Don’t let your retirement portfolio drift rudderless. Even the best investment plans need regular adjustments. That’s where rebalancing comes in, a key strategy for effectively managing your Individual Retirement Account (IRA), aligning your assets with your retirement planning goals, and reducing long-term risk.

In an uncertain economic environment, where stock markets are sometimes volatile, knowing when and how to rebalance your IRA is becoming an essential skill for anyone wishing to secure their savings for retirement.

Why rebalancing is essential for your IRA

When you establish an investment strategy in an IRA, whether Traditional or Roth, you choose an asset allocation (stocks, bonds, cash, diversified funds, gold, etc.) that reflects your risk profile, investment horizon and retirement goals.

But markets change over time. Some asset classes outperform, others fall, and your portfolio becomes unbalanced.

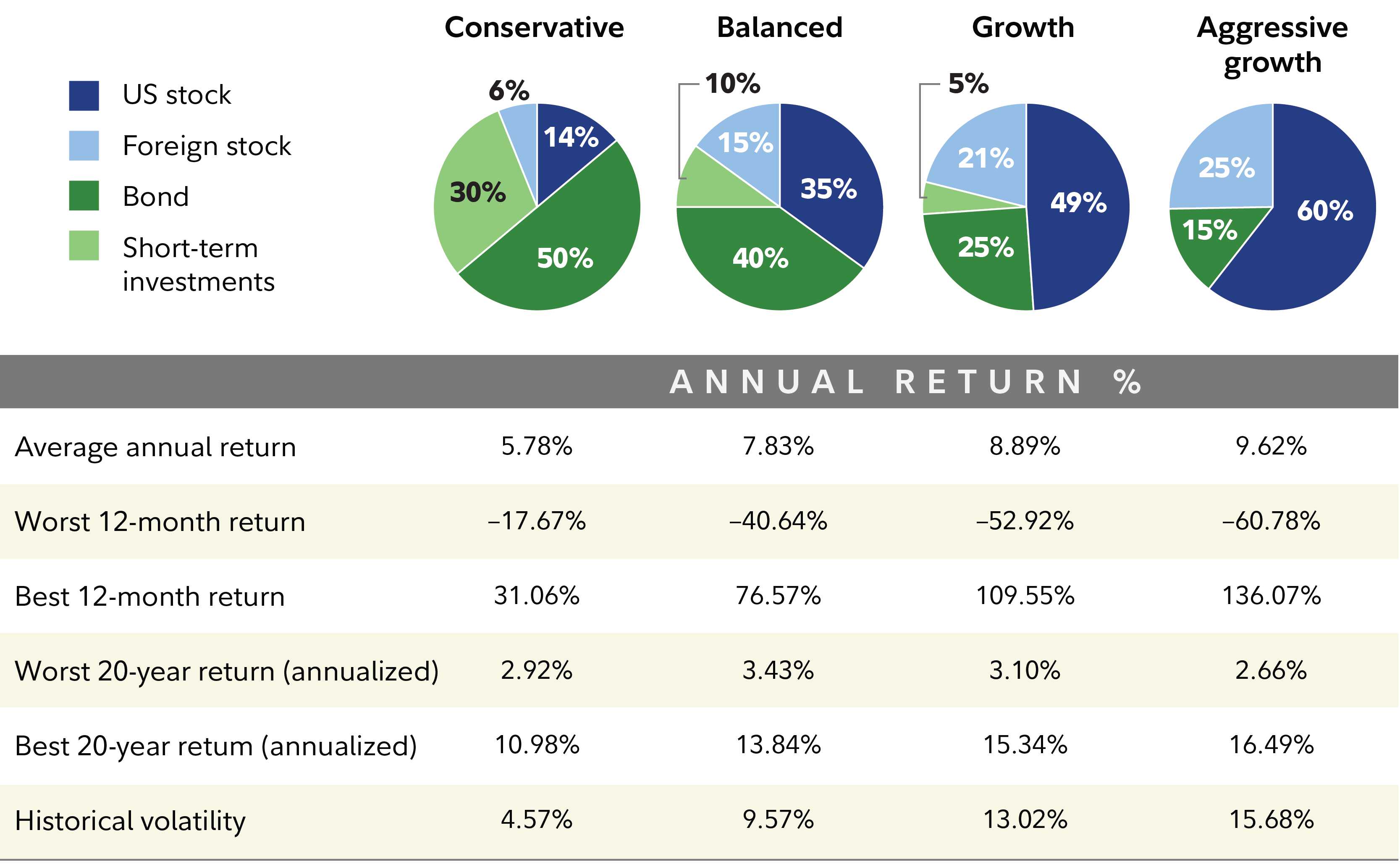

An initial allocation of 60% equities and 40% bonds, for example, may turn into 75%-25% after a year of rising stock markets. This means more risk than you anticipated, or less diversification.

