It will be a week packed with central bank decisions, though a cautious bias and rate pauses are widely expected from four major institutions: the Federal Reserve, the Bank of England, the Bank of Japan, and the People’s Bank of China. On the sidelines, Norges Bank, Bank Indonesia and the Turkish central bank are also likely to keep rates steady. In contrast, the Swiss National Bank and the Swedish Riksbank are both expected to deliver quarter-point cuts.

Federal Reserve (Fed) – 4.25%/4.50%

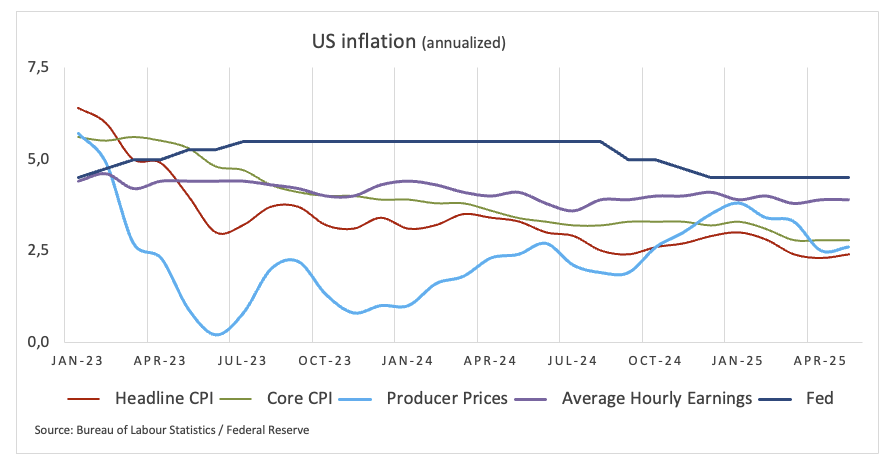

The Federal Reserve is expected to maintain its benchmark policy rate at its two-day meeting later in the week, balancing slowing US growth with risks from trade tensions, budget battles, and Middle East unrest.

Indeed, investors are expecting the Fed to remain unchanged, but the Summary of Economic Projections (SEP) will be key. The report will show how soft data, such as slowing job gains and easing consumer price pressures, has changed the outlook and whether risks are shifting in favour of an early cut.

The employment report showed a slowdown in hiring, while April’s inflation data reassured concerns about US tariffs causing price rises. Fed officials are cautious about taking hasty action and are mindful of their dual mandate of maintaining price stability while balancing full employment.

The announcement and forecasts will be analysed for any indication of a shift in objectives and clues about the start of rate cuts.

Upcoming Decision: June 18

Consensus: Hold

FX Outlook: The Greenback has been on the defensive since President Trump took office in late January. Last week, the US Dollar Index (DXY) slipped below the 98.00 contention zone for the first time since March 2022, marking its fifth consecutive month of decline as continued uncertainty and lack of progress on US trade policy cloud the outlook.

Bank of England (BoE) – 4.25%

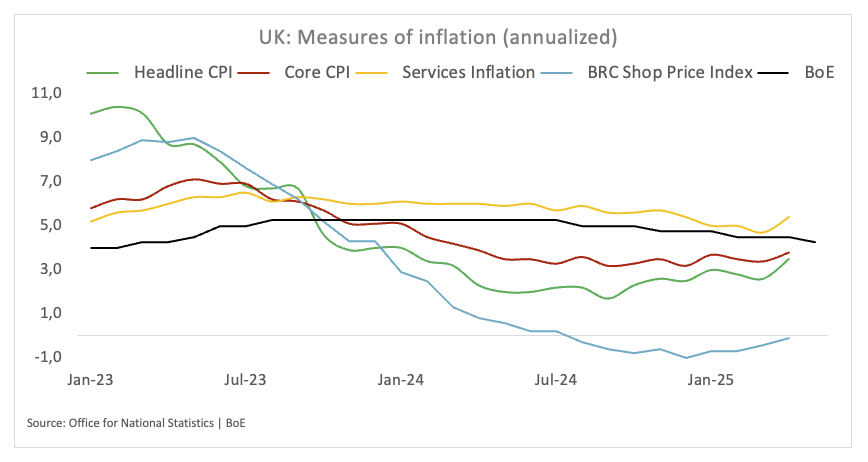

The BoE is balancing cautious rate cuts with new labour-market weakness, which supports calls for faster easing.

