- The US Dollar Index falls to more than three-year lows this week.

- The post-ceasefire optimism weighs heavily on the Greenback.

- The Fed’s next rate cut is expected at the September 17 meeting.

This week, the US Dollar (USD) faced heightened selling pressure, briefly falling to the 97.00 contention zone for the first time since March 2022 as reported by the US Dollar Index (DXY).

The monthly chart illustrates a significant (down) trend, showing the index is about to end its fifth consecutive month highlighted in red, indicating a decline exceeding 12% from the year-to-date peaks north of the 110.00 barrier recorded in mid-January.

Recently, geopolitics took over the global market’s sentiment following the Trump-brokered ceasefire between Israel and Iran, which has so far halted more than ten days of air attacks between those countries, and the late intervention of the US.

The news sparked a meaningful retracement in the Greenback across the board, sponsoring at the same time the move to fresh highs in most of its rival currencies, while US yields maintained a steady decline to multi-week lows.

Focus now shifts to trade deadline

President Donald Trump declared the US-China agreement “done” following the recent discussions in London. This announcement came after a series of debates between officials from Washington and Beijing, who successfully established a framework aimed at renewing their trade ceasefire. He stated that Beijing has pledged to provide magnets and rare earth materials as part of the agreement.

Furthermore, the White House has confirmed that the newly reached agreement permits the United States to implement a 55% tax on goods imported from China. The proposal details a 10% “reciprocal” tax, alongside a 20% tax aimed at fentanyl trafficking and a 25% tax imposed on current trade barriers. China has announced its intention to implement a 10% tax on imports originating from the United States.

Across the Atlantic, European Commission (EC) President Ursula von der Leyen highlighted the complexity of trade negotiations with the United States. She reiterated her aim to reach a final agreement by the July 9 deadline in light of President Trump’s comments labelling the EU as “unfair”.

During a press briefing at the G7 summit in Canada, she informed reporters that discussions continue to be complex, yet progress is being made, a development she deemed positive. She stated that she was making significant efforts to build momentum, suggesting that the negotiations were in a complex state and the outcome remained to be seen.

Let’s recall that a failure to reach a deal between the US and the EU will result in a 50% tariff duty on all imports from the EU.

In examining the wider economic landscape, it is crucial to note that even lower tariffs may result in negative long-term consequences for the economy.

Despite the potential for initial price increases to lessen, persistent trade restrictions are expected to keep costs high in various sectors, limit consumer spending, and hinder overall economic growth. The Federal Reserve (Fed) may be forced to reconsider its current ‘wait-and-see’ strategy if those threats materialise.

Amid persistent disputes, evidence suggests that the White House is leaning toward a preference for a weaker currency. What measures can we expect from the Trump administration to tackle the record-high trade deficit in a timely manner? A strategy aimed at the ‘repatriation’ of industries is in progress; however, attaining a positive outcome will necessitate considerable time and substantial financial investment.

Between the Fed’s independence and rate cuts

The Federal Open Market Committee (FOMC) maintained its policy rate during the June 17-18 meeting, aligning with expectations. However, the real focus shifted to the new guidance provided: the statement, the press conference, and particularly the updated dot plot drew significant attention.

The communications, when considered collectively, appeared somewhat less aggressive than what markets had anticipated, as officials continued to indicate a potential easing of approximately 50 basis points by the end of the year. The Committee is navigating a landscape marked by a subdued growth forecast and an elevated Unemployment Rate, juxtaposed with a marginally stronger inflation outlook.

Fed Chair Jerome Powell’s subsequent press conference failed to clarify expectations regarding two potential interest rate cuts. He adopted a notably patient tone and emphasised that the Fed expects tariff-related price pressure to emerge in the coming months.

During his semiannual testimony earlier this week, Powell cautioned Congress that increased import tariffs could lead to higher inflation this summer — a critical period for assessing the suitability of rate cuts. Powell warned that President Trump’s tariffs might result in rising goods inflation, emphasising the Fed’s necessity to navigate a precarious balance amid ongoing trade tensions and broader geopolitical uncertainties.

