- The US Dollar Index reversed two weekly advances in a row.

- Progress on the trade front lent fresh oxygen to the Greenback.

- The Federal Reserve is expected to keep rates unchanged.

The week that was

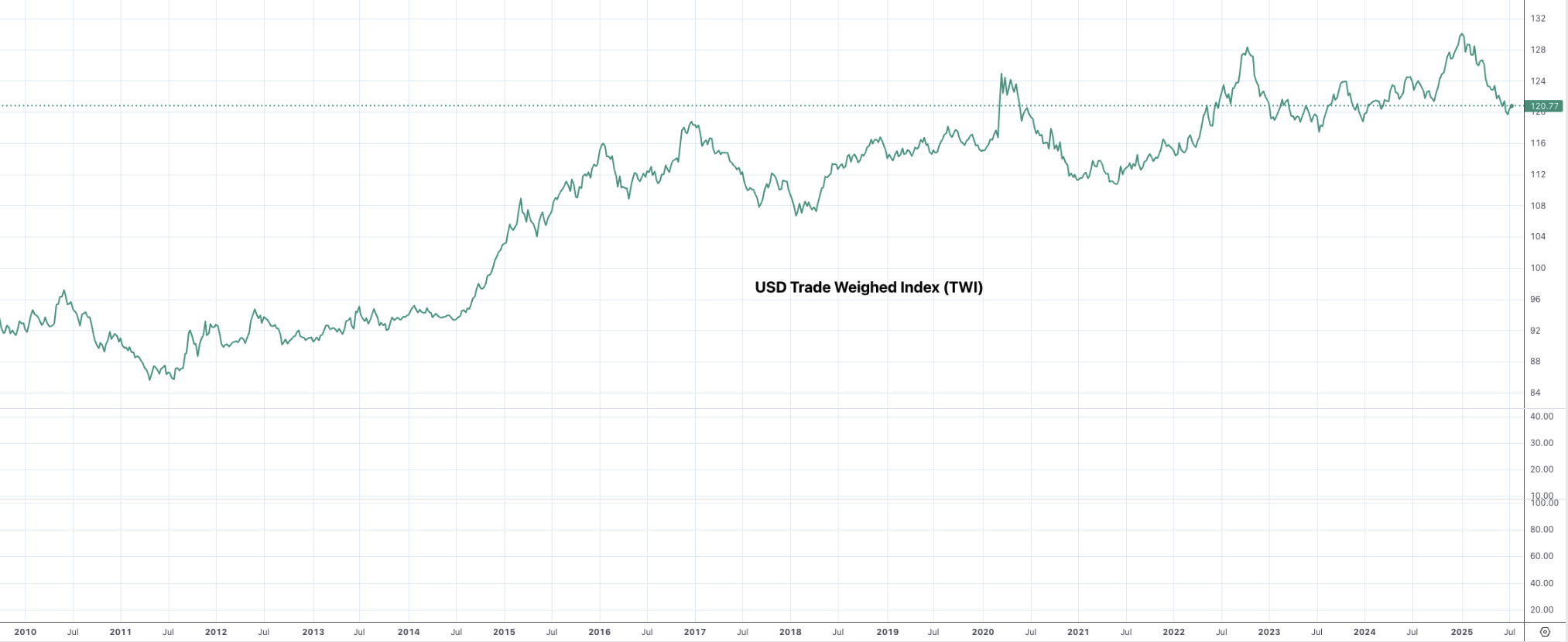

The strong rally that saw the US Dollar (USD) climb to multi-week highs in the past few days faced renewed downside pressure this week. Against that backdrop, the US Dollar Index (DXY) succumbed to the bearish mood and receded to the vicinity of the key contention zone around 97.00.

On the monthly chart, the index remains firmly en route to close this month with gains, setting aside at the same time five consecutive declines. Despite this brief period of optimism, the Greenback is not by any means out of the woods yet.

Geopolitical tensions have somewhat subsided, enabling the trade narrative to once again take the lead, largely driving both sentiment and price action.

The US calendar also contributed to the revived positive tone in the Greenback, with strong results from key fundamentals that confirmed the image of a resilient economy.

Looking at the bond market, yields in the short end of the curve advanced modestly, contrasting with declines in the belly and the long end of the curve.

Trade hopes emerge ahead of the August 1 deadline

Optimism among market participants returned in the wake of the announcement of a US-Japan trade deal in the past few days.

In light of this event, investors’ hopes of a more significant agreement with the European Union (EU) have done nothing but rise ever since.

President Trump admitted there was “maybe a 50‑50 chance—or even less”—of striking a trade deal with the bloc, despite Brussels’ “desperate” desire to get an agreement over the line.

