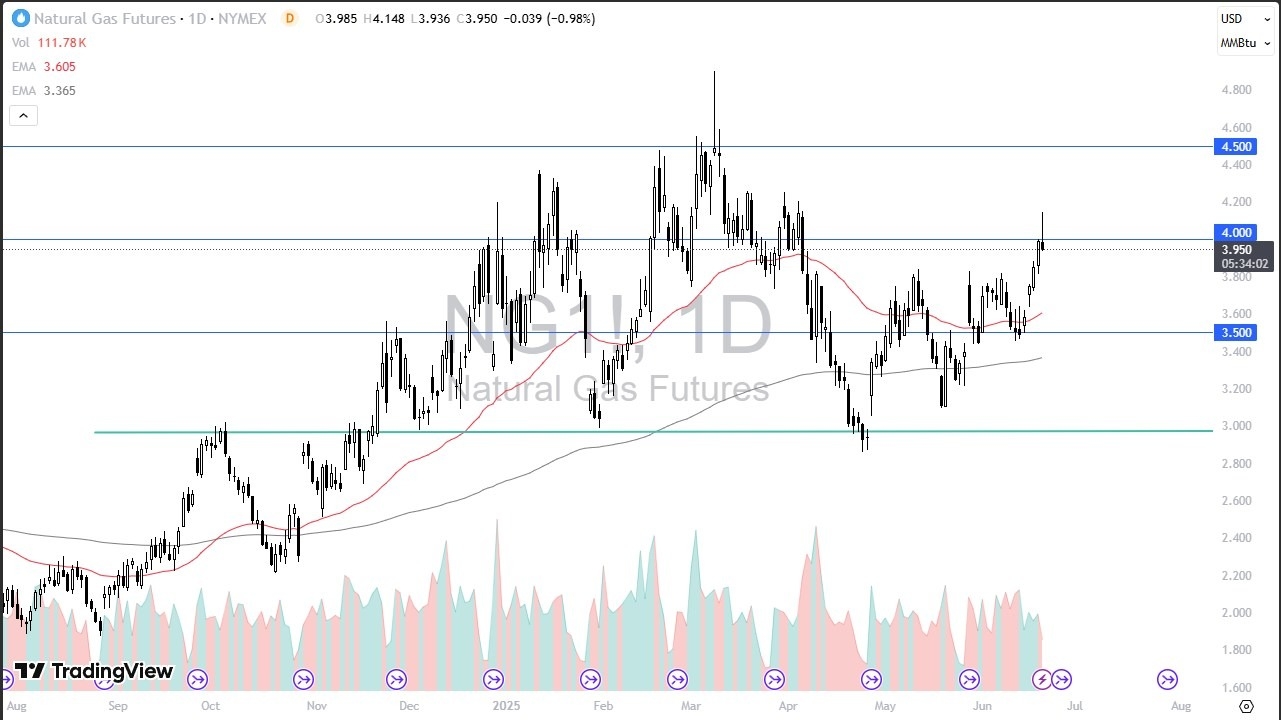

- The natural gas market has shown itself to be initially positive during the trading session on Friday, but we have gotten absolutely hammered later in the day as the area above $4 has offered a lot of supply. And here we are.

- The main thing here is that traders are focusing on the weather in the United States.

- That of course suggests more demand due to the heat wave coming over the next several days.

- Keep in mind that natural gas is burnt to produce electricity in a lot of the East where the heat wave is occurring. So, it made sense that people jumped in and pushed this market higher.

We also have concerns about Iranian gas fields. And with that, the whole war thing has people worrying about the idea of whether or not there will be a shock to supply for other countries, which will then come buy it from the U.S., which is what this contract is based on. However, typically speaking, this time of year isn’t overly bullish. This is a market that got a little too far ahead of itself above the $4 level.

And now it’s starting to flash an exhaustion signal, which is exactly what I was looking for. It’s not that the market can’t go higher from here. Markets can do whatever they want. It’s just that, statistically speaking, you generally see selling pressure this time of year. You’ll notice that we just touched the 61.8 % Fibonacci retracement level.

Potential Short? Maybe.

So that sets it up as a potential short as well. Where would we go? Well, eventually we may go back down to $2.86, but that is a long way from here. I would anticipate that $3.85 would be the first serious signs of support.

Ready to trade daily Forex analysis? We’ve shortlisted the best commodity brokers in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.