Source: Fidelity

Rebalancing brings your portfolio back to its target allocation. This helps to limit excessive exposure to an asset class that has become dominant, protect your savings from excess volatility, maintain consistent investment discipline, and reinforce regularity in buying undervalued assets and selling overvalued ones.

Over the long term, this methodical approach can have a significant impact on the stability and performance of your retirement portfolio.

How often should you rebalance your IRA?

There is no universal timetable for rebalancing, but two approaches dominate in practice.

The first is to rebalance at a fixed frequency. For example, every year, every six months or every quarter. This method has the advantage of simplicity, establishing a regular routine that avoids impulsive or over-frequent adjustments.

The second approach is based on exceeding predefined thresholds. If an asset class deviates by more than 5% or 10% from its allocation target, an adjustment is triggered. This strategy is more reactive to market movements, but requires continuous monitoring.

Within an IRA, both approaches can be implemented with no immediate tax consequences, since reinvested capital gains and dividends are not taxed as long as the funds remain in the account.

This is a considerable advantage over an ordinary brokerage account and offers greater flexibility for long-term investors.

How to rebalance your IRA?

The first step in rebalancing is to make a clear diagnosis of your current portfolio composition.

This involves measuring the proportion of each asset class (equities, bonds, cash, etc.) and comparing it with your target allocation.

This gap between target and reality will enable you to identify overweighted or underweighted assets.

