- US ‘One Big Beautiful Bill’ and tariffs back and forth to set the market’s tone.

- Macroeconomic data proved once again the resilience of the American economy.

- EUR/USD is overbought in the long term but still poised to extend its advance.

The EUR/USD pair kept rallying in the first week of July, peaking at 1.1830 before retreating slightly. Still, the pair retained most of its weekly gains and settled at around the 1.1780 mark.

The US Dollar (USD) continued to suffer from fiscal and political jitters in the United States (US), although encouraging employment-related figures provided the currency some near-term relief.

‘One Big Beautiful Bill’ and tariffs

With geopolitical tensions cooling, the market’s attention jumped back to tariffs, and US President Donald Trump’s ‘One Big Beautiful Bill’, a massive spending and tax cut bill that extends Trump’s first-term decisions on the matter. The bill finally passed Congress on Thursday, with the US President expected to sign it within the Independence Day celebration late Friday.

It is worth noting that this bill was the main reason for Trump’s battle with Elon Musk a few weeks ago, which ended up with the American leader losing what, up to then, was his main advisor. Nevertheless, Trump celebrated the approval and said it is “the beginning of our new Golden Age.”

Financial markets, however, are hardly convinced of the benefits of this new law. The Congressional Budget Office estimated that the bill will add around $3.3 trillion to federal deficits over the next 10 years and leave millions without health insurance. It also includes $150 billion in new defence spending and another $150 billion for border enforcement and deportations, which will be financed with cuts in health care spending. The tax cuts will end up benefiting those with higher incomes, while low-income Americans will suffer the most, as they will lose health and food support.

Concerns revolved also around tariffs and mounting tensions between President Trump and Federal Reserve (Fed) Chairman Jerome Powell.

Trump unleashed his rage against the Fed’s head amid the central bank’s decision to keep rates on hold at high levels. Powell participated in the annual central banking gathering organized by the European Central Bank (ECB) in Sintra, Portugal, where he repeated that uncertainty about the impact of tariffs on the economy is the main reason behind the Fed’s stance.

Among other things shared in Truth Social, Trump claimed, “Too Late should resign immediately!!!,” referring to Powell.

Adding to all the chaos, Trump said he would start sending letters to multiple countries on tariffs. Regarding trade deals, the US clinched one with Vietnam, but there were no reports on progress with other major economies.

European Central Bank Banking Forum

The leaders of major central banks from Europe and Asia gathered in Portugal to discuss risks related to conducting monetary policy. Indeed, trade tensions and neutral rates were at the top of the list. Policymakers also discussed the USD reserve currency status, but acknowledged there’s a long path ahead before any other currency could take its place.

Back in May, European Central Bank (ECB) President Christine Lagarde noted that for the Euro to become a reserve currency, Europe needs a stronger geopolitical and legal foundation as it grows its capital markets through a strong European economy.

Lagarde shared some comments at the beginning of the forum, noting that the world ahead is more uncertain, and that is likely to make inflation more volatile. She hit the wires again on Friday with some hawkish remarks, stating the ECB will do whatever it must do to reach its inflation target, adding the economic system needs to become more efficient before the Euro can boost its global currency status.

US resilient economy

As usual, at the beginning of each month, the US macroeconomic calendar was flooded with employment-related data. The Bureau of Labor Statistics (BLS) reported that the number of job openings on the last business day of May stood at 7.769 million, higher than the previous 7.395 million monthly openings and above the market expectation of 7.3 million, according to JOLTS Job Openings.

The ADP Employment Change report came next and painted a gloomy picture, as the private sector lost 33K positions in June, much worse than the 95K addition expected. The report spurred some concerns but was quickly overshadowed by the Nonfarm Payrolls (NFP) report for the same month. The country added 147K new positions in June, much better than the 110K expected. Additionally, the Unemployment Rate edged lower to 4.1% from 4.2%, better than the 4.3% expected, while the Labor Force Participation Rate ticked down to 62.3% from 62.4%. Finally, Average Hourly Earnings retreated to 3.7% on a yearly basis from the 3.8% posted in May, softer than the 3.6% anticipated.

