The US Dollar (USD) sharply reversed course after Federal Reserve (Fed) Chair Jerome Powell struck a notably dovish tone during his appearance at the Jackson Hole Economic Symposium, pinning interest rate cut bets to the ceiling. Market sentiment is back on the rise, sending the Greenback to fresh three-week lows. However, hopes for a Fed rate trim in September will now have to overcome key inflation data coming up late next week.

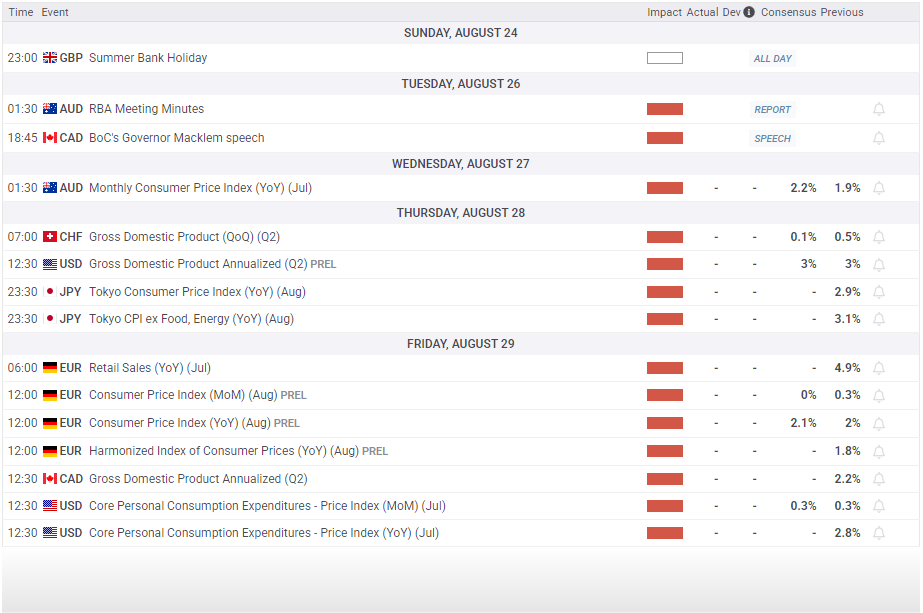

The US Dollar Index (DXY) erased most of the week’s gains on Friday, tumbling back below 97.60 and chalking in a third consecutive week of declines. Global markets, and US Dollar positioning by proxy, have tilted firmly into bets for a quarter-point interest rate cut on September 17. However, several key hurdles remain, notably the upcoming core Personal Consumption Expenditure Price Index (PCE) inflation print due on August 29. Over the horizon, another round of Nonfarm Payrolls (NFP) jobs data ats the beginning of September, as well as another update on Consumer Price Index (CPI) inflation, stand as roadblocks to a clear path toward fresh rate cuts.

The Fed’s dual mandate of guiding both inflation controls and defending job creation is running into conflicting datasets: Recent employment figures are seeing sharp downside revisions, which would typically prompt looser policy to bolster the domestic economy, yet inflation metrics have made functionally no progress toward the Fed’s 2% inflation target in over a year. As long as the Fed continues to tilt toward a rate cut at September’s Federal Open Market Committee (FOMC) interest rate decision, the US Dollar will likely continue to face further declines as hedging flows push the Greenback lower.

In a near-perfect mirror of the DXY, EUR/USD saw a late-week reversal that wiped out the week’s cumulative losses, putting the Fiber in the green for a third consecutive week. The Euro remains unable to climb over the 1.1800 handle against the US Dollar, but general market sentiment has priced in a firm technical floor from 1.1600.

A fresh round of preliminary August CPI figures from Germany will greet EUR/USD traders next week. Annualized German inflation is expected to tick up slightly to 2.1% YoY, but generally remain safely within 2025’s 2.0-2.3 range. Markets are firmly betting that the European Central Bank (ECB) will maintain its current interest rate holding pattern for the time being, with the next interest rate cut not expected until December.

GBP/USD snapped a four-day losing streak after Fed head Powell’s apparent policy stance pivot. Most of the week’s losses were pared away on Friday, but Cable is still tilted toward the low side as the Pound Sterling (GBP) struggles to maintain bidding support. It will be a short trading week for GBP/USD traders, with London markets shuttered on Monday for an extended weekend, and nothing impactful on the economic data docket for the week.

USD/JPY continues its ongoing pattern of little week-on-week movement. The Dollar-Yen pairing has been treading water in recent weeks, shifting slightly lower but sticking close to the 147.50 region over a five-week period. The latest round of Tokyo CPI inflation is due on August 28, and the preliminary inflation metric has been holding above the Bank of Japan’s (BoJ) target band since March.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.