Governor Andrew Bailey’s assessment that the labour market has loosened is supported by wage growth slowing and employment declining. The Bank Rate remains steady at 4.2%, and markets have priced out any possibility of a cut next week.

Focus now shifts to the autumn, with a September decrease now about 24% likely. The Monetary Policy Committee (MPC) will examine whether muted pay growth and softer hiring offer enough protection to go beyond quarterly cuts as the central bank considers “how far and how quickly” to lower rates.

Any indication of a quicker route to reduced rates could impact markets still uneasy due to trade tensions between the US and China.

Upcoming Decision: June 19

Consensus: Hold

FX Outlook: The British pound (GBP) and its risk-sensitive peers have benefited from the persistent weakness of the US Dollar, driving GBP/USD to fresh multi-month highs past 1.3600 the figure. While trade-related uncertainty is likely to persist, at least over the short term, the prospects for further gains in Cable remain intact, particularly as long as it trades above its key 200-day SMA near 1.2920.

Bank of Japan (BoJ) – 0.50%

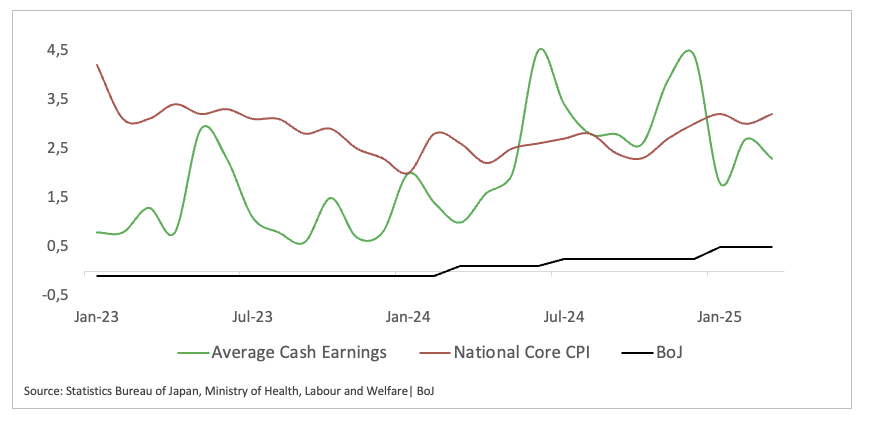

In the run-up to this week’s policy meeting, markets are weighing how the “dovish pause” in May and an increasingly uncertain outlook will shape the timing of further rate hikes. Governor Kazuo Ueda has reiterated that while the central bank ended its ultra-loose stance with a landmark increase to 0.5% in January, real rates remain negative because underlying inflation has yet to settle at 2.0%. He also told parliament that the BoJ will only “continue to raise interest rates” once it is “more convinced” that inflation will sustainably hover around its target, a conviction that now looks delayed toward FY2027 given recent downward revisions to growth forecasts.

Even as inflation remains above the BoJ’s target and steady wage gains from major employers fuel hopes of a sustained uptrend, fresh US tariff threats have cast a pall over Japan’s fragile recovery.

Against that, economists say such external risks could prompt the bank to temper the pace of tightening, opting for measured pauses rather than back-to-back hikes. In this context, June is expected to present more of the same cautious language: acknowledging risks and allowing for additional tightening, but refraining from changing the policy rate until policymakers have more concrete evidence that inflation will remain within target without endangering growth.

Upcoming Decision: June 17

Consensus: Hold

FX Outlook: USD/JPY remains in a consolidation pattern, with the lower bound holding near the 142.00 level. On the upside, the May highs around 148.70 have emerged as strong resistance, reinforced by the 200-day SMA. Unless the BoJ signals a clear shift toward an imminent rate hike, the Japanese yen is likely to remain under selling pressure.