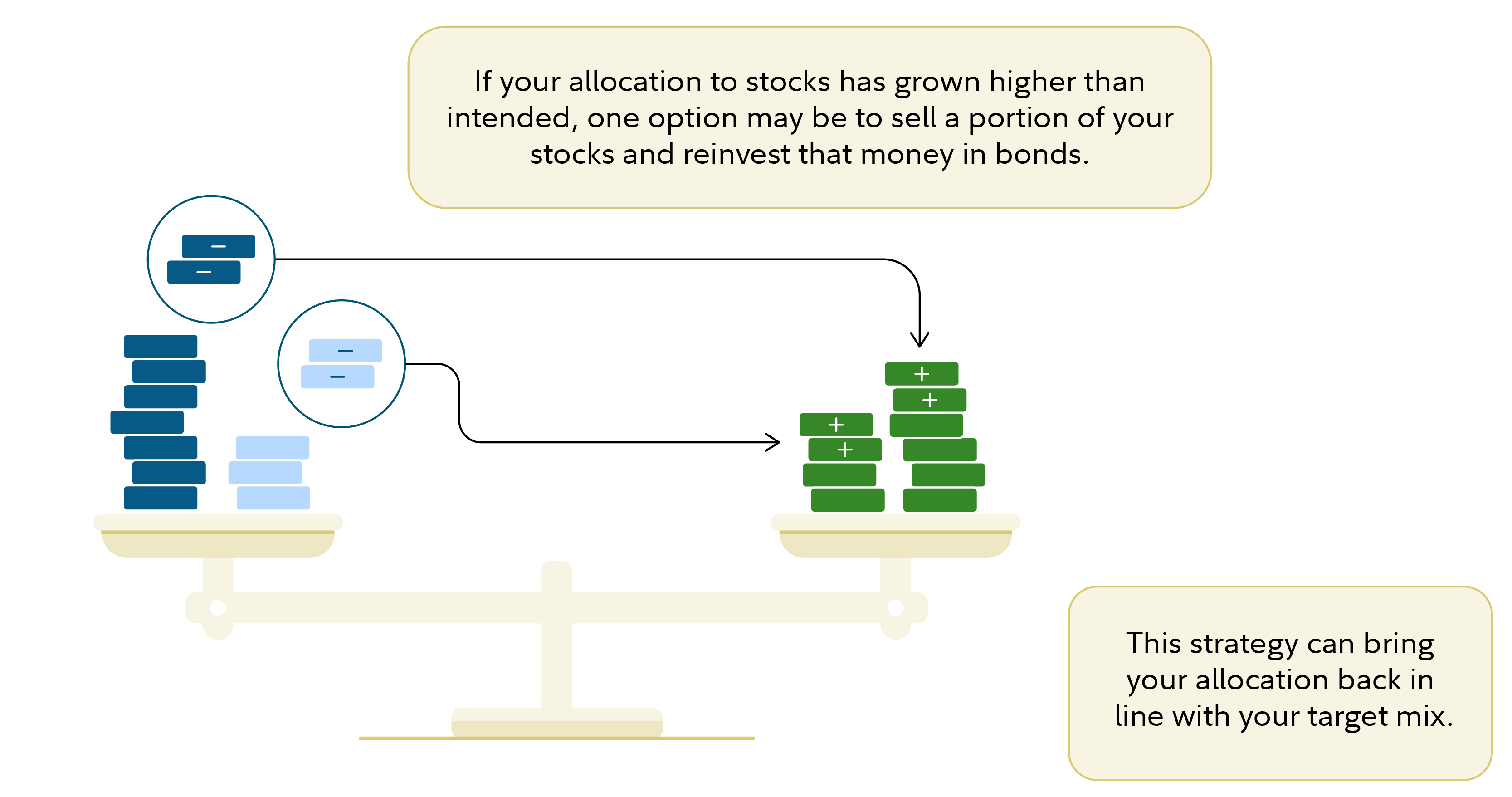

Once you’ve established this, you can make adjustments. In general, this means selling assets that have grown too much and reinvesting in those that have become too little.

In an IRA, these operations are tax-free, making the process simpler than with other accounts.

