The most recent CFTC Positioning Report for the week ending June 10 highlights a cautious approach among investors in anticipation of critical US inflation data. This sentiment is further influenced by the ongoing US-China trade discussions in London, alongside the evolving geopolitical risks in the Middle East that are impacting the global landscape.

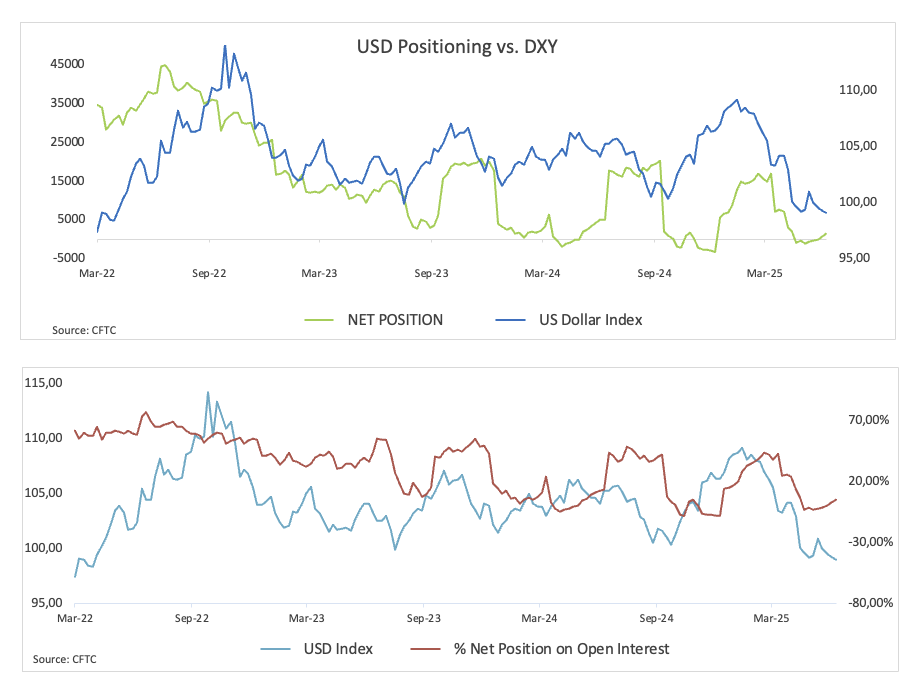

Speculators intensified their bullish stance on the US Dollar (USD), with net longs increasing for the second week in a row, this time hitting a multi-week peak around 1.4K contracts. In the same line, open interest resumed its uptrend to two-week highs over 30K contracts. Against this backdrop, the US Dollar Index (DXY) remained stable around the 99.00 region, indicating the ongoing caution among traders.

Non-commercial net longs in the Euro (EUR) have increased further, advancing to levels last seen in early September 2024 around 93K contracts. Hedge funds, in the meantime, increased their net short positions to approximately 151.2K contracts, marking the highest level observed since early January 2024. Open interest picked up extra pace and now exceeded 810K contracts, reaching a peak not seen in around two years. EUR/USD maintained its gradual advance and aimed to consolidate above the 1.1400 barrier.

Speculative net longs in the British Pound (GBP) surged to multi-month peaks around 51.6K contracts. The move, however, came in contrast with a decent drop in open interest. GBP/USD treaded water in the upper end of its recent range, hovering around the key 1.3500 zone.

Net long positions in the Japanese Yen (JPY) held by non-commercial players retreated to around 144.6K contracts, the lowest level since early April. Commercial trades, in the meantime, trimmed their bearish bets to around 169K contracts, also the lowest level in several months, all against the backdrop of a decent build in open interest to around 388.2K contracts. The upside impulse in USD/JPY gathered steam, breaking above the ey 145.00 hurdle.

Bullish bets in Gold receded marginally, although they remained at multi-week highs around 187.5K contracts following an acceptable bounce in open interest. Gold prices showed some fresh weakness, revisiting the $3,300 zone per troy ounce in response to investors’ hope of some improvement on the US-China trade front.

Speculative net longs in WTI jumped to nearly 192K contracts for the first time since February on the back of increasing geopolitical effervescence in the Middle East amid the Israel-Iran tension. In tandem with this move, open interest climbed to nearly 2.02M contracts, or multi-year peaks. Prices of the American WTI rose further and retested new highs around the $66.00 mark per barrel.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.