Other than that, the US published the ISM Purchasing Managers’ Index (PMI), showing that economic activity in the manufacturing sector picked up some pace in June, with the index advancing to 49.0 from 48.5 in May, coming in above experts’ expectations of 48.8. The services PMI report for the same period rose to 50.8 from 49.9 in May. The figure was better than the market expectation of 50.5.

European modest progress

Across the pond, the Eurozone preliminary estimate of the June Harmonized Index of Consumer Prices (HICP) was confirmed at 2% on an annualized basis. The core annual figure printed at 2.3% while the monthly reading resulted at 0.3%. The German annual HICP was reported at 2%, easing from the 2.1% posted in May. Germany also released Retail Sales, which were up 1.9% in May, down from the 2.9% posted in April.

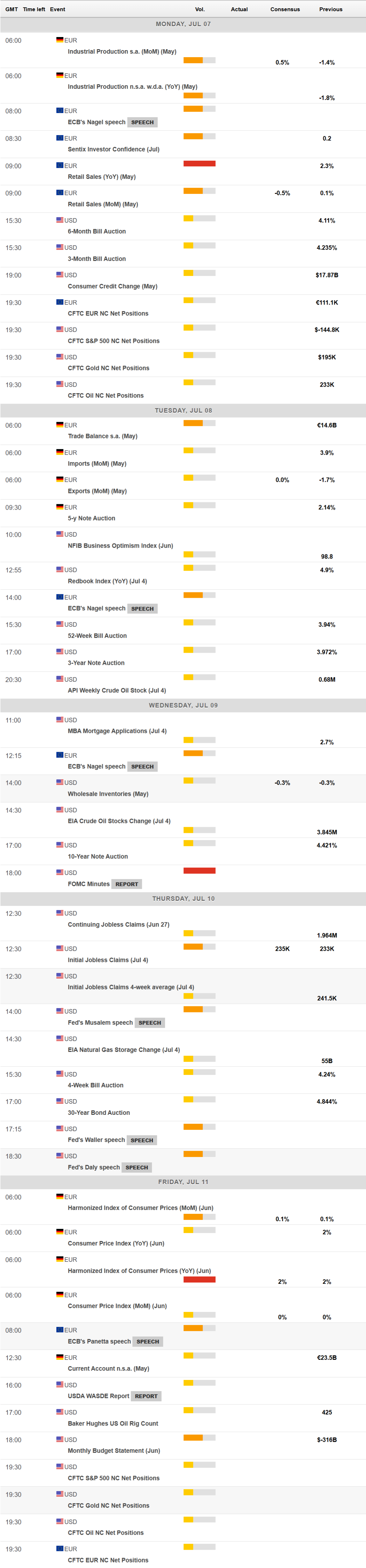

In the upcoming days, the Eurozone will release May Retail Sales, while Germany will publish the final estimate of the June HICP. The US calendar will feature the Federal Open Market Committee (FOMC) Meeting Minutes. Other than that, political and fiscal woes will remain the main market drivers.

EUR/USD technical outlook

From a technical point of view, EUR/USD is overbought, yet still bullish in the long term. The weekly chart shows it posted a higher high and a higher low while settling above the previous weekly high. Technical indicators, in the meantime, advance with uneven strength, far above their midlines. In fact, the Relative Strength Index (RSI) indicator currently stands at 74, without signs of upward exhaustion. At the same time, the 20 Simple Moving Average (SMA) heads north almost vertically, far below the current level, while above converging and directionless 100 and 200 SMAs.

On a daily basis, the technical picture is also bullish. EUR/USD develops above all bullish moving averages, with the 20 SMA providing support in the 1.1600 area. The Momentum indicator resumes its advance with modest strength within positive levels, while the RSI indicator stabilized around 70.

The weekly low at 1.1717 comes as immediate support, en route to the former 2025 high at 1.1631. A break below the latter could open the door for a steeper decline towards the 1.1500 area, yet additional slides seem unlikely at this point. On the flip side, 1.1830 comes as the immediate resistance level, followed by the 1.1900 region, as the pair topped around it between July and September 2021. A clear break above it exposes the psychological threshold of 1.2000.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.