- Gold failed to stabilize above $3,400 after bullish breakout.

- The technical outlook highlights bulls’ hesitancy in the near term.

- The Fed’s policy announcements, US-China trade talks could trigger the next big action in Gold.

Following a bullish start to the week, Gold (XAU/USD) reversed its direction and retreated below $3,400. Key macroeconomic data releases from the United States (US), the Federal Reserve’s (Fed) monetary policy decisions and fresh developments surrounding the US-China relations could ramp up XAU/USD’s volatility and provide important directional clues.

Gold fails to stabilize above $3,400

After spending the previous week in a tight consolidation channel, Gold broke out of its range on Monday and attracted technical buyers. Additionally, the US Dollar (USD) came under renewed selling pressure amid a deepening feud between US President Donald Trump and the Fed, allowing XAU/USD to gather further bullish momentum.

Citing a letter sent to the Department of Justice (DoJ), Fox News reported late Monday that Republican Representative Anna Paulina Luna has referred Fed Chairman Jerome Powell to the DoJ for criminal charges, accusing him of perjury on two occasions. Moreover, Treasury Secretary Scott Bessent told CNBC that they need to review the entire Fed institution and its performance, citing the Fed’s “fear-mongering over tariffs” despite a lack of significant signs of inflation as justification. As a result, Gold gained more than 1% both on Monday and Tuesday to rise above $3,400 for the first time in about a month.

As risk flows started to dominate the action in financial markets, Gold reversed its direction and staged a deep correction midweek. Trump announced early Wednesday that he completed a “massive deal” with Japan, explaining that Japan will invest $550 billion into the US and pay 15% reciprocal tariffs, down from 25%, to the US. Reflecting the upbeat market mood, Japan’s Nikkei 225 Index gained more than 4% and reached its highest level since July 2024. Later in the day, Wall Street’s main indexes opened on a bullish note and made it difficult for Gold to find demand as a safe haven.

The USD benefited from upbeat macroeconomic data releases on Thursday, forcing XAU/USD to stay on the back foot. The US Department of Labor announced that the number of first-time applications for unemployment benefits declined to 217,000 in the week ending July 19 from 221,000 in the previous week. This reading came in better than the market expectation of 227,000. Other data from the US showed that the business activity in the private sector expanded at an accelerating pace in early July, with the S&P Global preliminary Composite Purchasing Managers Index (PMI) rising to 54.6 from 52.9 in June.

In the meantime, growing optimism about improving US-China trade relations helped the risk mood remain upbeat on Friday, causing Gold to extend its slide to below $3,350. US Treasury Secretary Scott Bessent told Fox Business late Thursday that the US is in a “pretty good place with China on trade.” Moreover, the Wall Street Journal reported that the Trump administration is preparing for a new round of trade talks with China next week, with a focus on securing an economic agreement that will increase the US’s access to Chinese markets, particularly in business and technology.

Gold investors shift attention to US-China talks, Fed interest rate decision

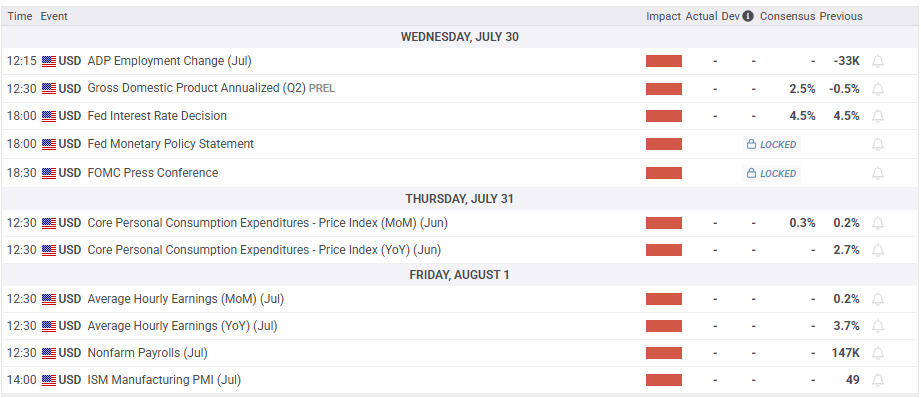

The economic calendar will offer multiple high-impact data releases and the Fed will announce monetary policy decisions following the July 29-30 policy meeting.

According to the CME FedWatch Tool, markets see virtually no chance of a rate cut in July and price in a probability of about 40% for another rate hold in September, up from roughly 10% a month before. Hence, investors will scrutinize the statement language and Fed Chairman Powell’s remarks in the post-meeting press conference for fresh hints at the timing of the next rate cut.

Ahead of the Fed event, the US Bureau of Economic Analysis will release its first estimate of the annualized Gross Domestic Product (GDP) growth for the second quarter. Following the 0.5% contraction recorded in the first quarter, the GDP is expected to rebound. A negative GDP print could feed into expectations for a rate reduction in September and trigger a USD selloff with the immediate reaction, pushing XAU/USD higher. Conversely, a reading near the market expectation could cause investors to refrain from taking large positions in Gold.

In case Powell leaves the door open for a rate cut in September, citing alleviated uncertainty from recently announced trade deals, US Treasury bond yields could turn south with the immediate reaction, opening the door for a leg higher in Gold. On the flip side, XAU/USD could stretch lower if Powell avoids committing to a rate cut at the next meeting, citing the latest uptick seen in inflation readings.

On Friday, the US Bureau of Labor Statistics will publish the employment report for July. An increase of more than 100,000 in Nonfarm Payrolls (NFP) could suggest that labor market conditions are good enough for the Fed to prioritize controlling inflation in policy-making and support the USD. If the NFP disappoints with a print at or below 70,000, the USD could struggle to find demand heading into the weekend and help XAU/USD gather bullish momentum.

Meanwhile, market participants will pay close attention to headlines coming out of the US-China talks. If sides make further progress in trade and economic relations, risk flows could dominate the action in financial markets and make it difficult for Gold to find demand.

Gold technical analysis

The near-term technical outlook highlights buyers’ hesitancy. The Relative Strength Index (RSI) indicator on the daily chart stays slightly below 50, and XAU/USD struggles to pull away from the 20-day and the 50-day Simple Moving Averages (SMAs) after clearing these levels earlier in the week.

On the upside, $3,400 (static level, round level) aligns as an interim resistance before $3,450 (static level) and $3,500 (all-time high, end-point of the January-June uptrend).

If Gold confirms $3,340 (20-day SMA, 50-day SMA) as resistance, technical sellers could remain interested. In this scenario, $3,285 (Fibonacci 23.6% retracement) could be seen as the next support level ahead of $3,250 (100-day SMA) and $3,150 (Fibonacci 38.2% retracement).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.