Switzerland National Bank (SNB) – 0.25%

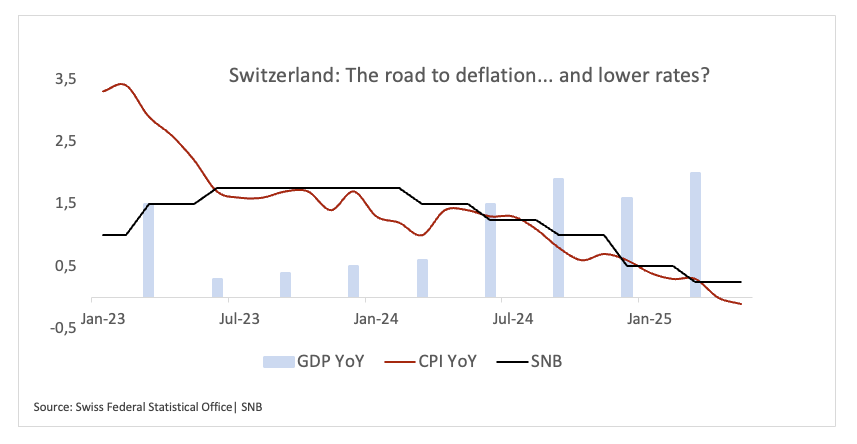

In light of the latest data releases, SNB officials are increasingly focused on deflationary risks rather than debating whether to cut rates below zero. Inflation is undershooting the bank’s projection by around 0.3 percentage points for Q2, and the Swiss Franc (CHF) remains unusually strong, prompting the US Treasury to place Switzerland on its FX intervention watch list, both factors that heighten the case for easing.

In fact, markets currently assign a nearly 70% probability to a 25 basis-point cut and around 30% to a larger move. Although recent data could justify an unusually large half-point reduction, SNB policymakers have cautioned against overreacting to a single data point and stressed the importance of preserving medium-term price stability.

The deposit rate is already at its post-financial-crisis floor of –0.7%, curtailing the SNB’s scope for deeper cuts and thus making a quarter percentage point reduction the most likely outcome.

Upcoming Decision: June 19

Consensus: 25 basis point rate cut

FX Outlook: The Swiss Franc remains strong and motivates USD/CHF to navigate the lower end of its range around the 0.8100 region, close to its yearly troughs near 0.8040 set in mid-April. So far, spot has entered its fifth consecutive month of losses, with the Franc picking up extra pace in response to unabated safe-haven demand.

People’s Bank of China (PboC) – 3.00% / 3.50%

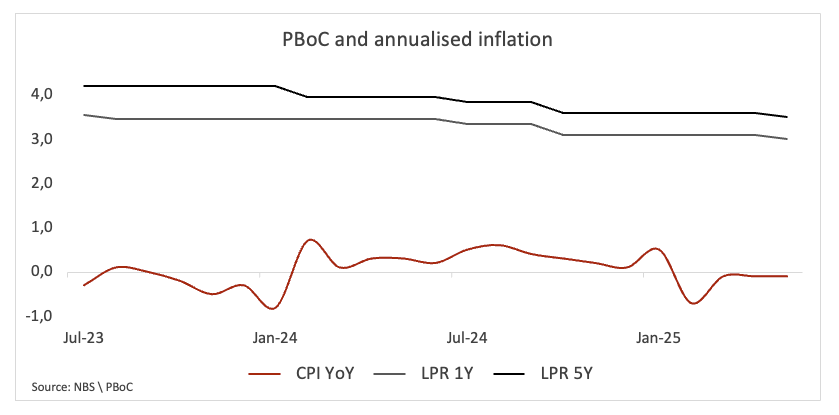

Since the beginning of the year, the People’s Bank of China (PBoC) has discreetly changed its strategy, injecting liquidity into the system and indicating the possibility of additional easing measures to support an economy still struggling with the aftermath of COVID lockdowns.