It is worth recalling that, just a day earlier, the European Commission (EC) had declared that a negotiated solution was “within reach,” even as EU member states approved counter‑tariffs on €93 billion of US goods should talks collapse.

Indeed, the euro bloc has been laser-focused on heading off the 30% import levies Trump has threatened to impose from August 1. And according to diplomats in Brussels, both sides now seem to be edging toward a framework akin to the US‑Japan agreement — a uniform 15% tariff on EU exports to the US.

Tariffs remain a double-edged sword

Over time, even a small tariff reduction could have unintended consequences for the US economy.

In the short run, consumers may be able to avoid significant price increases, but long-term trade restrictions are likely to keep prices high across important industries, reduce household spending, and slow overall growth. Should those pressures materialise, the Fed might struggle to maintain its cautious, prudent approach.

Behind the scenes, negotiations reveal that the White House quietly favours a softer US Dollar, a move that could give US exporters a boost but make trimming the nation’s record trade gap even tougher.

Meanwhile, Washington’s grand idea of bringing factories back onshore won’t happen overnight. Rebuilding America’s industrial backbone demands both time and deep pockets. In the end, any meaningful cure for our imbalances will rest not on tariff tweaks alone, but on bold, long‑term investments that restore US competitiveness at its core.

Bets for a July rate cut evaporate

Next week’s Federal Reserve (Fed) meeting is poised to be another uneventful one on rates: policymakers are almost certain to leave borrowing costs unchanged for a fifth straight time. Yet behind the calm lies a clear consensus: most Fed officials expect to cut rates at least twice before the year is out, according to the forecasts they released in June.

Chair Jerome Powell, however, has urged caution. With President Trump’s looming trade deadlines and fresh tariffs still a wild card, Powell and his colleagues want to be absolutely sure they won’t unleash another bout of stubborn inflation. At the same time, a steady labour market has given them the luxury of waiting for stronger signals before loosening policy.

That atmosphere of measured patience persists even as President Trump turns up the heat. In recent weeks he’s publicly mused about firing Powell — only to backtrack, insisting he has no plans to do so — and even ran through the scenario with congressional leaders. Yet Powell shows no sign of being rattled. He hasn’t hinted at stepping down early, and insiders say he may well stay on the Fed’s board after his term as chair ends in May.

Earlier on Friday, Trump described his private Thursday meeting with Powell — part of a tour of the Fed’s Washington headquarters renovation — as “very good,” adding he left with the sense that the central bank chief was open to cutting rates. The White House and the Fed sparred over the hefty tab for that construction work, but both men emerged keen to put any personal frictions aside and keep the policy debate focused squarely on the economy.

What’s next for the US Dollar?

Next week promises a flashpoint for both economic data and trade developments.

On the data front, all eyes will be on the US labour market: Nonfarm Payrolls headline the show, backed up by Q2 GDP figures and the ISM’s latest manufacturing gauge.

On the trade side, markets will be glued to the August 1 deadline. If no deals are sealed by then, hefty new levies kick in, and with them the greatest risk of a fresh escalation in global trade tensions.

What about techs?

When the multi-year low of 96.37 (July 1) is overcome, the index might attempt a move to the February 2022 floor of 95.13 (February 4), which comes ahead of the 2022 base of 94.62 (January 14).

On the upside, the July ceiling of 98.95 (July 17) emerges as the immediate barrier. Once cleared, DXY could hit the June top at 99.42 (June 23), before the psychological 100.00 hurdle and the weekly peak at 100.54 (May 29).

Meanwhile, the index is expected to maintain its negative trend as long as it continues below the 200-day and 200-week Simple Moving Averages (SMAs), which are now at 103.41 and 103.07, respectively.

Furthermore, momentum indicators show a minor bearish bias. The Relative Strength Index (RSI) has recovered to nearly 48, but the Average Directional Index (ADX) remained flat-lined around 13, indicating a lack of trend strength.

All in all

The US Dollar’s retreat shows little sign of slowing.

Despite occasional bursts of strength, the Greenback looks set to carve fresh lows amid White House trade uncertainty and growing budget concerns, especially now that Trump’s “Big and Beautiful Bill” is law.

While the Fed may hesitate before resuming its easing cycle, its data‑driven shifts will likely alternate between boosts and setbacks, offering only fleeting relief for the currency.

In the absence of any near‑term catalysts, there’s scant reason to expect a decisive US Dollar rally on the domestic or global stage. And with the yawning US trade deficit casting a long shadow, political logic suggests the Greenback could remain under pressure as policymakers eye a weaker currency to help rebalance the ledger.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.