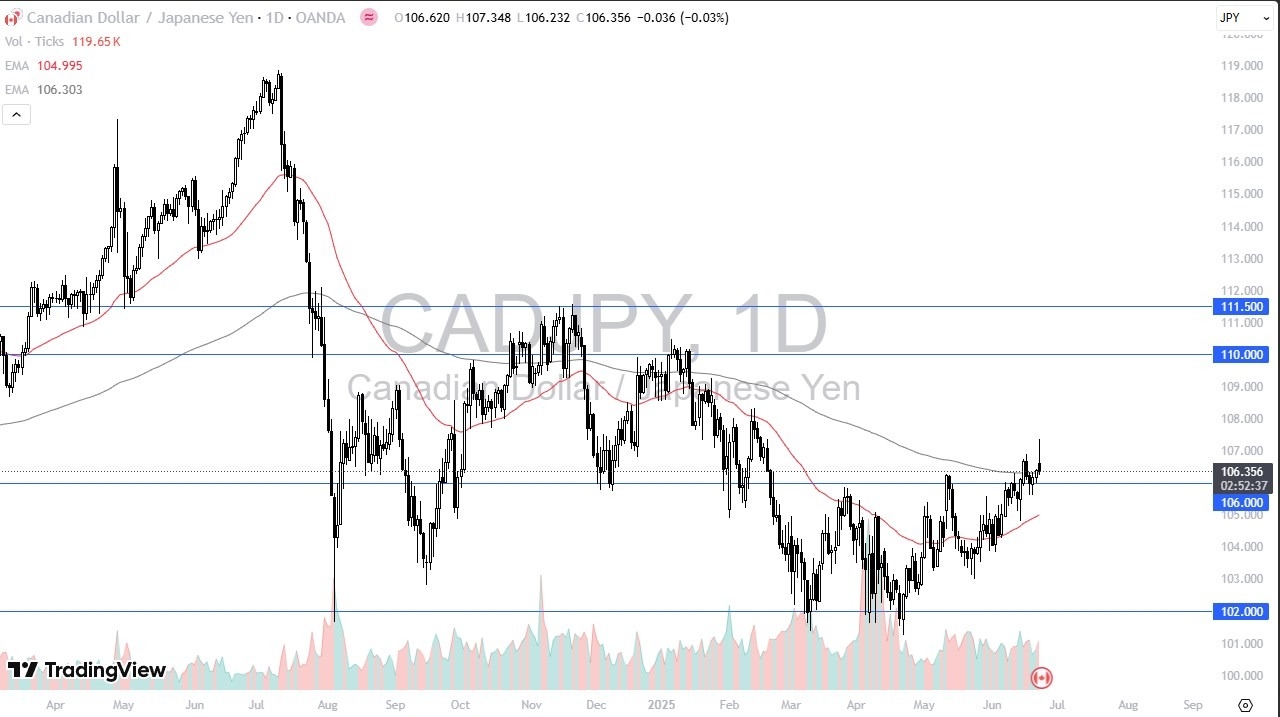

- The Canadian dollar has rallied a bit during the trading session on Monday as people ran away from the Japanese yen.

- Although having said that, we have given back all of those gains and more as we are sitting right at the crucial 200 day EMA.

- The 200 day EMA is widely followed as a trend defining indicator.

So therefore, we need to pay attention to how we behave in that general vicinity. The market breaking down from here does seem quite a bit of support though, especially near the 106 yen level. And then again, at the 105 yen level as the 50 day EMA rapidly approaches that handle. That being said, if we can break above the top of the shooting star, that is a very strong sign opening up the possibility of a move to 108.33 yen and then eventually 110 yen.

Interest Rate Differential

While the Canadian dollar pays almost nothing in interest rates and swap, it does pay something against the Japanese yen. And of course, I think the bank in Japan has a whole plethora of problems to deal with. Not the least of which is the fact that we’ve seen a handful of days recently where there’s been no buyers of Japanese debt. I do believe that we are eventually going to see the Japanese yen weaken, but right now it doesn’t look like we quite have the momentum.

That makes a certain amount of sense considering that everybody out there is worried about the Middle East and the conflict spreading. And that does provide a little bit of a need for a safety trade, which the Japanese yen is nonetheless I’m looking to see if we can break the top of this shooting star.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.