Spring data painted a mixed picture: Q1 GDP surprised on the upside at 5.4% on an annualised basis, giving Beijing room to breathe as it targets roughly 5% growth for 2025, while consumer prices remained below zero into May, underscoring persistent deflationary pressures.

Regarding trade, tensions between the US and China have eased after a two-day meeting in London involving officials from both nations.

In the meantime, the PBoC is seen keeping its policy rates unchanged at its June 20 event following a 10 basis point reduction in May.

The central bank should err toward a cautious stance, closely following developments in the domestic economy and trade before making any further adjustments. Additionally, the PBoC should not rule out the possibility of implementing additional stimulus measures if deflationary pressures intensify or if the economic outlook unexpectedly deteriorates.

Upcoming Decision: June 20

Consensus: Hold

FX Outlook: USD/CNH continues to navigate the area of multi-month lows near the 7.1700 region, always closely watching trade headlines and policy decisions by the PboC. While below its 200-day SMA around 7.2200, further downside pressure should persist around the pair, with the next target turning up at the November 2024 trough of 7.0865 (November 4).

Norges Bank (NB) – 4.50%

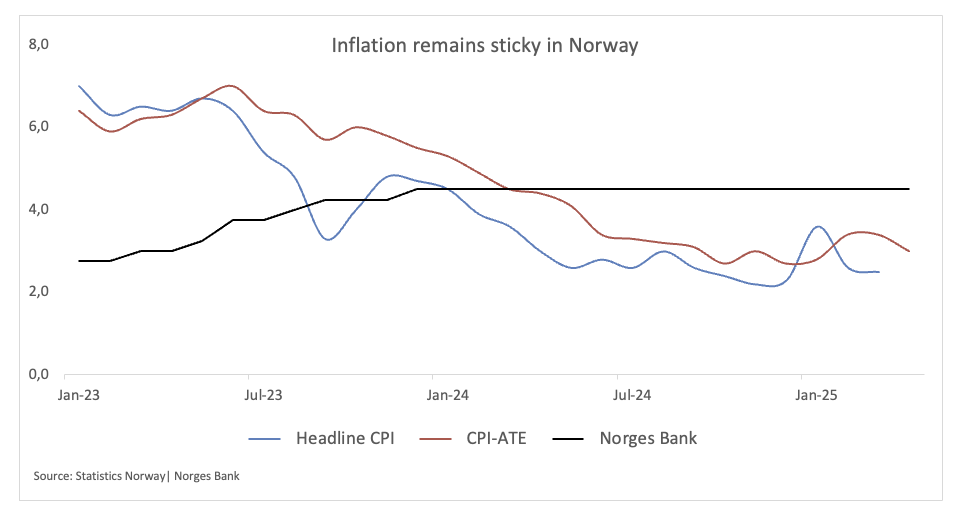

Norges Bank is expected to maintain its key policy rate at 4.5% next week, despite a mixed economic backdrop.

Headline inflation has cooled but remains above the central bank’s 2% target, primarily due to elevated food and services prices. Base-effect dynamics suggest that core inflation could accelerate again this autumn.

Changes worldwide may be both helpful and harmful, with new estimates suggesting a drop in oil prices and slower expansion of Norway’s trade partners. However, high tariffs and wage settlements mean imported costs are still rising, making it less likely that the central bank would ease monetary policy too soon.

Private spending has been better than expected due to real pay improvements, while employment remains strong. The housing market is also slightly weakening, in line with expectations. Norges Bank’s March projections suggest a gradual reduction of the policy rate to about 4% by year-end and toward neutral levels thereafter.

Upcoming Decision: June 19

Consensus: Hold

FX Outlook: The Norwegian Krona (NOK) has been appreciating on a persistent basis since its yearly lows vs. the Euro (EUR) in mid-April, with EUR/NOK accelerating its downtrend to the boundaries of the 11.4000 zone at some point during last week. The cross has broken below its key 200-day SMA near 1.1170 back in early May, opening the door to a more bearish outlook and paving the way for a potential visit to its YTD bottom around 1.1125 reached on April 2.

