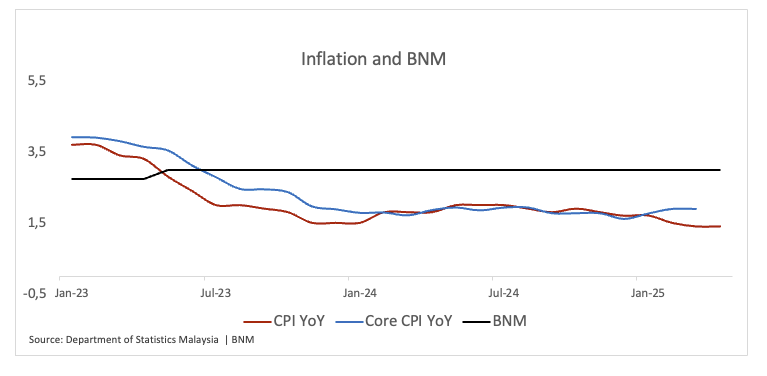

Bank Negara Malaysia (BNM) – 3.00%

The timing of any modification in the bank’s monetary policy is intended to remain data-dependent.

Meanwhile, tariff and trade dynamics continue to shape the scenario both for the BNM and for the Rinnggit. The impending July gathering coincides with the end of a 90-day reciprocal tariff break, while a US-China trade truce, effective from May 14 to August 12, could pave the way for more discussions and a possible agreement. This timeframe may enable the Bank Negara Malaysia (BNM) to take a more cautious and careful approach.

However, the outlook remains clouded by uncertainties about upcoming US sector-specific tariffs, notably those aimed at semiconductors, medicines, timber, and vital minerals. These actions may offer a considerable negative risk to Malaysia’s trade prospects in the near future.

With inflation running at multi-year lows and economic momentum losing impulse, a quarter-point rate cut by the BNM should not be entirely ruled out this week. The broader consensus continues to pencil in two 25-basis-point cuts to the Overnight Policy Rate (OPR) in the second half of 2025, one in each quarter, bringing the policy rate to 2.50% by year-end.

Upcoming Decision: July 9

Consensus: Hold

FX Outlook: The Malaysian Ringgit (MYR) has lost some impulse in the past few days following multi-month highs vs. the US Dollar (USD), with USD/MYR slipping back below 4.1800 on July 1 just to regain momentum afterwards. Further progress on the trade front is expected to maintain the risk-on trade in place, which should in turn lend support to MYR. As long as the USD/MYR remains below the 200-day SMA near 4.3800, further downside for the pair is likely.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.