- AUD/USD added to Monday’s gains beyond the key 0.6500 resistance zone.

- The US Dollar alternated gains with losses, with focus on US-China trade talks.

- Consumer Confidence in Australia improved to 92.6, Westpac reported.

The Australian Dollar (AUD) regained some altitude on Tuesday, buoyed by a vacillating mood around the US Dollar (USD). Indeed, AUD/USD extended Monday’s optimism above the 0.6500 hurdle, trading at shouting distance the yearly peaks near 0.6540 reached in mid-May.

Central banks steer the narrative

Global currency markets remain tightly tethered to central bank signals, with traders parsing every word for clues on the direction of monetary policy.

At its May meeting, the Federal Reserve (Fed) opted to keep rates unchanged, with Chair Jerome Powell reiterating a data-dependent approach. Softer inflation prints for April and a run of weaker domestic indicators have pushed market expectations toward a potential rate cut by September.

Meanwhile, the Reserve Bank of Australia (RBA) cut its official cash rate (OCR) by 25 basis points to 3.85%—a widely anticipated move. The RBA signalled a cautious easing path, projecting the cash rate could fall to 3.2% by 2027. Inflation is expected to slow to 2.6%, with GDP growth seen cooling to 2.1% in 2025.

The Minutes from the latest meeting underscored the bank’s preference for a predictable policy path in a volatile global environment. However, the RBA left the door open to a more aggressive easing cycle if consumer spending continues to weaken or wage growth falters amid a softer labour market. Conversely, it warned of potential upside risks if global policy surprises ripple through the domestic economy.

Markets are currently pricing in nearly 80% odds of another 25-basis-point cut as early as July and close to 100 basis points of easing by the end of 2026.

China’s mixed signals cast a shadow

Australia’s top trading partner, China, continues to offer a murky macroeconomic picture. While first-quarter industrial production beat expectations, lacklustre retail sales and tepid investment highlighted underlying fragilities.

In a further sign of economic caution, the People’s Bank of China lowered its one-year and five-year Loan Prime Rates to 3.00% and 3.50%, respectively. Compounding the unease, May’s Caixin Manufacturing PMI slipped to 48.3, falling deeper into contraction territory and dampening hopes for a stronger rebound, while latest inflation data showed the economy remains mired in a deflationary path, as the June headline CPI dropped by 0.1% YoY.

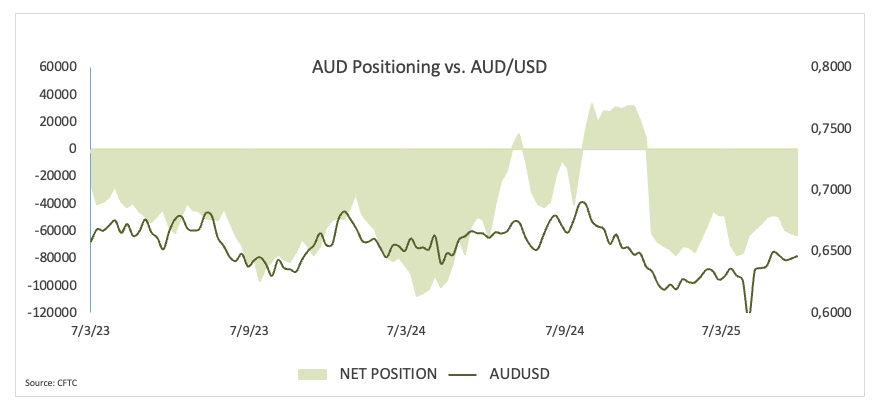

Bearish bets on the Aussie climb

Sentiment around the Australian Dollar remains broadly negative. CFTC data showed net short positions climbed to multi-week highs around 63.2K contracts in the week to june 3. Rising open interest indicates a growing bearish trend across speculative markets.

Key technical levels in focus

AUD/USD faces immediate resistance at the 2025 high of 0.6537 (May 26). A break above this level could open the door to the November 2024 top at 0.6687 and, beyond that, the 2024 peak of 0.6942.

On the downside, support lies at 0.6356 (May 12), reinforced by the intermediate 55-day simple moving average (SMA) at 0.6375. Deeper support sits near the interim 100-day SMA at 0.6339, with the psychological 0.6000 level and the April 9 low of 0.5913 further out.

Momentum indicators remain constructive, however, with the Average Directional Index (ADX) on an upside trajectory past the 25 level, indicating a modestly strong trend. The Relative Strength Index (RSI) has rebounded above 59, suggesting further upside potential in the short term.

AUD/USD daily chart

Looking Ahead

Attention now turns to Australia’s Consumer Inflation Expectations on June 12 along with the speech by the RBA’s Jacobs.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.