Data from the Commodity Futures Trading Commission (CFTC) for the week ending August 5 showed that the FX galaxy was mostly following expectations about President Trump’s trade deadline (which will be pushed back again eventually) and speculation about how the White House might affect the Federal Reserve’s independence, all in the middle of a debate over who could replace Chair Jerome Powell.

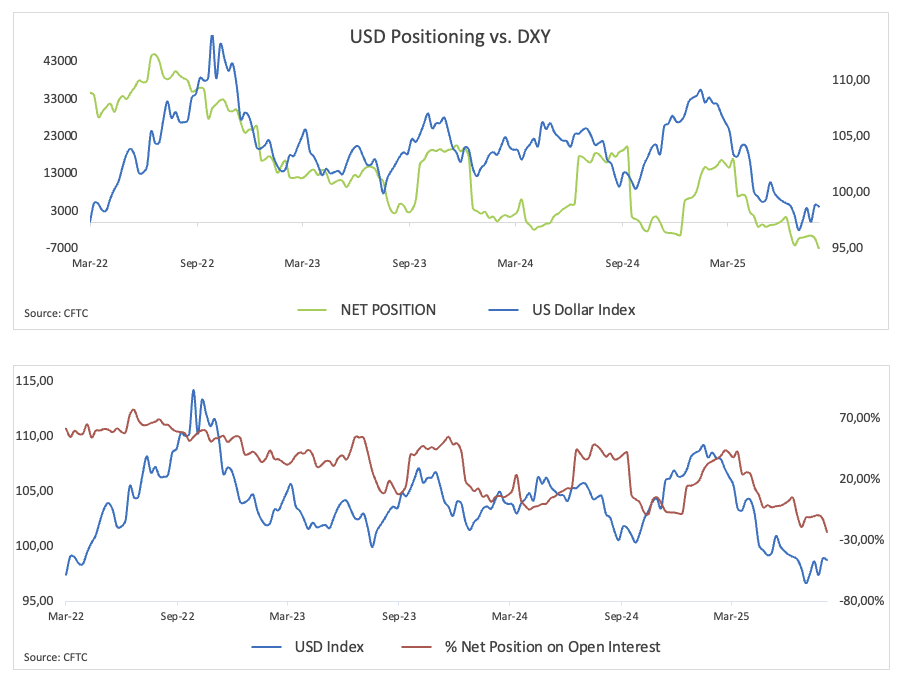

Non-commercial players turned more bearish on the US Dollar (USD) last week, lifting net short positions above 7K contracts — the first time that’s happened since March 2021. Additionally, open interest dropped to a two-month low of approximately 30K contracts. The US Dollar Index (DXY)’s brief push to fresh three-month highs, nudging past the psychological 100.00 mark, quickly faded. The reversal was fuelled in part by a disappointing Nonfarm Payrolls report, which showed just 74K jobs added in July.

Speculators further trimmed their net long positions in the Japanese Yen (JPY), bringing holdings down to just over 82K contracts — the lowest since mid-February. Institutional traders (mostly hedge funds) also cut their net shorts, sending bearish bets to multi-month lows near 87.3K contracts. Open interest, however, climbed to an eight-week high of around 337.4K contracts. During this period, USD/JPY staged a meaningful correction from five-month highs near 151.00 to the 147.00 neighbourhood, driven almost entirely by dynamics in the Greenback.

In the Euro (EUR), speculative appetite eased for a third week in a row, with net longs dropping to five-week lows around 116K contracts. Commercial traders also reduced their net shorts to about 163.5K contracts, or multi-week troughs. In addition, open interest slipped to a four-week low of roughly 828.3K contracts. The pronounced decline in EUR/USD appears to have stalled just below 1.1400, sparking a significant rebound afterwards.

Bearish sentiment remained unchanged on the British Pound (GBP) as non-commercial net shorts rose to about 33.3K contracts — the highest since April 2024. Additionally, open interest dipped slightly to 206.2K contracts but stayed near multi-week highs. GBP/USD’s steep pullback found decent support in the 1.3150–1.3140 band, paving the way for a firm move back above the 1.3300 handle in the subsequent days.

In Gold, speculative net longs rose to a two-week high just above 237K contracts, with open interest edging up to nearly 450K. Prices of the yellow metal rebounded after deflating to lows near $3,280, retargeting the key $3,400 mark per troy ounce.

Non-commercial net shorts in the VIX jumped to around 86.5K contracts — the highest since September 2022 — largely on the back of rising gross short positions. Open interest also climbed to nearly 451K contracts, a one-year high. The VIX has fallen sharply from NFP-led peaks near 22.00 to around 17.00, staying within the consolidation range that’s been in place since early May.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.