- Gold extended its slide after failing to stabilize above $3,400.

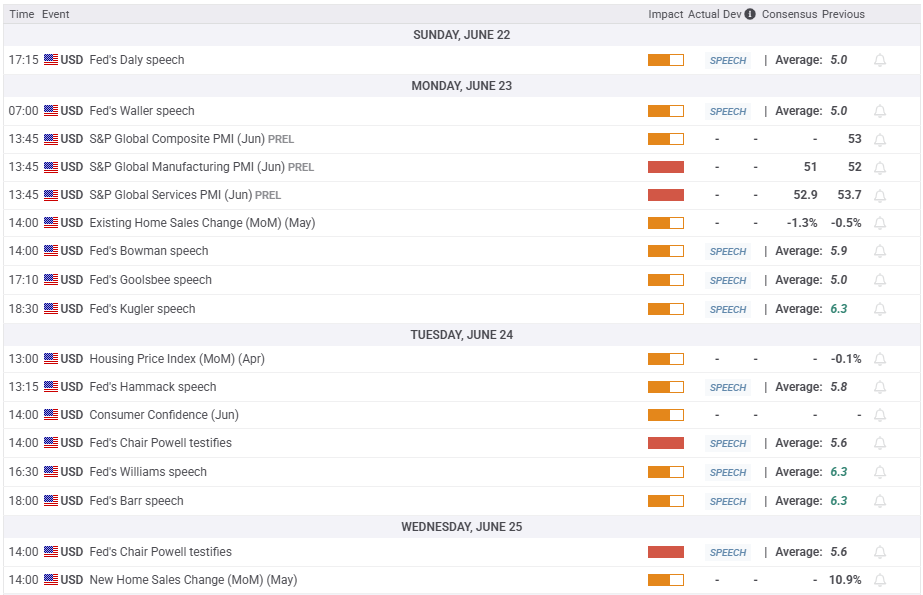

- Fed Chairman Powell will testify on monetary policy.

- The near-term technical outlook suggests that Gold is close to turning bearish.

Gold (XAU/USD) turned south at the beginning of the week and continued to push lower after breaking below $3,400 as price action was largely driven by headlines surrounding the Iran-Israel conflict. The evolution of this weeklong crisis in the Middle East, along with Federal Reserve (Fed) Chairman Jerome Powell’s testimony, could drive Gold’s valuation in the near term.

Gold reverses direction, registers weekly losses

Gold started the week under bearish pressure and lost more than 1% on Monday. Although Israel and Iran exchanged missile strikes over the weekend, safe-haven flows failed to dominate the action in financial markets. United States (US) President Donald Trump said that many meetings were taking place and that there will be peace between Israel and Iran soon. Additionally, the Wall Street Journal reported that Iran was looking to end hostilities with Israel and resume the talks over its nuclear program.

Following Tuesday’s choppy action, Gold edged slightly higher early Wednesday after comments from Trump revived concerns over the US getting directly involved in the conflict in the Middle East. “We now have complete and total control of the skies over Iran,” Trump said and added that Ayatollah Ali Khamenei is “an easy target.”

In the second half of the day, the Federal Reserve’s policy decisions helped the US Dollar (USD) gather strength and caused XAU/USD to stretch lower in the late American session.

The Fed left the policy rate unchanged at the range of 4.25%-4.5% after the June meeting, as widely expected. The revised Summary of Economic Projections (SEP) showed that policymakers are still expecting interest rates to be lowered by a total of 50 basis points (bps) in 2025.

On a hawkish note, officials’ preference shifted toward a single 25 bps rate cut in 2026, compared to two in March’s SEP. In the post-meeting press conference, Fed Chairman Jerome Powell said that tariff increases are likely to weigh on economic activity and push up inflation. Powell further noted that they are “well-positioned” to wait and learn more before considering policy adjustments.

Early Thursday, Bloomberg reported that US officials were preparing for a possible strike on Iran in the coming days. Similarly, the Wall Street Journal claimed that President Trump had approved attack plans on Iran earlier this week but wanted to wait to see if Tehran would abandon its nuclear program. As markets adopted a cautious stance in response to these headlines, Gold managed to limit its losses and closed flat on Thursday.