Source: Fidelity

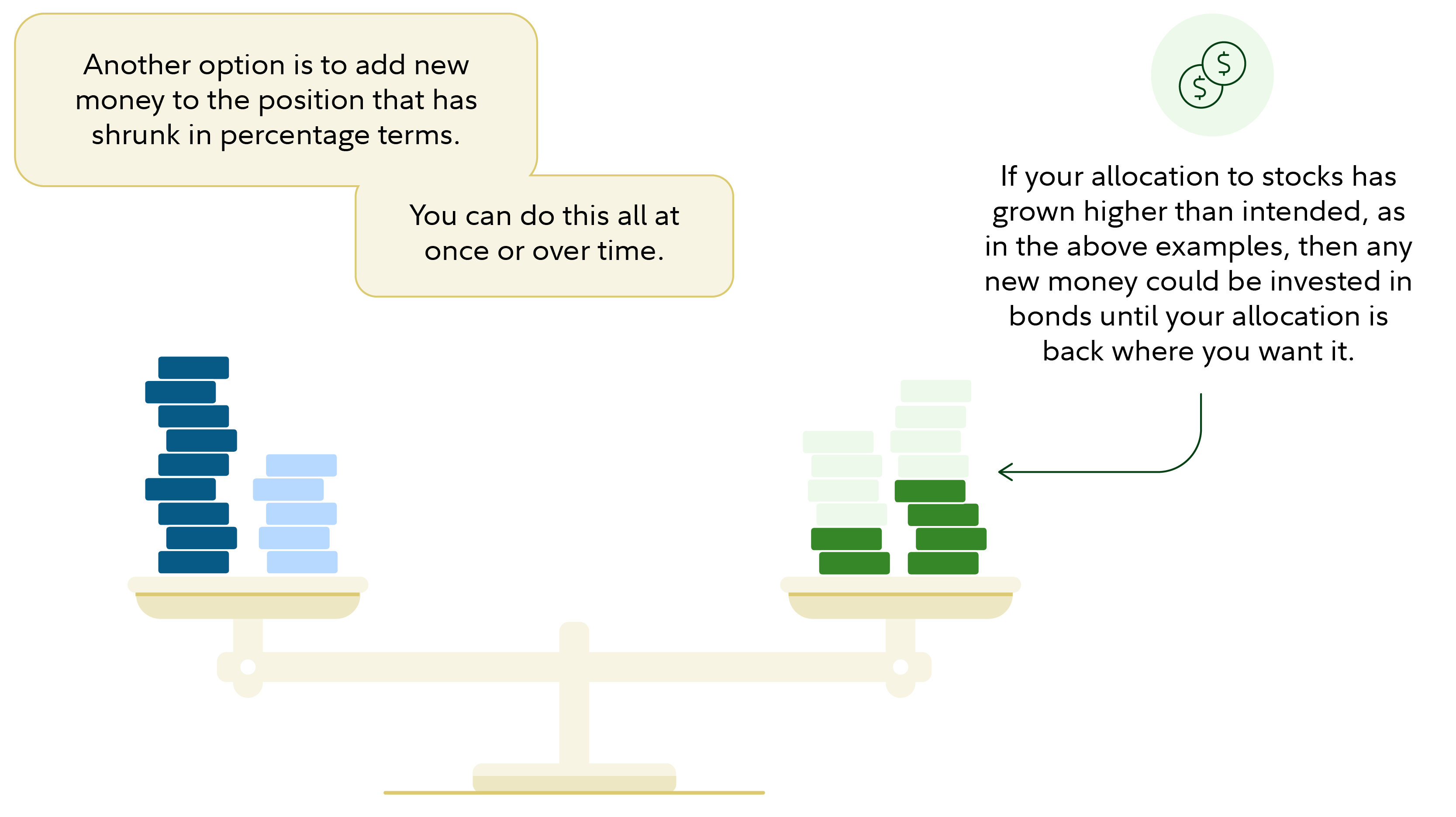

Another method is to use your new contributions to correct imbalances.

If you are still in the savings phase, you can allocate your annual payments to under-represented asset classes, thus avoiding the need to sell excess assets.

Source: Fidelity

From age 73 onwards, Traditional IRA holders are required to withdraw minimum amounts each year within the Required Minimum Distributions (RMDs).

These withdrawals can be a strategic opportunity to rebalance, targeting excess assets to cover RMDs rather than withdrawing randomly.

Finally, it’s important to keep an eye on fees. Although transactions in an IRA do not generate taxes, they can generate costs if they are frequent or involve high-fee funds.

The aim is to rebalance efficiently, without unnecessarily undermining portfolio performance.

Adapting your portfolio as retirement approaches

Rebalancing is not just a response to market fluctuations, it’s also a strategic tool to accompany the passage of time.

As you approach retirement age, it’s essential to gradually adapt your portfolio to reduce risk and secure accumulated gains.

Typically, younger investors can afford a more aggressive allocation, with a large share of equities.

But as you approach your sixties and begin to make withdrawals, this strategy needs to evolve.

A gradual rebalancing towards more bonds, cash or defensive assets can limit the impact of a major stock market correction when you need to dip into your IRA.

Source: Fidelity

This shift in allocation can be made gradually, year after year, through regular rebalancing. This avoids abrupt adjustments and allows you to maintain a stable, consistent trajectory towards your retirement planning goal.

IRA, Social Security and rebalancing: A trio to coordinate

Rebalancing doesn’t happen in a vacuum. It must be part of an overall retirement planning strategy, which also includes your Social Security entitlements.

Why do you need to do this? Because the level of guaranteed income you receive will influence your need to take risks in your portfolio.

For example, a retiree with a full Social Security pension and a paid-up home may need less growth in his or her IRA, and therefore be able to steer his or her strategy towards more bonds or stable investments.

Conversely, an investor whose IRA constitutes the bulk of retirement savings will need to manage his allocation more finely to balance growth and security.

Automatic or manual rebalancing?

Many fund managers and IRA platforms offer an automatic rebalancing service. This is particularly useful for investors who prefer a passive approach.

However, this automation is no substitute for a personalized annual review. Life events such as a change in income, a new family situation or a major market shift may warrant specific adjustments.

The right balance is often a combination of automatic rebalancing for routine adjustments and one-off manual rebalancing in the event of a change in circumstances.

Update your plan, not just your portfolio

Rebalancing your IRA is much more than shifting a few percentages between stocks and bonds.

It’s an opportunity to reassess your retirement goals, adapt your risk level to your situation, and optimize your savings to maximize their long-term effectiveness.

By actively maintaining your portfolio, you ensure that it remains aligned with your real needs, risk tolerance and investment horizon.

As many experts remind us, the greatest risk for a long-term investor is not market volatility, but inaction.

Rebalancing your IRA regularly, taking into account all your resources for retirement, including Social Security, is an important step in any serious retirement planning strategy.

IRAs FAQs

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.