- Gold failed to make a decisive move in either direction.

- The near-term technical outlook highlights XAU/USD’s indecisiveness.

- In the absence of high-impact data releases, markets will scrutinize US tariff headlines.

Gold’s (XAU/USD) trading range narrowed as investors assessed macroeconomic data releases from the United States (US), while keeping the uncertainty surrounding the US’ trade regime in the back of their minds. The Federal Reserve (Fed) will be in the blackout period ahead of the July 29-30 policy meeting and the US economic calendar won’t offer any high-impact data releases, possibly making it difficult for Gold to find direction in the short term. Still, any developments in the trade front or regarding Trump’s threats to fire Fed Chair Jerome Powell could move the needle.

Gold struggles to gather bullish momentum

The US Bureau of Labor Statistics reported on Tuesday that annual inflation, as measured by the change in the Consumer Price Index (CPI), rose to 2.7% in June from 2.4% in May. On a monthly basis, the CPI and the core CPI, which excludes volatile food and energy prices, increased 0.2% and 0.3%, respectively. These figures caused investors to second guess Fed rate cut prospects in September and boosted the US Dollar (USD). In turn, XAU/USD closed the second consecutive day in negative territory.

After stabilizing in the European session on Wednesday, Gold benefited from falling US Treasury bond yields and registered daily gains. Citing multiple sources with direct knowledge of the matter, CBS News reported that US President Donald Trump asked Republican lawmakers whether he should fire Fed Chairman Jerome Powell. This headline weighed on the USD and caused US T-bond yields to turn south. Meanwhile, the data from the US showed that the Producer Price Index (PPI) rose by 2.3% on a yearly basis in June. This reading followed the 2.6% increase recorded in May and came in below the market expectation of 2.5%.

Nevertheless, improving risk mood didn’t allow Gold to preserve its bullish momentum on Thursday. Investors grew optimistic about the US economic outlook after Trump noted late Wednesday that they were very close to a trade agreement with India and added that a deal could also be reached with Europe.

In the second half of the day, upbeat macroeconomic data releases from the US further supported the USD and caused XAU/USD to continue to push lower. Weekly Initial Jobless Claims declined to 221,000 from 228,000 in the previous week and Retail Sales rose by 0.6% in June, beating the market forecast for an increase of 0.1%.

Later in the day, dovish comments from Fed Governor Christopher Waller, who said late Thursday that he continues to believe that the Fed should cut its interest rate target at the July meeting, limited the USD’s gains and helped XAU/USD erase a portion of its daily losses.

Gold investors search for next catalyst

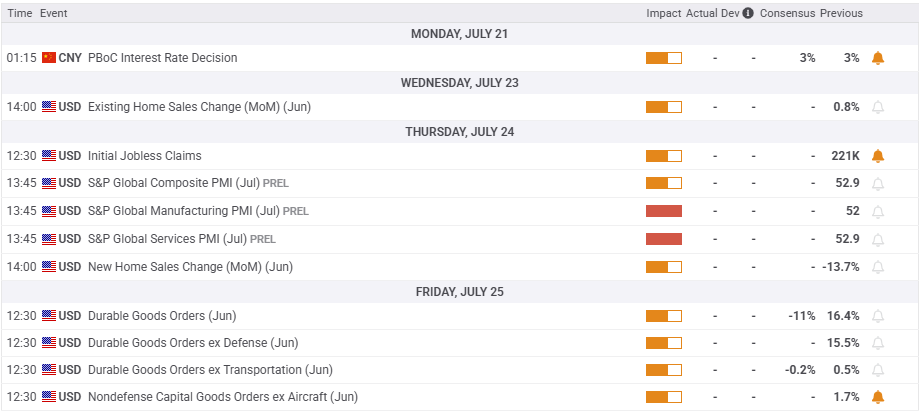

The economic calendar will offer some interesting data releases in the second half of the week, but these are unlikely to have a long-lasting impact on Gold’s valuation.

On Thursday, S&P Global will release the preliminary Purchasing Managers’ Index (PMI) reports for July. In case the Manufacturing PMI and Services PMI come in near or above June’s readings of 52.0 and 52.9, respectively, the USD could preserve its strength and weigh on XAU/USD. Conversely, the USD could come under pressure and help XAU/USD stretch higher if any of the headline PMIs drop below 50.0, indicating a contraction in the respective sector’s economic activity.

On Friday, Durable Goods Orders for June will be the last data release of the week from the US. The market reaction to this data is likely to be straightforward and remain short-lived, with a disappointing print hurting the USD and a positive surprise supporting the currency.

The Fed will be in the blackout period ahead of the July 29-30 monetary policy meeting. Nevertheless, investors will pay close attention to fresh developments surrounding the clash between US President Trump and Fed Chairman Powell.

In case Trump focuses on Powell’s management of the funds in the renovation project and tries to fire him based on that issue, the USD could come under pressure and allow XAU/USD to gain traction. On the flip side, news of the US finding a middle ground in trade relations with major partners, or the Trump administration backing off from Powell, could be supportive for the USD and open the door for another leg lower in XAU/USD.

Gold technical analysis

The Relative Strength Index (RSI) indicator on the daily chart fluctuates in a narrow band at around 50, and Gold struggles to pull away from the 50-day and the 20-day Simple Moving Averages (SMAs), highlighting a lack of directional momentum.

On the upside, $3,400 (static level, round level) aligns as the next resistance level before $3,450 (static level) and $3,500 (all-time high, end-point of the January-June uptrend).

Looking south, the first support level could be spotted at $3,285 (Fibonacci 23.6% retracement) before $3,200-$3,205 (round level, 100-day SMA) and $3,150 (Fibonacci 38.2% retracement).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.