NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world.

The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month. The release rocks financial markets for a long time, generally impacting the prices of stocks, Gold, the US Dollar (USD) and many other assets.

This makes it one of the best chances for traders to make a profit, albeit carrying its own set of risks.

Do NFP data provide opportunities for traders?

Yes, plenty.

Nonfarm Payrolls are a critical indicator of the economic health of the United States, which is the world’s largest economy.

Trading around an NFP release is volatile and can be risky because almost all assets tend to move sharply in a matter of minutes, sometimes seconds. While some traders prefer to remain on the sidelines during the event, others find opportunities amid these market swings.

Gold price (XAU/USD) after the release of NFP data for May. Source: FXStreet.

How to trade NFP?

The data comes along with many other indicators related to the labor market. When trading, it is essential to know that the first impact belongs to the headline Nonfarm Payrolls figure – the change in the number of jobs created in the US in a certain month in all non-agricultural businesses. It is expressed in thousands, and it can be positive or negative.

A positive print means that the US economy created new jobs over the month, while a negative one means that employers, on average, shed jobs.

A few days before the publication of the data, dozens of economists and analysts present their estimates of how many jobs they think the US economy created (or destroyed) over the month, forming a consensus.

Any significant deviation from this consensus – how far or close to the actual figure is from what was expected – usually becomes the main factor moving markets.

It is difficult to predict how markets will react, but generally, NFP data that comes above the consensus tends to push shares of US stocks higher as it can imply higher company profits going forward.

However, the context is also important: in the current situation, where the Federal Reserve (Fed), the US central bank, is keeping interest rates high and seems in no hurry to cut them while other central banks have cut rates several times in the current cycle, investors fear that a strong economy will mean ‘higher-for-longer’ borrowing costs. In such a case, stock prices may fall despite the economic strength that the indicator implies.

As for the US Dollar, the reaction is mostly straightforward. A report showing a resilient labor market is generally bullish for the USD as it means a strong economy. On the contrary, a weak report means a softer economy, weighing on the Greenback.

The DXY US Dollar Index fell after the release of May’s NFP report but quickly recovered losses. Source: FXStreet.

However, the US economy leads the world and the US Dollar is the world’s reserve currency.

That makes the US Dollar’s reaction different in times of crisis. If the US economy is struggling, it means other places are doing even worse. A weak NFP report causes people to flee to the safety of the US Dollar. In other words, when things are really bad, the US Dollar can also gain.

For Gold, an NFP report showing a higher-than-expected increase in jobs tends to lead to price declines. On the contrary, a downside surprise – meaning that the economy has created fewer jobs than expected or has even destroyed jobs – supports price increases for the yellow metal.

Apart from the headline NFP, which data do I need to look at?

The headline NFP data is included in the so-called Employment Report.

This includes plenty of other statistics to which traders also pay attention. While the Nonfarm Payrolls headline change causes the first big reaction in markets, the nuances that bring other indicators need to be taken into account once the dust settles as these could even fully unwind the first reaction.

Two more components worth watching. The first one is Average Hourly Earnings, particularly when inflation is high, as these reflect changes in salaries.

When people make more money, higher inflation tends to follow.

When pay falls, price rises tend to moderate.

The second component worth examining is the Unemployment Rate. When markets are worried about an economic recession – when the economy doesn’t grow –, they check out every change in the jobless rate because a quick increase in the Unemployment Rate is an early sign of a recession ahead.

And that’s not all.

In some cases, the NFP report for the current month includes significant revisions for previous releases. While markets are focused on the most recent figures, significant upward revisions make the report look better, and considerable downward revisions make the response worse.

What is expected for June NFP data?

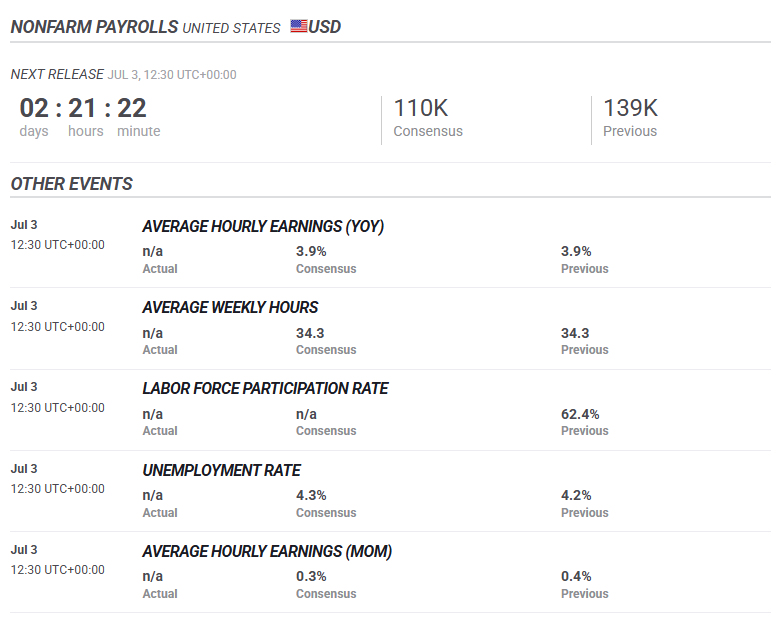

Expected outcomes of the June NFP report. Source: FXStreet.

Nonfarm Payrolls data will be published on Thursday, a day earlier than the usual schedule, due to the Independence Day holiday.

The FXStreet economic calendar points to an increase of 110,000 jobs in June, easing from the 139,000 gained in May. Financial markets also anticipate the Unemployment Rate to tick up to 4.3%.

“Nonfarm Payrolls risks are skewed to the downside,” says Yohay Elam, senior financial Analyst at FXStreet.

A slide in the headline Nonfarm Payrolls below 100,000 would ring alarm bells, sending Stocks and the US Dollar down amid recession fears. Gold, on the contrary, would benefit from a potential decline in Treasury yields as the precious metal has an inverse correlation with returns on American debt, he says.

Meanwhile, a beat on estimates (which would be the fourth consecutive one) would boost the Equities and the Greenback, while weighing on the precious metal, Elam adds.

“A small drop below 100K would seem as a ‘within estimates’ read. However, losing one digit would have an outsized impact on investors. Moreover, markets have gotten used to better-than-expected outcomes followed by significant downward revisions. The bar to beat the consensus is higher this time,” he concludes.

FXStreet covers Nonfarm Payrolls live, providing insights about all the components and their impact on markets.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.