Potential signal:

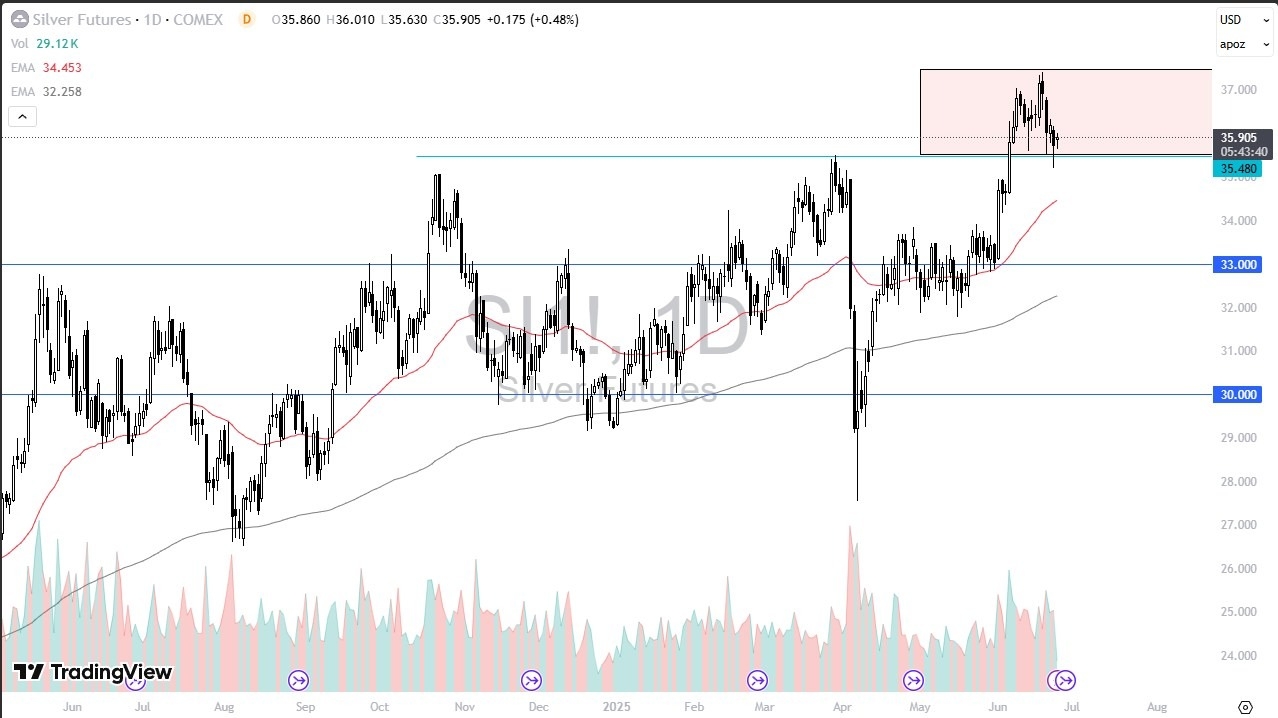

- I would buy silver at $36.20, with a stop loss at $35.50, and a target of $37 above.

Silver markets have seen a little bit of support during the trading session on Wednesday, as metals markets have calmed down a bit. We initially saw quite a bit of selling in the precious metals markets, as the Middle East calmed down, but at this point we still have to look at the possibility that the $35.50 level continues to offer as a floor. After all, we formed a massive hammer during the Tuesday session, and now it looks like traders are willing to step in and pick up silver based on value.

Technical Analysis

The technical analysis for silver is very bullish, and I don’t think that it changes anytime soon. As mentioned previously, the $35.50 level is an area that a lot of people will be watching as support. Even if we were to break down below there, we have the 50 Day EMA sitting right around the $34.40 level and rising. We also have a cluster of previous action there that suggest there is a certain amount of interest anyway, so I think that is just an area of confluence that we need to pay close attention to. Ultimately, I do believe that will be a very important level or if we do in fact start selling off.

On the other hand, if we rally and break above the top of the hammer from the Tuesday session, that could send this market looking to the $37.50 level, which is a large, round, psychologically significant figure, and an area that has been resistance previously. If we can break above there, then the market could very well continue to go much higher, perhaps reaching the $40 level above, which of course has a lot of psychology attached to it as well.

Regardless, the one thing that I don’t see on this chart is an opportunity to start shorting silver, as it has been so strong for so long, and therefore I think you have to look for short-term pullbacks as a potential buying opportunities but also keep in mind that this is a very volatile market, and it of course can be very dangerous if it goes against you and you have too big of a position.

Ready to trade our daily forex analysis? Here are the best Silver trading platforms to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.