- Gold fell to a fresh four-week low below $3,300.

- The Iran-Israel ceasefire weighed heavily on Gold this week.

- The technical outlook highlights a buildup of bearish momentum ahead of key US employment data.

Gold (XAU/USD) came strong under selling pressure and fell below $3,300 as geopolitical tensions in the Middle East eased. The technical outlook reflects a bearish bias in the near term as investors gear up for June employment data from the US.

Gold struggles to find demand after Iran-Israel ceasefire

Gold started the week with a bullish gap following the news of the United States’ bombing of several Iranian nuclear sites over the weekend. But, in the second half of the day on Monday, the USD benefited from the better-than-expected S&P Global Purchasing Managers Index (PMI) data and made it difficult for XAU/USD to hold its ground.

As risk flows dominated the action in financial markets on Tuesday, Gold declined sharply and fell below $3,300 for the first time since early June. US President Donald Trump announced early Tuesday that Iran and Israel agreed to a ceasefire, easing geopolitical tensions and making it difficult for safe-haven assets to find demand.

Later in the day, Federal Reserve Chairman Jerome Powell adopted a cautious tone on policy-easing while testifying about the Semiannual Monetary Policy Report before the House Financial Services Committee. Powell reiterated that they are not in a rush to cut interest rates, adding that they need more time to confirm that inflation pressures caused by tariffs will remain contained. These comments supported the USD and further weighed on XAU/USD.

The USD came under selling pressure late Wednesday as the Fed’s independence came under question again, helping XAU/USD erase a small portion of its weekly losses.

The Wall Street Journal (WSJ) reported that US President Donald Trump is considering naming his candidate for the next Chairman of the Fed early, in a bid to undermine Fed Chair Jerome Powell. Citing people familiar with the matter, the WSJ said he could announce Powell’s possible replacement by September or October. Trump is reportedly evaluating the commitment to cut rates from Kevin Hassett, Director of the National Economic Council, and Treasury Secretary Scott Bessent, who are reportedly among the names under consideration. The USD Index slumped to its weakest level since March 2022 on Thursday following this development. Nevertheless, Gold failed to gather bullish momentum as the market mood remained upbeat.

Following the meager recovery attempt, Gold continued to stretch lower early Friday and touched its weakest level in nearly a month. The final data releases of the week from the US showed that annual inflation, as measured by the change in the Personal Consumption Expenditures (PCE) Price Index, rose to 2.3% in May from 2.2% in April (revised from 2.1%). The core PCE Price Index, which excludes volatile food and energy prices, rose 2.7% in the same period. Although the USD struggled to find demand following these figures, the risk-positive market environment didn’t allow XAU/USD to shake off the bearish pressure.

Gold investors await key data releases from the US

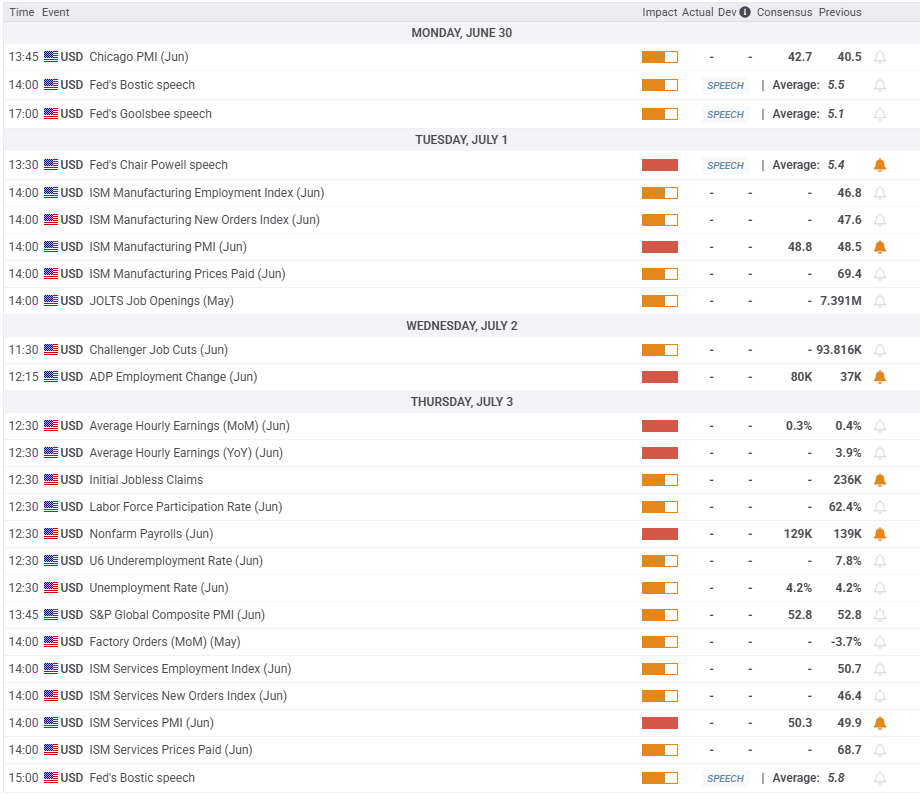

Fed Chairman Powell will participate in a policy panel on Tuesday with other central bankers at the European Central Bank (ECB) Forum on Central Banking in Sintra, Portugal. Later in the day, the US economic calendar will feature the Institute for Supply Management’s Manufacturing PMI data for June and JOLTS Job Openings data for May.

The CME Group FedWatch Tool shows that markets are currently pricing in about a 20% probability of a Fed rate cut in July. This market positioning suggests that the USD could stage a rebound with the immediate reaction in case Powell hints again that they are likely to wait until September before taking action.

On Wednesday, Automatic Data Processing (ADP) will release employment figures for the private sector. Because financial markets will be closed in observance of the July 4 holiday on Friday, the US Bureau of Labor Statistics will publish the June employment report on Thursday. Hence, investors could refrain from taking large positions based on the ADP data.

During his congressional testimony, Powell noted that the labor market was strong and was near full employment. However, he also acknowledged that a weakening labor market could cause them to ease the policy sooner.

A significant negative surprise, with a Nonfarm Payrolls reading below 100,000, could revive expectations for a rate cut next month. In this scenario, the USD could come under renewed bearish pressure and open the door for a decisive rebound in Gold. On the flip side, a print above 150,000 would suggest that the labor market is healthy enough for the Fed to take its time to assess inflation dynamics. In this scenario, Gold could turn south in the second half of the week.

Gold technical analysis

Gold dropped below the lower limit of the six-month-old ascending regression channel and made a daily close below the 50-day Simple Moving Average (SMA) for the first time since early January. Additionally, the Relative Strength Index (RSI) indicator on the daily chart fell to a fresh 2025 low near 40, reflecting a buildup of bearish momentum.

In case Gold confirms $3,285 (Fibonacci 23.6% retracement of the six-month-old uptrend) as resistance, $3,200 (static level, round level) could be seen as the next support level before $3,160-$3,150 (100-day SMA, Fibonacci 50% retracement).

On the upside, $3,330 (lower limit of the ascending channel, 50-day SMA) could be seen as the first resistance level ahead of $3,355 (20-day SMA) and $3,400 (static level, round level).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.