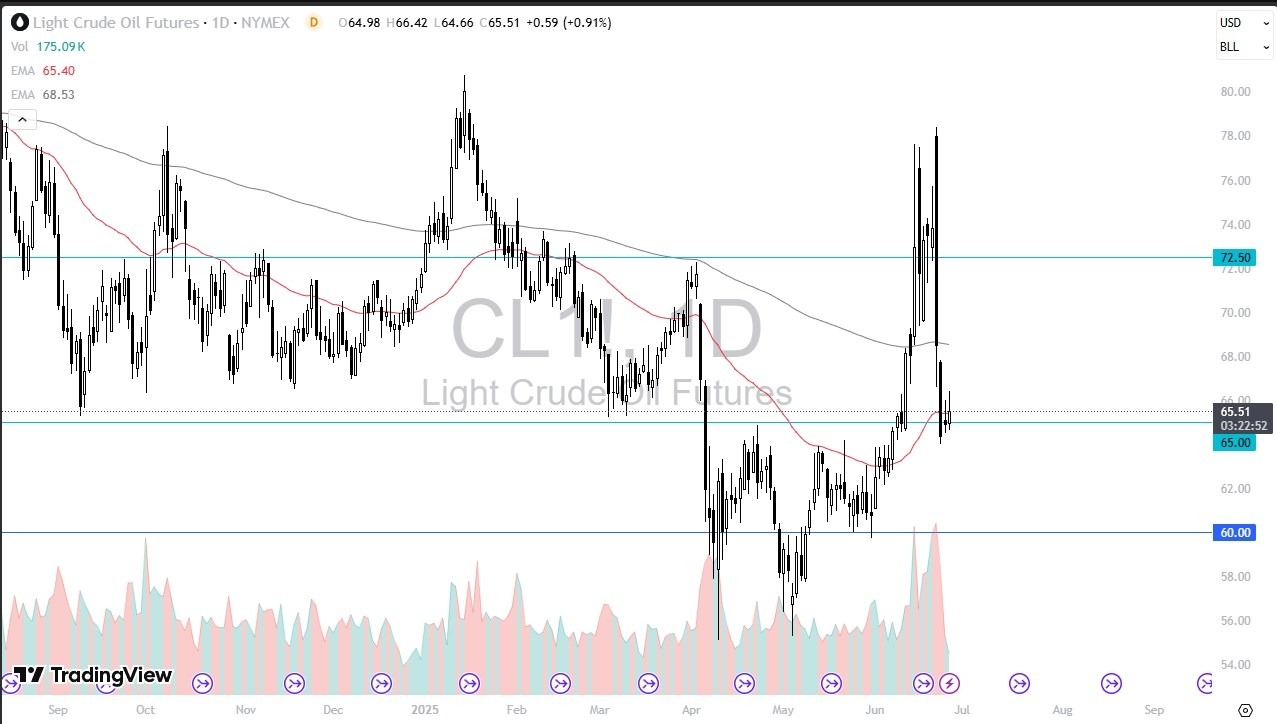

- Light sweet crude has been slightly positive during the trading session on Thursday as we continue to hang around the $65 level.

- The $65 level, of course, was the area that previously had offered so much in the way of resistance.

- So now I think it’s interesting that we are stopping right here after all of that noise coming out of the Middle East.

The Last Couple of Days

The last couple of days has been exactly what the market needs to see after a sell off and that stabilization. get core PCE numbers coming out of the United States in the morning on Friday, but the question at this point in time probably comes down to whether or not the oil will see a lot of economic demand. People are worried about a recession in the United States as the GDP numbers came out worse than anticipated, but quite frankly,

It’s very likely that sooner or later we will bounce after that violent move to the upside and then the violent plunge as soon as peace broke out in the Middle East. If we were to break down then the $62 levels in area I’d watch, but I think if we can break above the highs of the day from Thursday, then I think we go look into the 200 day EMA. I do believe that if we go higher, it is a grind higher.

It is not some type of explosive move. That’s actually preferable. These types of moves can blow up accounts when they get this volatile. It looks like we got the breakout from the resistance that I’d been looking for previously. We didn’t know why it would happen, but it did happen. And now we have broken out, pulled back and confirmed, or at least are in the process of confirming previous resistance as support. Classical technical analysis breakout trade.

Ready to trade Oil daily analysis and predictions? Here are the best Oil trading brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.