The persistent decline in US inflation, despite the Consumer Price Index (CPI) and the Producer Price Index (PPI) meeting a minor stumbling block after the headline Personal Consumption Expenditures (PCE) matched consensus in May and rose above estimates when tracked by the core print, combined with a cooling domestic labour market, appears to support the view that lower interest rates are on the way, even in light of Powell’s cautious approach.

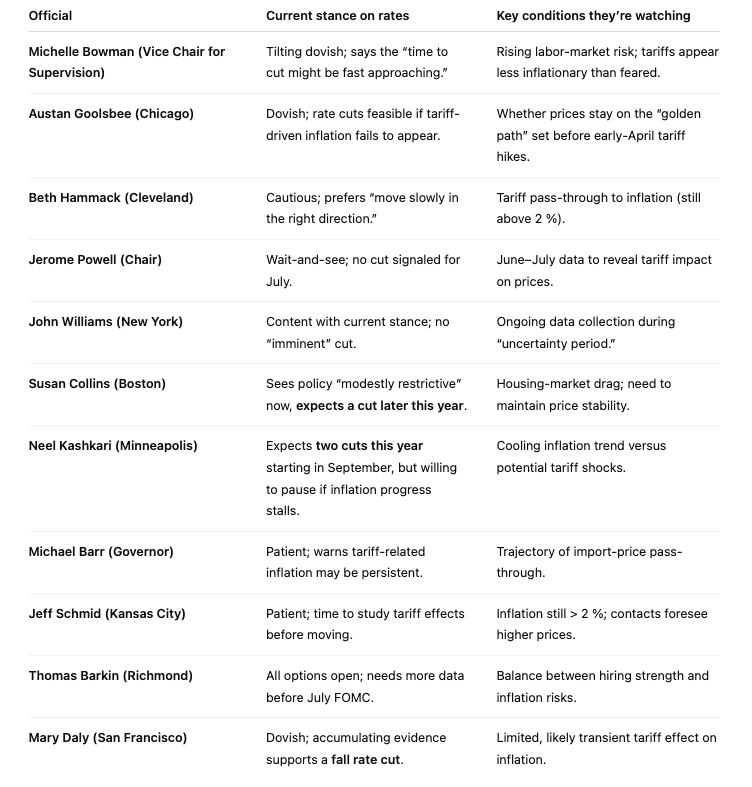

Is Powell’s prudent bias losing followers?

Overall picture

- Dovish bloc (Bowman, Goolsbee, Collins, Kashkari, Daly) sees cooling inflation and limited tariff pass-through as grounds for rate cuts starting in the fall, some advocating as many as two moves.

- Cautious/neutral bloc (Hammack, Powell, Williams, Barr, Schmid, Barkin) stresses data dependence: they want proof that tariffs either will not lift inflation or that any boost is transitory before easing.

- Consensus: A July cut is unlikely; September or later remains the earliest realistic window, contingent on whether summer inflation prints confirm or refute tariff-driven price pressure.

What’s in store for the US Dollar?

Next week, investors will focus primarily on the US labour market, with the releases of JOLTS Job Openings, the ADP report, the usual weekly Initial Jobless Claims, and the crucial Nonfarm Payrolls. In addition, the ISM will be in the spotlight with its key gauges from the Manufacturing and Services sectors.

What about techs?

The selling bias on the US Dollar Index (DXY) appears to have carte blanche.

That said, once the multi-year trough at 97.00 (June 27) is cleared, the index could set sail to the February 2022 floor at 95.13 (February 4), which is just above the 2022 base of 94.62 (January 14).

On the upside, initial resistance emerges at the June ceiling of 99.42 (June 23), an area underpinned by the provisional 55-day SMA. North from here sits the weekly peak of 100.54 (May 29), which precedes the May high of 101.97 (May 12), in turn underpinned by the interim 100-day SMA.

Of note: the index remains poised to extend its downward path as long as it navigates below the 200-day and 200-week Simple Moving Averages (SMAs), currently at 103.81 and 102.97, respectively.

In addition, momentum indicators remain tilted toward a bearish bias: The Relative Strength Index (RSI) has deflated to the 32 area and flirts with the overbought zone, while the Average Directional Index (ADX) around 15 shows a lacklustre trend strength.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.