- The Pound Sterling rebounded firmly from three-month lows against the US Dollar.

- GBP/USD buyers await the US CPI inflation, UK jobs, and GDP data for fresh impetus.

- The daily technical setup shows the tide has turned in favor of the major.

The Pound Sterling (GBP) gradually recovered ground against the US Dollar (USD), lifting GBP/USD from three-month lows to ten-day highs near 1.3500.

Pound Sterling witnessed a bullish reversal

The GBP/USD pair received a double-booster shot in the past week, which helped it to stage a decent comeback, recording its best weekly performance since late June.

The July American labor data disappointment and a slowdown in the services sector intensified concerns over US economic prospects, doubling down on expectations that the Fed will lower interest rates in September.

Traders are pricing in a 93% chance of a rate cut in September, with at least two rate cuts priced in by the end of the year, the CME Group’s Fed Watch Tool showed.

This dovish narrative remained a drag on the US Dollar, while the latest tariff announced by US President Donald Trump on its major trading partners accentuated economic worries and the Greenback’s weakness.

A Financial Times (FT) report on Thursday, citing a letter from Customs and Border Protection, stated that the United States (US) has imposed tariffs on imports of one-kilo Gold bars.

Earlier on Thursday, Trump’s higher reciprocal tariffs on imports from dozens of countries took effect, with heavy levies on Switzerland, Brazil, and India. The US president also threatened additional tariffs on China and Japan against their oil imports from Russia after charging India with an extra 25% tariff.

Mounting tensions over the Fed’s appointments and, therefore, its independence exacerbated the USD’s pain, aiding the pair’s recovery.

Trump nominated Council of Economic Advisers Chairman Stephen Miran to replace Fed Governor Adriana Kugler. Miran is also seen replacing Jerome Powell when his term ends in May 2026, according to some industry experts.

On the Pound Sterling side of the equation, buyers capitalized on the hawkish Bank of England’s (BoE) split vote of 5:4 in favor of a rate cut on Thursday instead of a 7:2 composition expected.

The BoE delivered on the expected 25 bps rate cut from 4.25% to 4% on ‘Super Thursday, with the vote split showing policymakers remained concerned about still high inflation, even as it cut rates.

According to Goldman Sachs, the vote split in the BoE meeting “implies one of the most hawkish versions of a 25 bps cut that reasonably could have been expected.”

Expectations of the divergence in the monetary policy outlooks between the Fed and the BoE provided legs to the GBP/USD recovery rally.

Watch out for top-tier US and UK economic data

With the BoE event risk out of the way and Trump’s tariff on almost all US trading partners in effect, attention turns to high-impact economic data releases from both sides of the Atlantic.

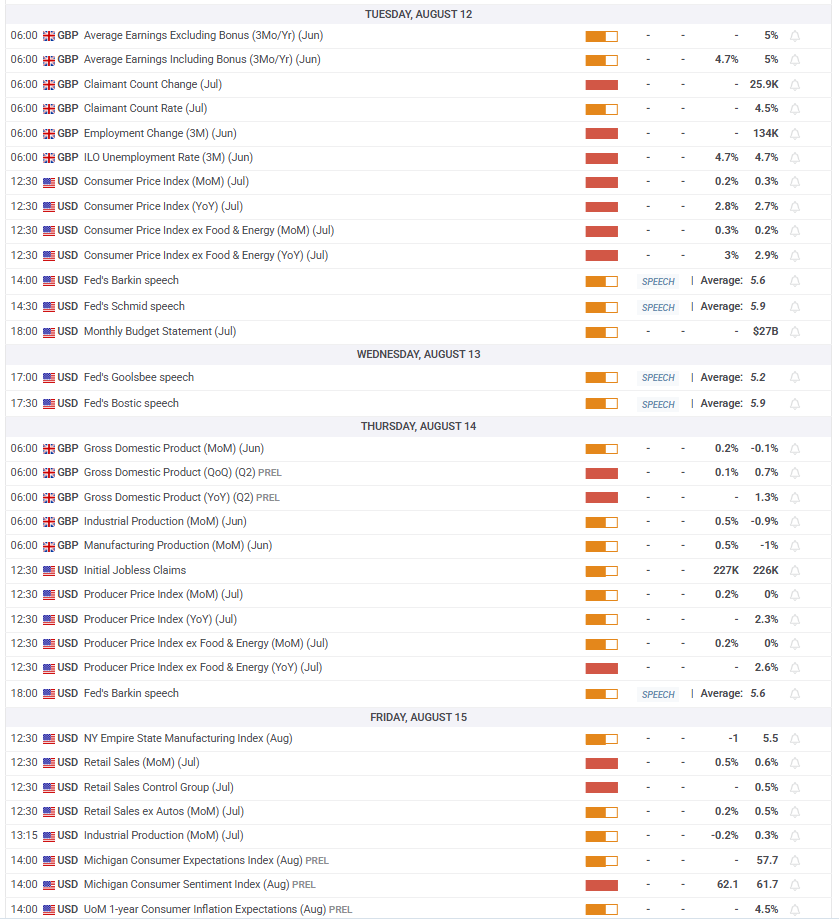

Monday is a quiet one, setting the stage for a terrific Tuesday as volatility will likely ramp on the UK jobs report and the US Consumer Price Index (CPI) data publications.

On Wednesday, speeches from a bunch of Fed policymakers will fill in an otherwise light data docket.

Traders will eagerly await the preliminary second-quarter Gross Domestic Product (GDP) data of the British economy alongside Industrial Production and Trade figures.

Later that day, the US calendar will feature the Producer Price Index (PPI) inflation data and the usual weekly Jobless Claims.

The Chinese Retail Sales and Industrial Production data will garner some attention early Friday before the release of the US Retail volumes data. The preliminary Michigan Consumer Sentiment and Inflation Expectations data will also be closely scrutinized.

Even as the focus returns to fundamentals, trade headlines will continue to play a pivotal role in driving the GBP/USD price action.

GBP/USD: Technical Outlook

GBP/USD’s daily chart shows that the late July sell-off from the 21-day Simple Moving Average (SMA) lost momentum as dip-buying emerged near the 1.3200 region.

Amid renewed buying interest, the pair recaptured the 100-day SMA and 21-day SMA supports-turned-resistances, now at 1.3360 and 1.3398, respectively.

However, buyers are battling the April 29 high of 1.3445, at the moment, yearning for acceptance above that level on a weekly closing basis.

If that happens, a run back above the 50-day SMA at 1.3504 cannot be ruled out.

Further north, the July 24 high of 1.3589 will be put to the test, above which the next bullish target is located at the 1.3700 round level.

The 14-day Relative Strength Index (RSI) is sitting listlessly above the midline, suggesting that the pair’s recovery will likely have legs in the near term.

In case sellers fight back control, strong support is seen at 1.3360, the 100-day SMA.

A breach of the latter will refuel the downside toward the multi-month lows of 1.3141.

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

The US Federal Reserve (Fed) has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.