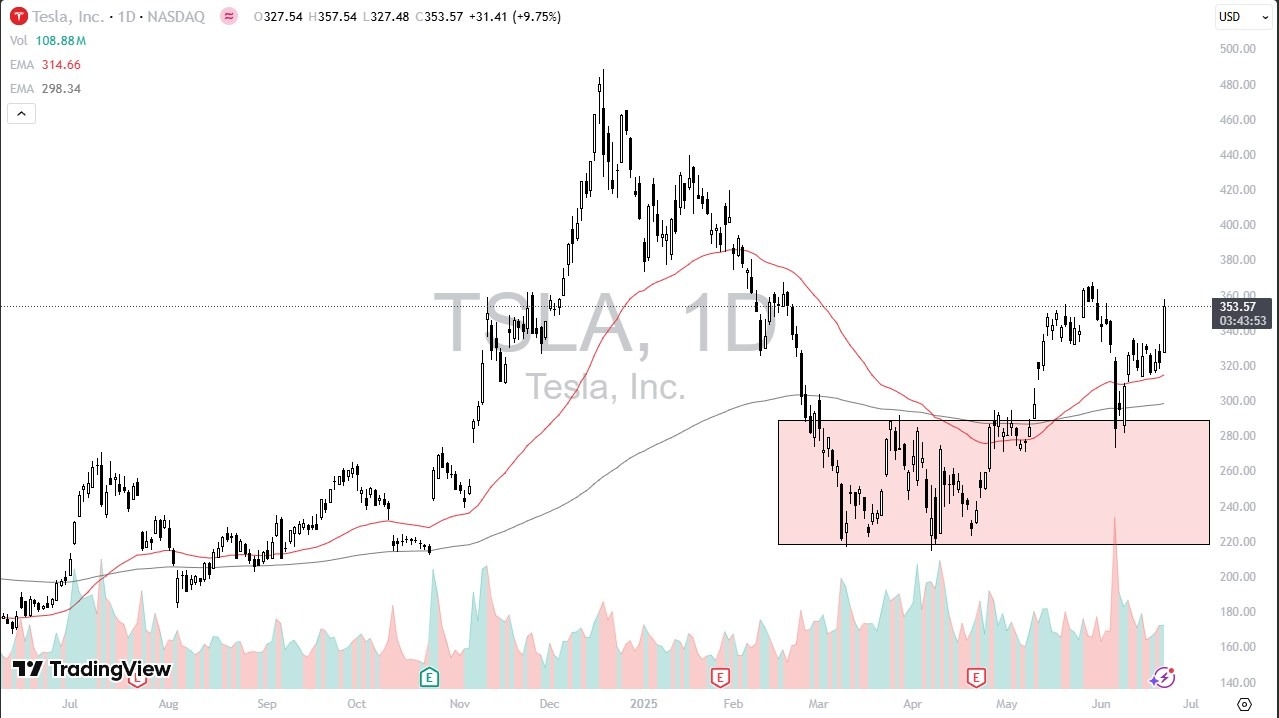

Potential Signal:

- On a move above $366, I’m a buyer of TSLA with a stop loss at $328.

- My target would be $410.

Tesla has seen a massive 10% move on Monday as traders are reacting to the news that Tesla will begin offering RoboTaxi service in Austin Texas for just $4.20 per ride. This is considered to be one of the next “great big moves” by Tesla to reach further into the markets for automobiles, and they have just hired a shot across the bow to almost everybody else in the same space.

Technical Analysis

The technical analysis for Tesla has been a bit interesting for a while, because we did have a massive selloff due to social media pressure on Elon Musk Due to his dealings with the US government and cutting of expenditures. There were protests across the country, and by protest, I mean people damaging Tesla vehicles and dealerships. That has since abated, as the latest thing is something else now, but it did have a major influence on Tesla and the way it was traded on Wall Street. However, once the drama stopped people started to pay attention to the fact that Tesla is a heavily favored stock.

During the June 5 session, we watched Tesla crumble on high-volume, essentially doing a “capitulation move.” Because of this, I’ve been watching Tesla for some time, and the news over the weekend of the taxi service has certainly driven the point home that Tesla is going nowhere. I think the move was probably a little overdone initially, but there should be plenty of support underneath that a lot of people will be paying close attention to.

The first obvious spot is somewhere near the $320 level, where the 50 Day EMA currently resides, as well as a lot of previous trading noise. Because of this, I think there is a little bit of a floor in this market in the short-term, but it is also worth noting that we have seen a lot of negativity creep into the overall market, and that might be influencing some of the giving back of the gains in Tesla.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.