- EUR/USD traded in an inconclusive fashion, bouncing off new lows near 1.1680.

- The US Dollar gained momentum and surged to new highs.

- Market participants now look at the release of the FOMC Minutes on Wednesday.

The Euro (EUR) managed to regain some pace vs. the US Dollar (USD) on Tuesday, with EUR/USD navigating a volatile range, receding to new two-week lows near 1.1680 just to regain traction and reclaim the 1.1700 hurdle and beyond toward the closing bell on Wall Street.

Geopolitics, trade, and risk sentiment

A fragile Middle East ceasefire brokered in late June by President Trump had lent the Euro and its risk-linked peers a temporary boost by lifting risk appetite. However, that effect has dissipated amid mounting trade worries.

Although the White House pushed back its tariff deadline to August 1, Trump’s Monday announcement of 25% levies on Japan and South Korea reignited global trade fears and sent the dollar higher to the detriment of its rival currencies.

Investors remained wary over a potential agreement with the European Union (EU) while the White House continued to wait for countries to open the door to trade deals. Both parties have emphasised the need for a deal, but there has been no concrete progress to date.

Policy divergence on hold

The Federal Reserve (Fed) held rates at 4.25%-4.50% in June, upgraded its inflation and unemployment forecasts, and signalled roughly 50 basis points of rate cuts by year-end.

In contrast, the European Central Bank (ECB) cut its deposit rate to 2.00% early in June, with President Lagarde warning that further easing hinges on a demonstrable drop in external demand.

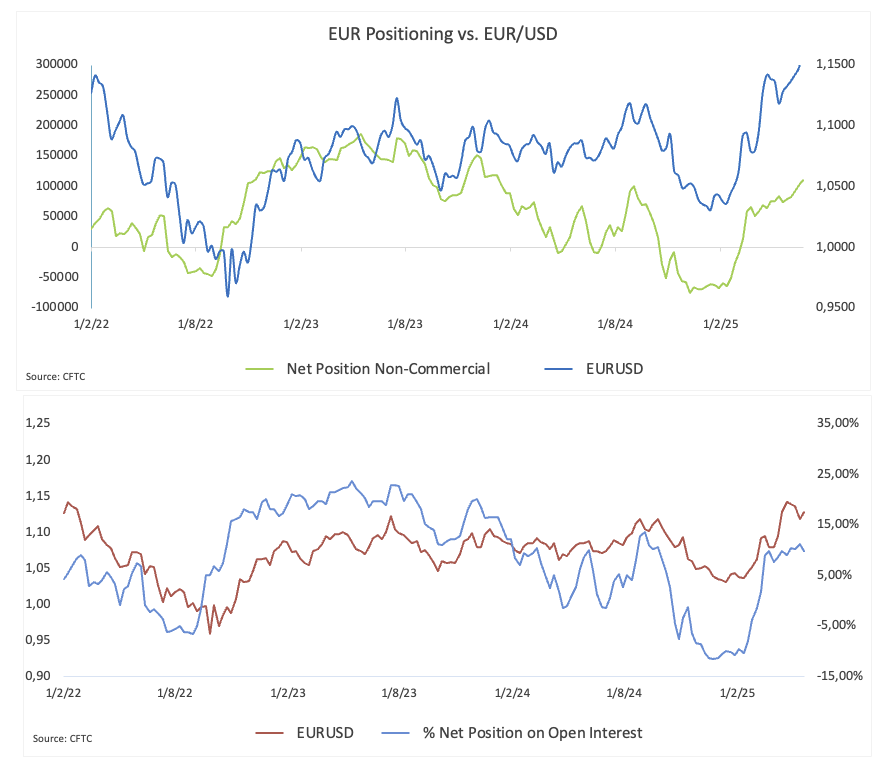

Bullish bets on EUR remain in place

Speculative net longs in the Euro (EUR) have declined somewhat, currently totalling about 107.5K contracts. In addition, commercial players, mostly hedge funds, have reduced their net short holdings to about 160.6K contracts. Furthermore, open interest has hit three-week highs, reaching 779K contracts.

Upcoming eurozone data

The final June Inflation Rate in the Euroland is due on July 10, seconded by the EMU’s Current Account results and Germany’s Wholesale Price readings on July 11.

Technical scenario

Immediate resistance is the 2025 ceiling of 1.1830 (July 1), ahead of the September 2018 high of 1.1815 (September 24) and the June 2018 top of 1.1852 (June 14).

On the other side, the 55-day simple moving average (SMA) at 1.1434 provides intermediate support, ahead of the weekly trough of 1.1210 (May 29) and the May floor of 1.1064 (May 12), both prior to the important 1.1000 threshold.

Furthermore, the Relative Strength Index (RSI), which approaches 63, implies stretched but still upward-leaning circumstances, while an Average Directional Index (ADX) near 33 indicates a firming trend.

EUR/USD daily chart

Medium-term view

Absent a fresh shock on the geopolitical or economic front, EUR/USD should regain its uptrend, supported by easing risk aversion and the prospect of Fed rate cuts.

Yet lingering trade uncertainty and President Trump’s shifting stance could cap gains as the year progresses.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.