- XAU/USD up 0.30% in North American trade, finding support above $3,350.

- US Treasury Secretary Bessent urges Fed to slash rates by 50 bps next month and target 150–175 bps lower overall.

- Geopolitics in focus: Trump to meet European, Ukrainian leaders before Alaska summit with Putin on Ukraine truce.

- Light data day; Fed speakers Goolsbee and Bostic on wires.

Gold price climbs during the North American session on Wednesday, up by 0.30% as investors continue to increase their bets that the Federal Reserve (Fed) will reduce interest rates at the September meeting. At the time of writing, XAU/USD trades at $3,357, above a key technical support level.

The latest inflation report in July showed mixed readings as the headline Consumer Price Index (CPI) remained unchanged, while core figures rose. Nevertheless, traders seem convinced that the Fed Chair Jerome Powell and Co. will resume its easing cycle in September.

Voices within the Trump administration echoed some of the US President’s demands to the Fed to lower rates. The Treasury Secretary Scott Bessent said the Fed should start cutting 50 basis points (bps) at the next meeting, adding that rates should be between 150 to 175 bps lower.

In the meantime, European and Ukrainian leaders were set to talk with Trump, before the Russian President Vladimir Putin meets him in Alaska to discuss a truce in Ukraine. Regarding trade talks, Washington and Beijing extended their trade truce by 90 days.

The lack of economic data left traders adrift, with Federal Reserve officials crossing the wires, led by Chicago Fed President Austan Goolsbee and Atlanta’s Raphael Bostic.

Traders will eye further data releases as the US schedule remains busy. Ahead awaits PPI data, Jobless Claims for the week ending August 9, Retail Sales, and the University of Michigan Consumer Sentiment index.

Daily digest market movers: Gold price rises despite Fed’s Goolsbee hawkish tilt

- The US CPI for July was a tenth below estimates at 2.7% YoY, unchanged compared to June’s reading. At the same time, core CPI expanded by 3.1% YoY, exceeding estimates of 3% and June’s 2.9% print. Digging into the data, energy prices fell by 1.1% while food prices stood unchanged.

- Although the impact of tariffs appears muted, current interest rates are likely offsetting some of those increases, according to the Kansas City Fed President Jeffrey Schmid on Tuesday. He noted that the muted effect of tariffs on inflation is likely a sign that policy is appropriately calibrated.

- Chicago Fed President Austan Goolsbee said that economists are unanimous that the Federal Reserve (Fed) must be independent from political interference. He added that independence is crucial, “because we don’t want inflation to come back.” He added that tariffs are a stagflationary shock and said that he is “uneasy” that tariffs are a one-time shock that creates transitory inflation.

- Regarding future Fed meetings, Goolsbee said they’re going to be live, meaning that most Fed members would not be pre-committed about interest rates.

- Following CPI, traders will also eye PPI and the evolution of the labor market and consumer spending via Retail Sales, which are expected to dip from 0.6% to 0.5% MoM in July. The week will end with the release of the US Michigan Consumer Sentiment Index, which is projected to improve from 61.7 to 62 in August’s preliminary reading.

- The US Dollar Index (DXY), which tracks the performance of the buck’s value against a basket of its peers, is down 0.25% at 97.81. The drop in the Dollar has pushed Gold’s prices higher, above $3,350.

- The US 10-year Treasury note yield plunges five basis points, to 4.238%.

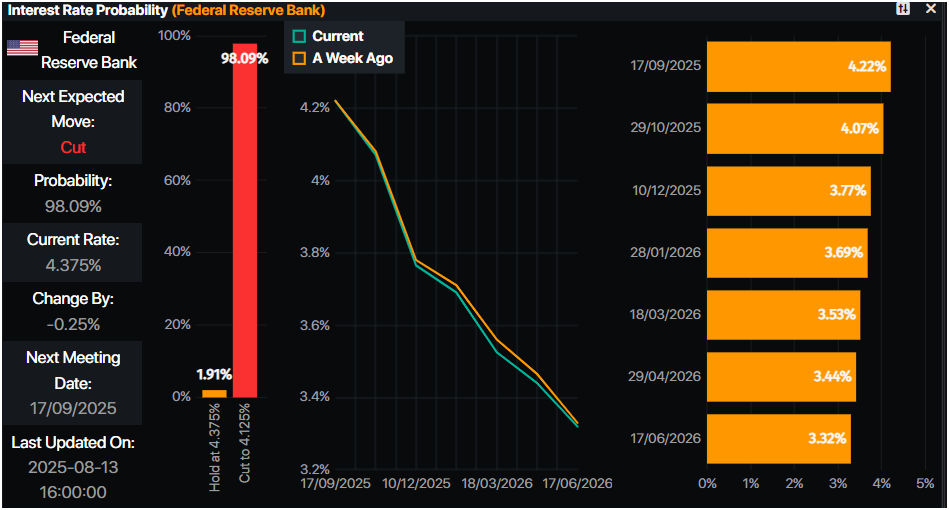

- Fed Interest Rate Probabilities show that traders had priced in a 98% chance of a quarter of a percentage rate cut at the September meeting, according to Prime Market Terminal data.

Technical outlook: Gold price climbs but faces resistance at the confluence of 20/50-day SMAs

Gold price holds firm at around the confluence of the 20 and 50-day Simple Moving Averages (SMAs) near the $3,349-$3,357 range, unable to clear top or bottom levels. Momentum is tilted bullish, as depicted by the Relative Strength Index (RSI). Nevertheless, neither buyers nor sellers seem committed to opening new positions ahead of the release of PPI figures.

If XAU/USD clears $3,357, the next resistance would be $3,380, followed by $3,400. A breach of the latter will expose June’s 16 peak at $3,452, followed by the record high of $3,500. Conversely, if Gold ends daily below $3,350, Bullion could slide towards the 100-day SMA at $3,288, previously breaking $3,300.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.