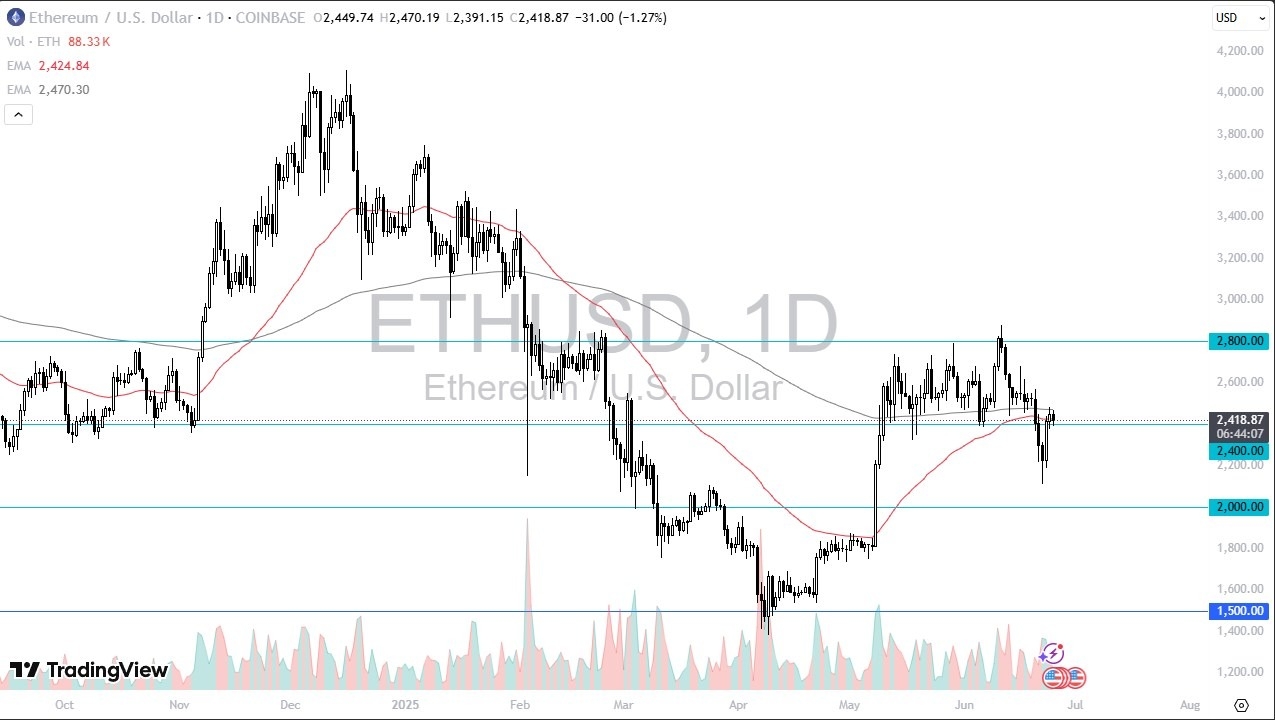

- Ethereum has been slightly negative during the trading session on Wednesday, but really, we’re just kind of hanging around the crucial $2,400 level.

- It’s probably worth noting that not only is this number a large, round, psychologically significant figure coming into play, but the fact that it was previously a support level is probably adding to its efficacy as resistance.

- The 50 day EMA and the 200 day EMA are both flat at this level, so we are simply just waiting for some type of reason to get moving.

Pay attention to Bitcoin. Bitcoin leads everything else, and if Bitcoin can break above that crucial $112,000 level, it’s likely that we will see Ethereum try to rally as well.

On a Breakdown

A breakdown from here is very possible, perhaps down to the $2,200 level, as that’s where we ended up about five sessions ago. If we break down below there, then it opens up the possibility of a drop to the $2,000 level. That will certainly be the case if we end up seeing Bitcoin falling because it will drag Ethereum right back down with it.

So anytime you trade Ethereum, you have to keep an eye on Bitcoin, because it allows other digital currencies to move in a specific manner. Without Bitcoin, there’s really nothing going on here. But that being said, it’s also worth noting that if this market starts to move to the upside, you can look at other alternative coins such as Ripple or other specific coins for specific ecosystems as a lot of them are built on top of Ethereum. So, with all of that being said, as the flow goes, it’s Bitcoin, then Ethereum, and then everything else. So, this is a great signal for meme coins and pretty much everything else. But at the same time, it is held hostage by what happens in Bitcoin. So, keep an eye on Bitcoin. It will lead you in the right direction with Ethereum.

Ready to trade Ethereum? Here are the best MT4 crypto brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.