Nevertheless, news of Trump giving Iran a last chance to make a deal to end its nuclear program and deciding to delay his final decision on launching strikes for up to two weeks helped the risk mood improve early Friday. In turn, Gold came under renewed bearish pressure and fell to its weakest level in over a week below $3,350.

Gold investors await Powell testimony, inflation data

Fed Chairman Powell will testify on the Semiannual Monetary Policy report on Tuesday and Wednesday. According to the CME FedWatch Tool, markets virtually see no chance of a Fed rate cut in July and price in about a 35% probability of another policy hold in September.

In case Powell hints at a September rate cut, the USD could weaken against its rivals with the immediate reaction and help XAU/USD regain its traction. On the flip side, the market positioning suggests that there is room for additional USD strength if Powell downplays the SEP projections and reiterates that they will continue to prioritize inflation, citing healthy conditions in the labor market.

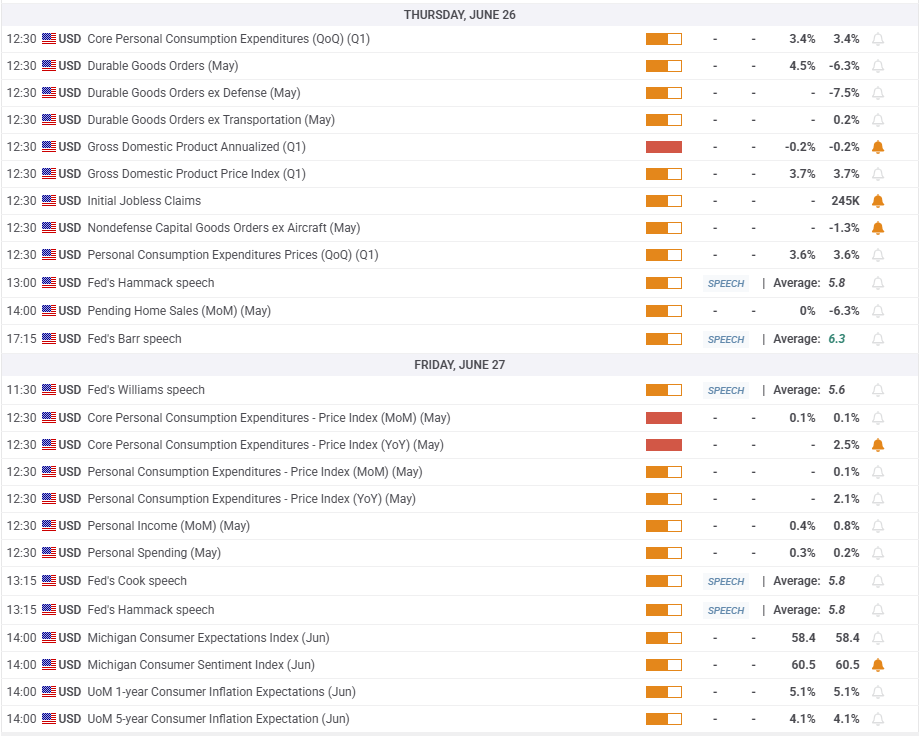

The US economic calendar will feature Personal Consumption Expenditures (PCE) Price Index data for May on Friday. In the post-meeting press conference, Powell said they estimate PCE and core PCE inflation to stand at 2.3% and 2.6%, respectively, in May. Although this comment takes away the surprise factor, a smaller-than-expected increase in the monthly core PCE Price Index reading could still hurt the USD in the near term.

Market participants will continue to pay close attention to headlines surrounding the Iran-Israel conflict. If Iran agrees to return to negotiations over the nuclear programme, Gold could remain under selling pressure. On the other hand, in the event of a further escalation of the conflict, with Iran refusing to negotiate and the US threatening military intervention, the precious metal is likely to stay resilient.

Gold technical analysis

The Relative Strength Index (RSI) indicator on the daily chart retreats toward 50 and Gold closes in on the lower limit of the six-month-old ascending regression channel, currently located at $3,330. This level is also reinforced by the 50-day Simple Moving Average (SMA).

A daily close below $3,330 could attract technical sellers. In this scenario, $3,300-$3,285 (static level, Fibonacci 23.6% retracement) aligns as the next support region before $3,200 (static level, round level).

Looking north, the first resistance level could be seen at $3,400 (static level, round level) before $3,460 (mid-point of the ascending channel) and $3,500 (all-time high set on April 22).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.