- The euro initially gapped lower against the US dollar, only to turn around and show signs of strength again as the world behaves as if it is not going to be overly concerned about the American strengths on Iran.

- With this, it looks as if the US dollar is losing some of its initial strength.

- Nonetheless, this is a market that has been bullish before, so it is simply a turnaround at this point in time, and a continuation of what we had seen before. That being said, there are still a lot of different levels that must be paid attention to.

Technical Analysis

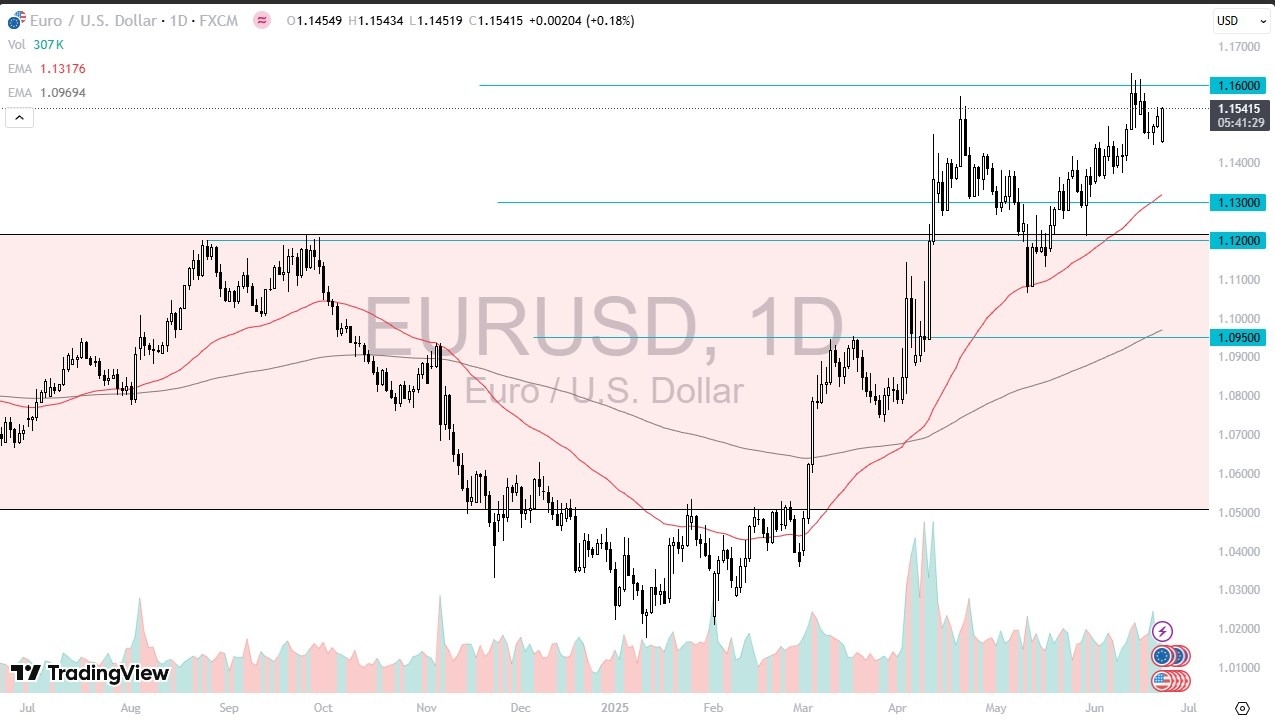

The 1.16 level is still massive resistance from everything that I can see, so it does make a certain amount of sense that it is an area that traders will be watching very closely if we do in fact rally. Nonetheless, this is a market that I think will remain very noisy, as we have a lot of questions to ask about risk appetite going forward. Obviously, if risk appetite shrinks, it benefits the US dollar in general. The euro, although not necessarily a “risky currency”, is not the US dollar, so it does tend to lose in times of major “risk off trading.”

Ultimately, if we do break down from here, level 1.13 is an area that I think will end up being a target, as it has been support previously, and we also have the 50 Day EMA hanging around in that same general vicinity. If we could break above the 1.16 level, then I think this is a market that is prime to go looking to the 1.1750 level rather quickly.

I would anticipate a lot of noisy behavior regardless, which is probably something that we could say about almost any and every market at the moment. All things being equal, we have a scenario where the next headline could drive the markets crazy, see you will have to be cautious and make sure that you keep your position size reasonable.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.