- EUR/USD retreated further, breaking below the 1.1600 support.

- The US Dollar climbed to multi-day highs, adding to Friday’s gains.

- Investors’ attention now gyrates to US CPI and Trump’s trade deadline.

The Euro (EUR) lost further momentum in quite a negative start to the new trading week, motivating EUR/USD to deflate below the 1.1600 support, hitting three-day troughs and flirting with its transitory 55-day SMA.

The US Dollar (USD), in the meantime, rose markedly, adding to Friday’s recovery as market participants geared up for the upcoming release of US inflation figures tracked by the Consumer Price Index (CPI) on Tuesday.

In addition, the US-China trade deadline also kicks in on Tuesday, adding to the generalised caution in the risk-associated universe.

Trade deal optimism evaporates quickly

The initial relief over the freshly signed US–EU accord—reducing most European export tariffs to 15% from the once-threatened 30%—has faded fast. Aerospace, semiconductor, and agricultural goods escaped the new duties, but steel and aluminium remain taxed at 50%. In return, Europe committed to buying $750 billion worth of US energy, boosting defence orders, and funnelling more than $600 billion into American investments.

Berlin and Paris were quick to voice scepticism: German Chancellor Friedrich Merz warned the deal would squeeze an already fragile manufacturing sector, while French President Emmanuel Macron branded it a “dark day” for the Continent.

Two tariff flashpoints

Trade politics continue to dominate the market. On August 7, President Trump’s “reciprocal” tariffs on imports from 69 partners took effect, lifting duties to between 10% and 41% within a week, alongside threats of stiffer measures against Russia should the Ukraine conflict persist.

By August 12, he must decide whether to extend the tariff truce with Beijing or allow levies to snap back to triple-digit levels—risking the return of a full-scale trade war.

Central banks: Keeping their powder dry

The Federal Reserve (Fed) left policy unchanged at its latest meeting, with Chair Jerome Powell striking a cautious tone despite dissent from Governors Waller and Bowman.

Over in Frankfurt, ECB President Christine Lagarde called growth “solid, if a little better”, yet money markets have already pushed expectations for a first rate cut out to spring 2026.

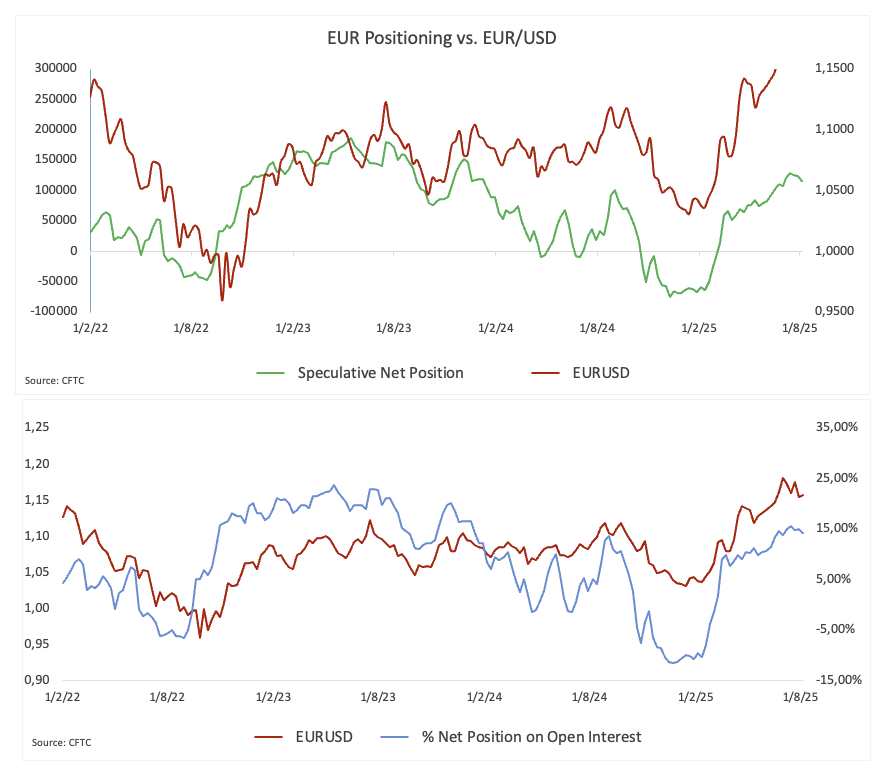

Speculators ease off the Euro

Speculators trimmed their net longs to five-week lows near 116K contracts, while commercial players also reduced their net shorts to about 163.5K contracts, or multi-week lows. Furthermore, open interest deflated to a four-week low of around 828.3K contracts.

Levels to watch

Resistance is at the weekly high of 1.1788 (July 24), ahead of the 2025 ceiling of 1.1830 (July 1) and the September 2021 top at 1.1909 (September 3), all preceding the psychological 1.2000 mark.

On the other hand, support starts at the August low of 1.1391 (August 1), backed by the interim 100-day SMA, and prior to the weekly floor at 1.1210 (May 29).

Momentum signals are mixed: the Relative Strength Index (RSI) has fallen below the 50 threshold, indicating potential for further losses, while an Average Directional Index (ADX) near 17 suggests a still indecisive trend.

EUR/USD daily chart

Outlook: Consolidation mode

EUR/USD looks set to continue trading within familiar ranges unless the Fed springs a dovish surprise or trade tensions alleviate markedly, with the mood around the Greenback likely driving the next meaningful move.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.