- Investors fear Trump’s upcoming tariff announcements.

- The Federal Reserve’s Meeting Minutes may shed light on how officials are worried about inflation.

- A rate decision in Australia and weekly US jobless claims complete the picture.

How high will tariffs go? United States (US) President Donald Trump’s next moves are worrying investors and will likely dominate trading.

1) Threats of additional duties may provide a buying opportunity

Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff. There will be no exceptions to this policy

This post from President Trump rattled investors, who received a reminder of the Commander-in-Chief’s desire to remain in the spotlight. Over the weekend, Brazil, Russia, India, China, and South Africa (BRICS) countries released a communique denouncing Trump’s tariff policy, prompting a lashing out.

His announcement came on top of another one, in which Trump promised to begin announcing duties on countries as early as Monday. These levies are set to take effect on August 1.

So far, the US has reached a complete trade deal with the United Kingdom (UK), one in principle with Vietnam, and a “trade truce” with China. Negotiations with Japan, Canada and the EU have been intense, but seem far from being concluded.

Will harsh duties come into effect soon, derailing the global economy? Not so fast. Back in April, Trump’s “Liberation Day” announcement hit global markets, but he suspended the lion’s share of them the following week, following turmoil, especially in Bond markets.

Other big threats also came and went, creating buying opportunities. Wall Street dubbed it the Trump Always Chickens Out trade (TACO trade).

Will recent history repeat itself?

2) RBA set for third rate cut this year

Tuesday, 4:30 GMT. The Reserve Bank of Australia (RBA) took its time before joining the global interest rate-cutting cycle, but the pace is gathering steam. Economists expect the RBA to cut rates by 25 basis points (bps) to 3.60% from 3.85%.

Inflation has been slowing in the land down under, sliding to 2.1% YoY as of May. In addition, Australia’s latest jobs report and retail sales fell short of estimates.

China, Australia’s No. 1 trading partner, has managed to weather US tariffs, but seems far from the heyday of growth that resulted in insatiable demand for Australian metals.

The interest rate cut is mostly priced in, but could still weigh on the Aussie (AUD), especially if RBA Governor Michelle Bullock and her colleagues signal further cuts ahead.

3) FOMC Meeting Minutes set to show no rush for cuts

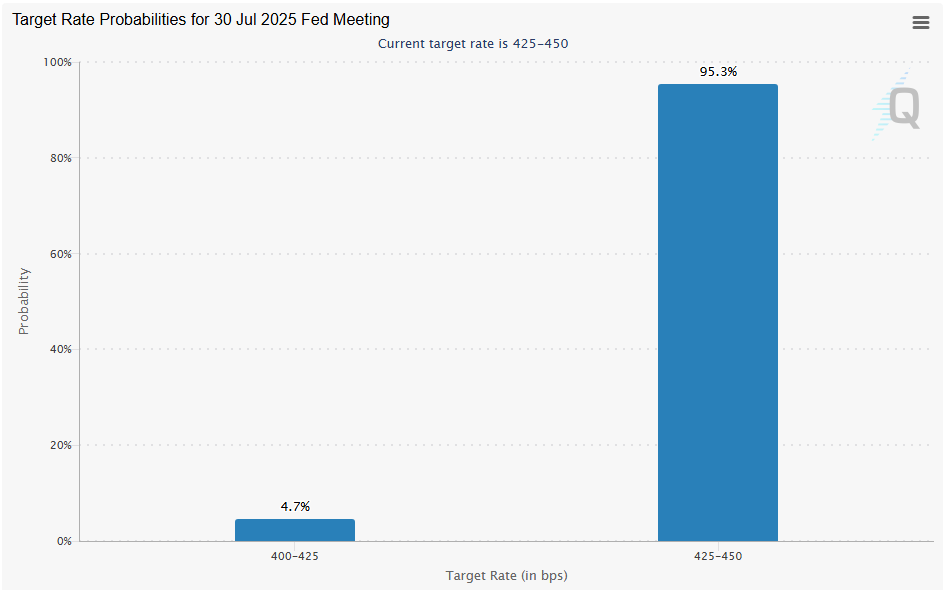

Wednesday, 18:00 GMT. How close is the Federal Reserve (Fed) to cutting interest rates? Thursday’s Nonfarm Payrolls (NFP) report for June beat estimates and all but removed the chances of a rate cut in July.

However, a peek into the Fed’s thinking about borrowing costs is of importance. The minutes are released three weeks after the decision, but they are revised until the last minute, allowing officials to convey a message to markets.

I expect a relatively hawkish tone, reflecting concerns about rising prices more than the labor market. The impact of the minutes tends to be short-lived.

Chances of a rate cut in July are low, according to the CME Fedwatch:

Source: CMEGroup.

4) US jobless claims may extend their fall

Thursday, 12:30 GMT. US weekly Initial Jobless Claims serve as a barometer for the labor market. After long weeks of hovering above 240K, they dropped below that threshold in the latest two releases, providing optimism, but were overshadowed by the Nonfarm Payrolls (NFP) report, published on Thursday for a change.

Will they extend their decline back to the previous range of the 220K’s? That would be good news for the domestic and global economy. A climb back above 240K would show that the drop was a one-off and that optimism was premature.

With few other data points, claims data could have a disproportionately large impact this time.

Final thoughts

This is a trickier week to trade, as announcements and reports about tariffs could come at unexpected hours. The deadlines remain fluid as well. Trade with care.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.