- The US Dollar Index falls for the second week in a row.

- Firmer US jobs data and the Fed’s rate cut repricing lent some late support.

- The July 9 tariff deadline should keep markets’ unease in place.

The week that was

The US Dollar (USD) saw further selling pressure this week, temporarily dipping to the 96.40 region for the first time since February 2022, according to the US Dollar Index (DXY).

The monthly chart shows a steep downtrend, although the index seems to have so far reversed five consecutive declines after an auspicious start in July. However, it is difficult for the Greenback to hide a drop of nearly 12% since the beginning of the year.

Geopolitics recently dominated the global market mood after the Trump-brokered truce between Israel and Iran, which has ended more than ten days of air bombardment between the two nations, as well as the US’s late participation.

The news caused a major retreat in the Greenback across the board, accompanied by a rise to new highs in most of its major competitor currencies, as US rates continued to fall to multi-week lows.

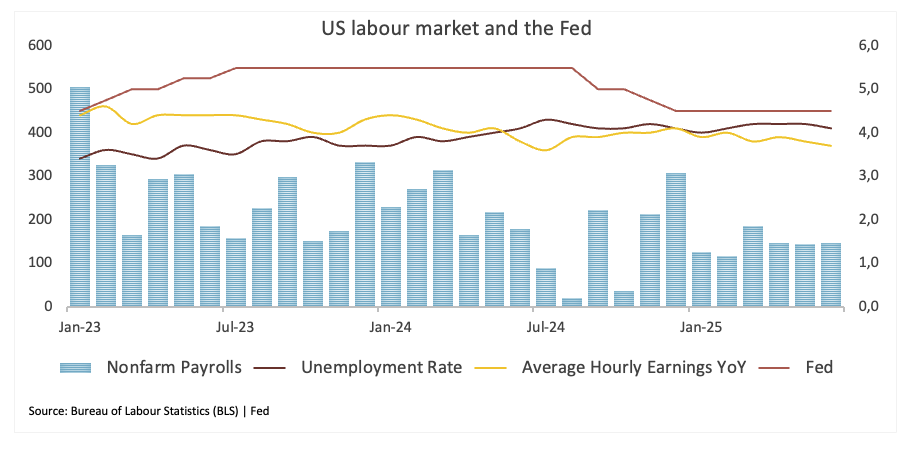

However, firmer-than-expected US Nonfarm Payrolls (+147K) in June, in combination with a decline in the Unemployment Rate (4.1%) and solid weekly Initial Jobless Claims (+233K), reinforced the view that the domestic labour market remains quite resilient. That, plus the unexpected improvement in the ISM Services PMI, lent extra wings to the US Dollar and sponsored a late bounce via investors’ repricing of a now later rate reduction by the Federal Reserve (Fed).

Trade concerns regain their shine

The approaching July 9 tariff deadline presents a significant threat to global markets, potentially affecting both market sentiment and the US Dollar.

In the latest news around the US and China, the Trump administration has lifted export limitations on chip-design software destined for China as part of Washington and Beijing’s attempts to reduce tensions under their recent trade agreement. Indeed, China’s Commerce Ministry reported that the two sides are actively working to execute the London deal and that the United States has told Beijing that it is lifting several export restrictions. Meanwhile, a ministry official said that China is “reviewing compliant export license applications for controlled items,” which includes rare earths.

Across the Atlantic, the European Union (EU) has failed to reach a breakthrough in trade negotiations with the Trump administration and may now seek to extend the status quo to avoid tariff hikes. The EU dropped hopes of a comprehensive trade agreement ahead of Trump’s July 9 deadline, but it is unclear if it will secure a lighter agreement in principle. Negotiators believe the US is willing to “pause” current tariffs for partners with which it reached an initial agreement, with possible tariff relief later. Without a preliminary agreement, broad US tariffs on most imports would rise from their current 10% to the rate set out by President Trump on April 2. Against this complicated backdrop, negotiations are set to continue into the weekend.

A look into the forest reveals that even reduced tariffs may have detrimental long-term effects on the economy.

Despite the possibility of early price rises being reduced, prolonged trade restrictions are projected to keep prices high in numerous industries, limit consumer spending, and stifle overall economic development. If these dangers materialise, the Federal Reserve (Fed) may be obliged to reassess its present ‘wait-and-see’ stance.

