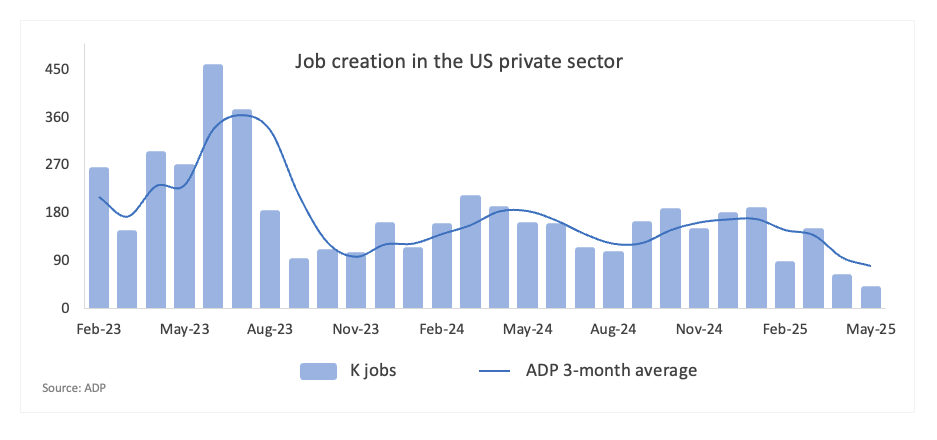

- With the ADP and NFP releases, it will be another key week for the US labour market.

- The US private sector is expected to add 95K new jobs in June.

- The US Dollar Index navigates an area last seen in February 2022.

This week, the US labour market is set to take centre stage, adding to the combo of factors driving market sentiment as of late, namely mitigated geopolitical tensions in the Middle East, rising hopes of further progress on the trade front and prospects of the resurgence of Fed easing in Q3, as well as the renewed animosity from President Donald Trump toward Federal Reserve (Fed) Chair Jerome Powell.

Despite concerns about a potential economic slowdown in the US economy having not dissipated, they seem to have been put on the back burner for the time being.

The ADP Research Institute is poised to release its June Employment Change report on Wednesday, and it will explore the dynamics of private sector job gains.

The ADP survey is typically published a few days prior to the official Nonfarm Payrolls (NFP) data and is frequently viewed as an early indicator of potential trends that may be reflected in the Bureau of Labour Statistics (BLS) jobs report, although the two reports do not always align.

Employment, inflation, and Fed strategy

Employment serves as a fundamental element of the Federal Reserve’s dual mandate, in conjunction with the objective of maintaining price stability.

Recent months have indicated a tentative reduction in inflationary pressure, leading to a shift in focus toward the US labour market. This change follows the Fed’s consistent approach during its June 17–18 meeting and the recent relatively dovish comments made by Chair Powell in Congress.

Currently, market participants anticipate a 50-basis-point easing by the Fed in the latter half of the year, a possibility that could gain additional backing from certain Fed officials.

In light of the recent optimism regarding the White House’s trade strategy, coupled with a resilient economy and declining consumer price pressures, the forthcoming ADP report — especially Friday’s NFP report — has gained increased importance, likely influencing the Fed’s subsequent actions.

When will the ADP report be released, and how could it affect the US Dollar Index?

The ADP Employment Change report for June is set to be released on Wednesday at 12:15 GMT, with projections indicating an increase of 95K new jobs following May’s disappointing gain of 37K. The US Dollar Index (DXY) is currently adopting quite a negative position as it navigates multi-year troughs amid somewhat better conditions in trade and ongoing speculation regarding a potentially more accommodative Fed in the medium-term horizon.

If the ADP figures surpass expectations, they may alleviate some concerns regarding a potential economic slowdown, thereby supporting the Fed’s cautious approach. On the other hand, if the figures do not meet expectations, it could heighten concerns regarding the economy’s momentum, which may lead the Fed to reevaluate the timing of its easing cycle’s resumption.

Pablo Piovano, Senior Analyst at FXStreet, argued that when the multi-year trough at 96.37 (July 1) is broken, the index has the potential to reach the February 2022 floor of 95.13 (February 4), which is somewhat higher than the 2022 bottom of 94.62 (January 14).

“On the upside, we could expect to encounter some early resistance around the June ceiling of 99.42 (June 23), which is supported by the proximity of the provisional 55-day Simple Moving Average (SMA). Further up emerges the weekly top of 100.54 (May 29), which precedes the monthly high of 101.97 (May 12),” Piovano added.

He also highlights that as long as the index stays below its 200-day SMA at 103.78 and the 200-week SMA at 102.99, it is likely to continue its decline.

“Plus, momentum indicators are still leaning toward the negative side: the Relative Strength Index (RSI) has dropped to the oversold region around 28, and the Average Directional Index (ADX) is hovering above 17, so the trend isn’t exactly blazing with intensity,” Piovano concludes.

(This story was updated on July 2 at 08:51 GMT to reflect a last-minute consensus change to 95K.)

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Last release: Wed Jun 04, 2025 12:15

Frequency: Monthly

Actual: 37K

Consensus: 115K

Previous: 62K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.