Riksbank – 2.25%

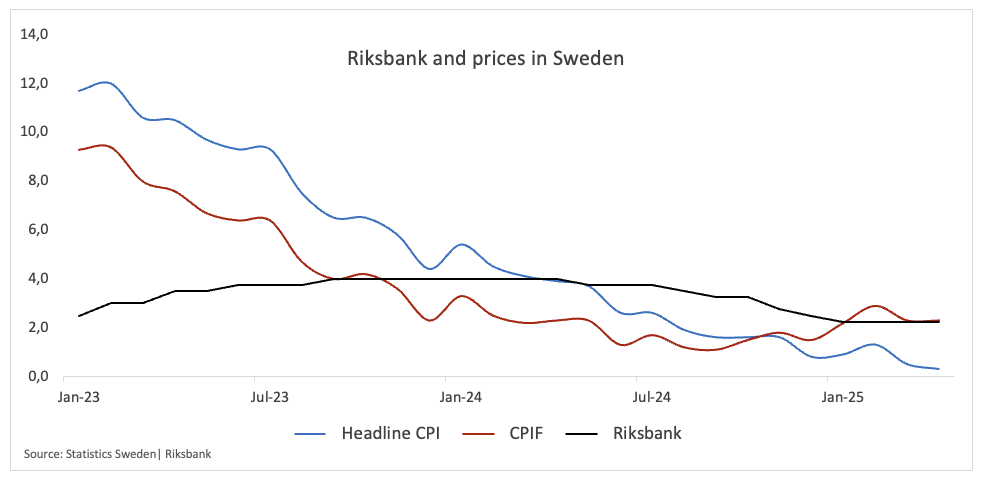

Sweden’s central bank is set to cut its benchmark repo rate by 25 basis points to 2.00% at its June 18 meeting.

This comes as final May inflation readings undershot expectations, bolstering market bets on easier monetary policy. On an annualised basis, CPIF inflation rose 2.3% in May, coming in below market consensus and the Riksbank’s internal forecasts. These discouraging results sparked speculation among investors about a near-certain rate reduction.

Furthermore, the Swedish economy appears to have lost some momentum in the first quarter, with the government downgrading its full-year GDP forecast to 1.8% from 2.3%.

In the meanwhile, Finance Minister Elisabeth Svantesson said that there are still big dangers and that US tariffs and other outside factors have made it much harder for exports to grow. The Riksbank, on the other hand, refers to Sweden’s strong public finances, thriving banks, and strong capital buffers as a way to protect against rising uncertainty.

Upcoming Decision: June 19

Consensus: 25 basis point rate cut

FX Outlook: The Swedish Krona (SEK) keeps its constructive tone so far this year, now apparently moving within a consolidative phase following a strong appreciation in place since early February. That said, monthly gains in EUR/SEK now appear limited by the 11.0000 barrier, while the 10.8000 zone is expected to offer decent contention for the time being.

Central Bank of the Republic of Türkiye (CBRT) – 46.00%

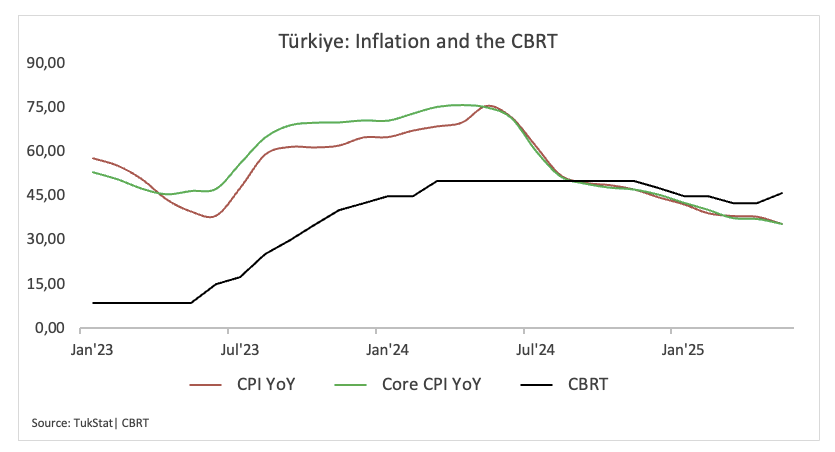

The central bank of Turkey is likely to keep its policy rate the same at its next meeting since inflation is high and the economy is doing relatively well.