Despite ongoing disagreements, evidence shows that the White House favours a weaker currency. What steps can we anticipate from the Trump administration to address the record-high trade imbalance in a timely manner? A plan for the repatriation of industries is underway; nevertheless, achieving a beneficial outcome will require significant time and financial expenditure.

A rate cut in the summer? Not likely

The Federal Open Market Committee (FOMC) maintained its policy rate at the June 17-18 meeting, as expected. However, the actual emphasis moved to the new advice provided: the statement, press conference, and, most importantly, the revised dot plot received a lot of attention.

When taken together, the messages looked to be somewhat less aggressive than expected, with officials indicating a possible 50 basis point lowering by the end of the year. The Committee is navigating an environment characterised by weak growth projections and a high unemployment rate, offset by a modestly improved inflation expectation.

Fed Chair Jerome Powell’s following news conference did not clarify expectations for two anticipated interest rate decreases. He kept a patient tone and said that the Fed expects tariff-related price pressure to materialise in the coming months.

During his semiannual testimony, Powell warned Congress that increasing import tariffs might contribute to higher inflation this summer, a vital time for determining the adequacy of rate decreases. Powell cautioned that President Trump’s tariffs might lead to higher goods inflation, underscoring the Fed’s need to strike a delicate balance amid continued trade tensions and wider geopolitical uncertainty.

Meanwhile, around the FOMC…

Fed rate setters remained mostly neutral in their remarks during the past few days:

Austan Goolsbee (Chicago Fed) said that with unemployment near 4% and inflation falling toward 2.5 %, he saw no near-term risk of a 1970s-style stagflation despite tariff pressures.

Raphael Bostic (Atlanta Fed) reiterated he still expects the Fed to cut rates once this year, noting the central bank has “some luxury to be patient” given solid labour markets. At a later conference, he also warned that trade-related inflation risks could persist longer than expected, arguing that prolonged tariff debates might keep price pressures elevated.

Jerome Powell (Fed Chair) emphasised at the ECB Forum in Sintra (Portugal) that the Fed will “wait and learn more” about the inflationary impact of tariffs before cutting rates, brushing aside political pressure for immediate, deep cuts.

Tom Barkin (Richmond Fed) cautioned that slowed immigration would complicate the interpretation of upcoming jobs data, making it hard to distinguish between weaker growth and a shrinking labour force. He said the Fed is watching inflation and labour markets before resuming cuts.

What’s in store for the US Dollar?

The publication of the FOMC Minutes from the June 17-18 meeting will be the highlight of a rather quiet week in terms of data releases, with the primary discussion expected to revolve around US tariffs and their July 9 deadline, as well as any last-minute trade agreement that may emerge.

What about techs?

Once the multi-year low at 96.37 (July 1) is cleared, the index might go to the February 2022 floor at 95.13 (February 4), which is just above the 2022 base of 94.62 (January 14).

On the upside, the first resistance arises at the June ceiling of 99.42 (June 23), which is underpinned by the proximity of the intermediate 55-day SMA. The weekly top of 100.54 (May 29) is north of here, and it comes ahead of the May high of 101.97 (May 12).

In the meantime, the index appears prepared to continue its negative trend as long as it stays below the 200-day and 200-week Simple Moving Averages (SMAs), which are presently at 103.72 and 102.99, respectively.

Furthermore, momentum indicators continue to show a negative bias. The Relative Strength Index (RSI) has deflated to 35, while the Average Directional Index (ADX) is at 18, indicating a lack of trend strength.

US Dollar Index (DXY) daily chart

All in all

The decline of the US Dollar is far from over. Despite intermittent displays of strength, the Greenback is positioned to test lower lows amid ongoing ambiguity from the White House regarding trade policy and emerging fiscal concerns, especially following Trump’s “Big and Beautiful Bill” nearing enactment.

The Federal Reserve may postpone the continuation of its easing cycle, but its data-driven approach might fluctuate between favourable and unfavourable outcomes, with sporadic support for the US Dollar seeming transient.

There are no triggers, at least in the short term, to prompt the US Dollar to change direction and embark on a sustained recovery, either locally or globally.

The only shortcut to rectify the substantial US trade imbalance is via a depreciated currency. Among all politicians, President Trump is well aware of it.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.