- Gold up 0.29% as investors await Thursday’s pivotal Nonfarm Payrolls report.

- ADP signals stalled hiring; Microsoft to cut 9,000 jobs, fueling slowdown fears.

- Geopolitical tensions ease, but Trump’s tariff deadline keeps trade risks alive.

Gold price climbs cautiously during the North American session as traders brace for the release of the latest Nonfarm Payrolls (NFP) figures in the United States (US), which could be crucial for the path of interest rates set by the Federal Reserve (Fed). At the time of writing, XAU/USD trades at $3,348, up 0.29%.

The latest job reports, as revealed by ADP, showed companies halting hiring instead of letting people go as they adjust to the current economic environment. News that Microsoft is cutting 9,000 jobs paints a gloomy outlook for the labor market.

On Thursday, the US Bureau of Labor Statistics will release the latest employment report, which is expected to show that the economy added 110,000 Americans to the workforce, below the 139,000 added in May. The Unemployment Rate is forecasted to rise from 4.2% to 4.3%, still within the projections of 4.4% set by the Fed in its latest Summary of Economic Projections.

Geopolitical risks diminished sharply as news broke of a possible 60-day ceasefire in Israel’s incursion into Gaza. This, along with the truce agreement between Israel and Iran, capped Gold’s rally, with the yellow metal faltering in its attempt to reclaim the $3,400 mark.

Aside from this, traders’ focus shifted to trade deals between the US and its peers. With the July 9 deadline right around the corner, US President Trump said he won’t extend the deadline to resume higher tariffs.

This shortened week, ahead of the US Independence Day on July 4, will feature Initial Jobless Claims and the NFP on Thursday.

Daily digest market movers: Gold price climbs as US yields and US Dollar advanced

- Gold rally is set to remain, as data revealed by the World Gold Council said that central banks added 20 tonnes of the yellow metal in May, with Kazakhstan leading the way. The National Bank of Kazakhstan reported 7 tonnes, followed by the Central Bank of Turkey, which reported 6 tonnes, and the National Bank of Poland.

- Bullion edges higher even as US Treasury yields rise. The 10-year US Treasury note is yielding 4.296%, a five-basis-point increase. US real yields, which are calculated by subtracting inflation expectations from the nominal yield, are also moving up close to six basis points to 2.006%.

- The ADP Employment Change report for June showed that private companies decreased hiring by 33,000 in June, well below estimates of 95,000. The report showed that service providers reduced payrolls by 66,000 in June due to declines in professional and business services.

- The approval of US President Donald Trump’s “One Big Beautiful Bill” is in doubt as House Republican hardliners are eyeing modifications to the bill, which Trump wants signed by July 4.

- Trump announced a trade deal with Vietnam, under which US products could be exported with 0% tariffs. In contrast, the US imposed a 20% tariff on Vietnam’s goods and 40% duties on transshipment.

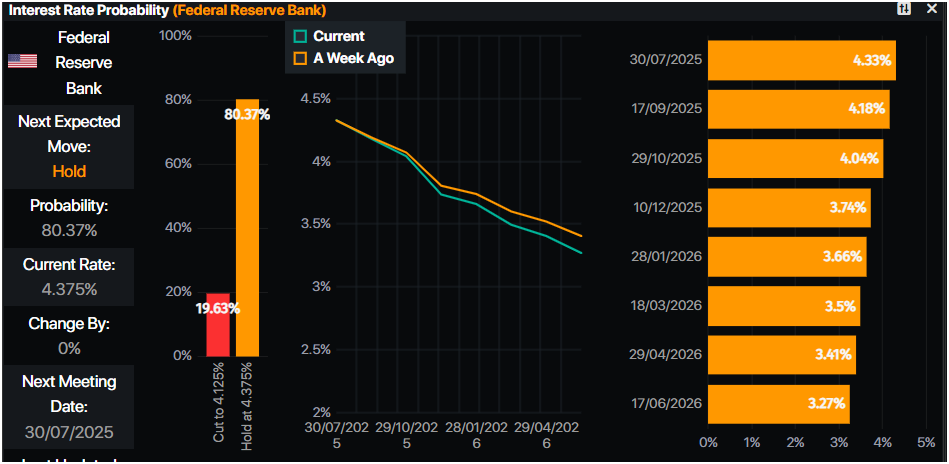

- Federal Reserve Chair Jerome Powell revealed that policy is modestly restrictive and added that he can’t say if July is too early to cut rates, though he wouldn’t rule anything out. He said that if not for President Donald Trump’s tariffs, the US central bank probably would have cut rates further.

- Money markets suggest that traders are pricing in 63.5 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price poised to challenge $3,400

The Gold price upward bias remains in place, with traders set to clear the current week’s peak of $3,358 that clears the path to test the $,3400 mark. Momentum remains bullish as portrayed by the Relative Strength Index (RSI). Therefore, the path of least resistance leans toward higher prices.

If XAU/USD climbs past $3,400, expect a test of $3,450 and the all-time high (ATH) at $3,500. Conversely, if Gold falls below the 50-day Simple Moving Average (SMA) at $3,320, the first support would be $3,300. A breach of the latter will expose the June 30 swing low of $3,246.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.