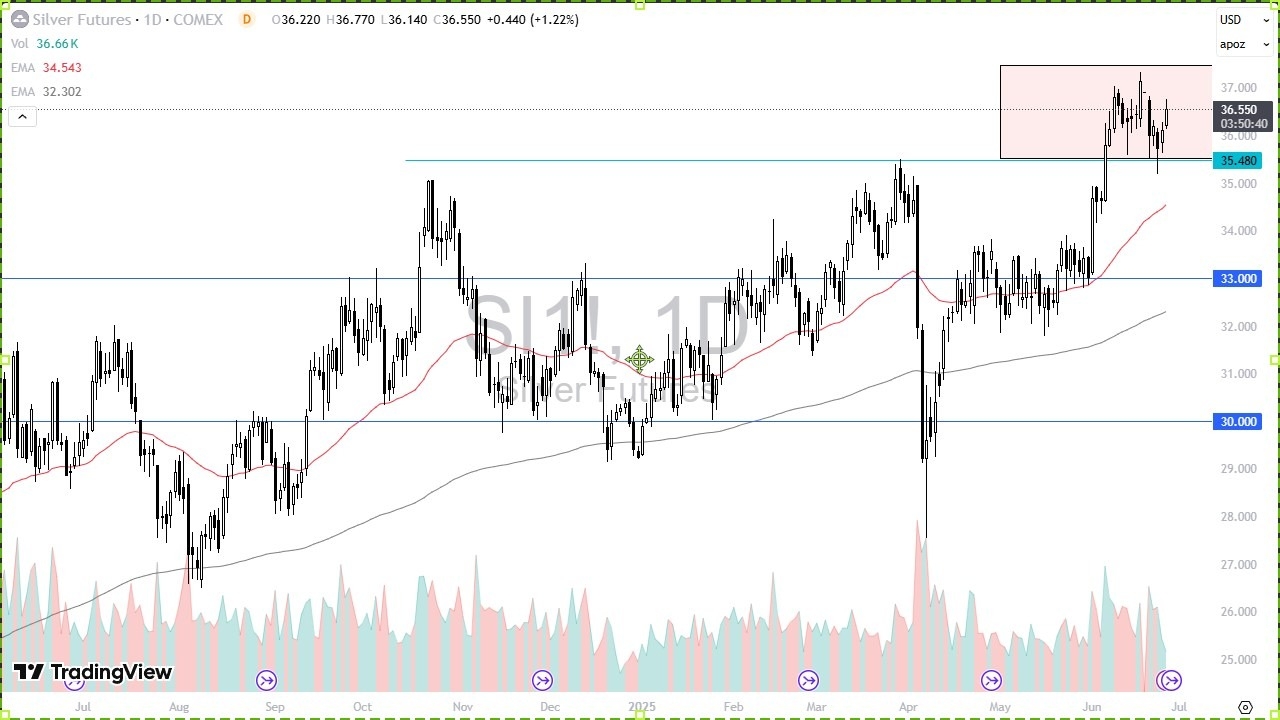

- Silver has rallied significantly during the trading session here on Thursday as we had pulled back and now, we have found quite a bit of bullish pressure and traders willing to step in and pick up silver yet again.

- All things being equal, this is a market that I think given enough time will probably continue to be buy on the dip and eventually I do anticipate that silver will probably break the $37.50 level, but I also think that it will take a certain amount of momentum or possibly even news to make that happen.

- With this, I am bullish, but I also recognize that it is probably going to be very noisy in the short term as silver typically is anyway.

The noise could only increase from here if we watch the various headlines that are currently going on.

Caution is Needed Here

So, you do need to be cautious with your position sizing. The silver market breaking above the $32.50 level has a measured move of roughly $40. And that’s my target. Patience will be necessary, but keep in mind that if the US dollar continues to shrink, that might be reason enough for silver to continue going higher.

I don’t want to short this market, but if we broke down below the $35.50 level, then maybe you have to rethink the entire situation. We’ll just have to wait and see how that plays out. A breakdown below that level, I think then you start looking at the 50-day EMA as potential support. Anything below there, then things start to change. But right now, I think it’s going to take a lot to make that happen. And therefore, I remain bullish of silver at the moment, and don’t really see a situation where I am selling it anytime soon.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.