Despite progress in professional equality, a persistent gap threatens women’s financial security in retirement, particularly when it comes to Individual Retirement Accounts (IRAs).

Women make up almost half of the US workforce. Yet they consistently save less than men for retirement.

This gap is not due to a lack of access to savings tools such as IRAs, but to a complex set of economic, social and behavioral factors that hinder women’s ability to build long-term wealth.

A persistent gap in IRA balances

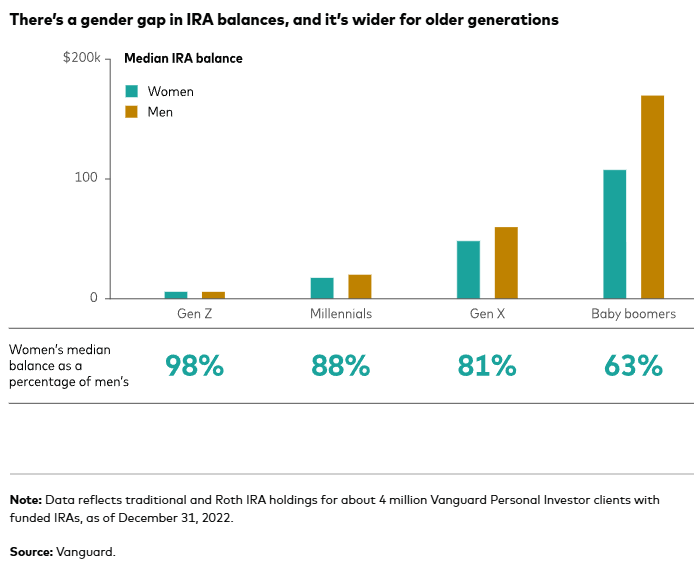

According to a report published by Vanguard in 2024, the median IRA balance held by women is lower than that of men across all generations.

The gap is minimal among Gen Z (women hold 98% of men’s median balance), but widens considerably with age, with baby-boomer women holding just 63% of men’s median balance.

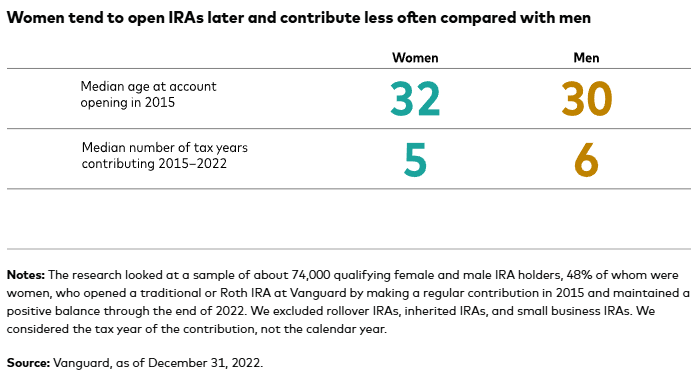

One of the main reasons? The timing of women’s IRA account opening. According to Vanguard, women open their accounts on average two years later than men, and contribute less frequently.

This difference, while seemingly modest, has a major impact over the long term. Indeed, delaying contributions means forgoing the power of compound interest, a fundamental pillar of retirement planning.

Lower incomes and career interruptions

The gap between IRA balances more broadly reflects the income gap between the sexes. According to a study by T. Rowe Price, the median balance of women’s retirement accounts is 65% lower than that of men. This is mainly due to lower salaries and lower contribution rates.

Women are also more likely to take career breaks to care for children or dependent relatives.

These breaks lead not only to lower earnings, but also to reduced Social Security entitlements and fewer opportunities to contribute to retirement accounts such as IRAs. Fidelity points out that over 75% of family caregivers are women.

These interruptions weigh on retirement entitlements. Social Security uses the best 35 years of earnings to calculate benefits. Fewer years worked, or years of part-time work, mean lower benefits, even though women are living longer.

Behavioural and structural obstacles

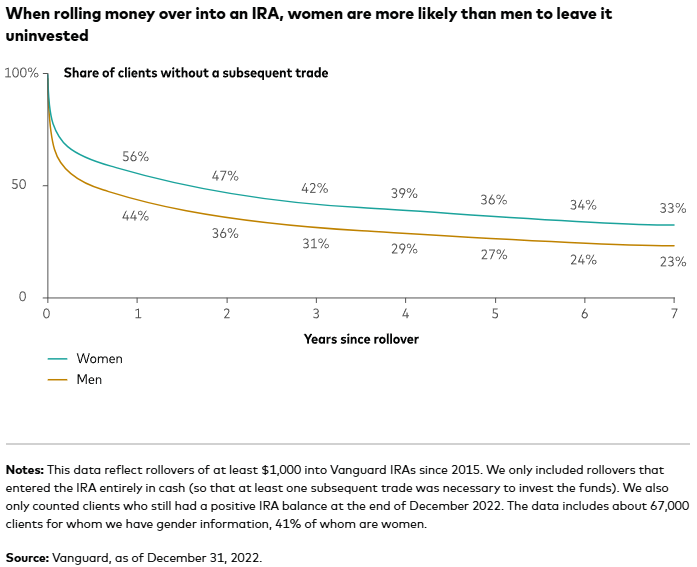

Even when contributing to an IRA, women can miss out on key opportunities. Vanguard found that women are more likely to leave their rollovers uninvested: 56% of them leave their money in cash for at least a year after a transfer to an IRA, compared with 44% of men.

And yet, when investing, women tend to create well-diversified portfolios and use professional allocations more frequently than men.

So the problem is not a lack of competence, but a lack of confidence.

Morgan Stanley reveals that 60% of women doubt their ability to retire in good conditions, compared to 73% of men.

This excessive caution, often accentuated by a lack of financial education or social stereotypes, can lead to an overly conservative approach to investment.

Longer retirement with fewer resources

Women live on average five years longer than men in the United States, and 81% of people over 85 are women, according to Fidelity.

This longevity implies greater financial needs in retirement, but also a greater risk of depleting savings.

Women also often receive lower Social Security benefits. This is due to lower earnings, interrupted careers and early retirement. The result is lower resources for a longer retirement.

How to close the gap?

According to Vanguard, younger generations of women, such as Gen Z, are already closing the gap. But more needs to be done, both individually and collectively.

Here are a few concrete suggestions for women:

- Start early and contribute regularly: Even small amounts invested early can generate significant gains.

- Don’t leave transfer funds idle: Invest as soon as possible to benefit from market growth.

- Take advantage of spousal IRAs: Married women with no personal income can still contribute via a spousal IRA.

- Delay the start of Social Security benefits: Waiting until legal age, or even age 70, increases monthly benefits.

- Get informed and take control: Using digital tools or consulting an advisor can help you plan better.

Closing the gap for a fairer future

The gender gap in IRAs and retirement savings is a real, but not insurmountable, challenge. It can be explained by income inequalities, family responsibilities, lack of investment confidence, and higher longevity.

Yet solutions do exist, and recent trends are encouraging. By acting early, investing intelligently and taking back control of their financial future, women can build a more serene and equitable retirement.

IRAs FAQs

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.