The CBRT’s Financial Stability Report said that recent changes in monetary policy and lower price pressures have increased demand for assets denominated in lira. It also said that attempts to reduce market volatility have kept the country’s sovereign risk premium from rising too much.

The quality of banks’ assets became a little worse, but their balance sheets are still strong enough to handle any shocks that could happen.

Inflation predictions for 2025 are still at 24%, and they are expected to drop to 12% by 2026 and 8% by 2027. The Monetary Policy Committee is likely to say again that it will only make choices based on evidence. It will also stress that any further easing depends on unambiguous, long-term disinflation and maintained financial stability.

Upcoming Decision: June 19

Consensus: Hold

FX Outlook: USD/TRY keeps its upward projection well in place, trading at shouting distance from the 39.5000 region. With the exception of occasional bouts of strength, the Lira is widely anticipated to remain on the defensive. TRY has been on a sustained depreciation since 2020, with the trend gathering steam since late 2021.

Bank Indonesia (BI) – 5.50%

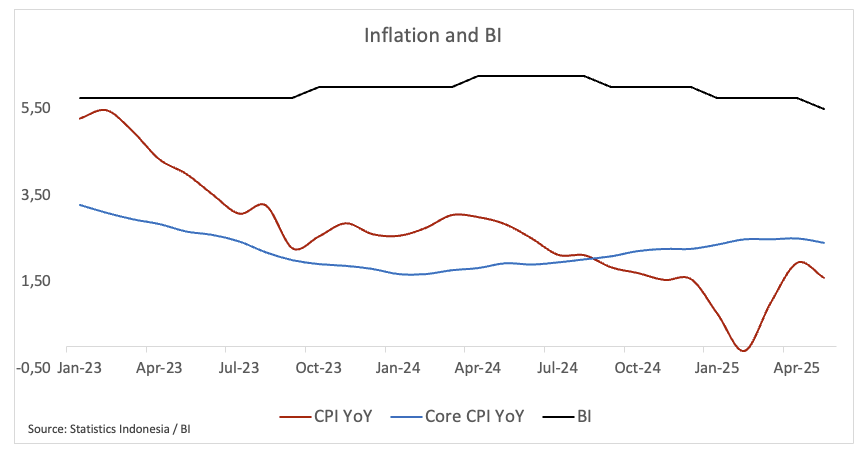

Bank Indonesia is seen maintaining its policy rate intact at 5.50% at its gathering on June 18.

If consensus materialises, the central bank would enter a two-month pause after starting its monetary easing in May following a four-month break.

The domestic economic activity slowed down a tad in the first quarter, with GDP expanding just 4.87% YoY, the worst since late 2021. The headline inflation rate increased from 1.03% in March to nearly 2.0% in April, mainly due to the end of a two-month government rebate on power bills, just to ease to 1.6% in May.

In the FX world, the rupiah has remained below 16,600 per dollar since early May, allowing Governor Perry Warjiyo to shift towards growth without capital outflows.

That said, markets will be monitoring BI’s future guidance to see how fast further cutbacks may occur. The central bank has achieved its fundamental objective of foreign exchange stability, facilitating a gradual easing cycle aimed at enhancing domestic demand.

Upcoming Decision: June 18

Consensus: Hold

FX Outlook: The Indonesian Rupiah (IDR) has largely been range-bound against the dollar since mid-May, with USD/IDR oscillating near 16,300 and finding support around the 200-day SMA at roughly 16,100. With global trade dynamics becoming increasingly uncertain, the IDR is expected to remain under close market scrutiny.