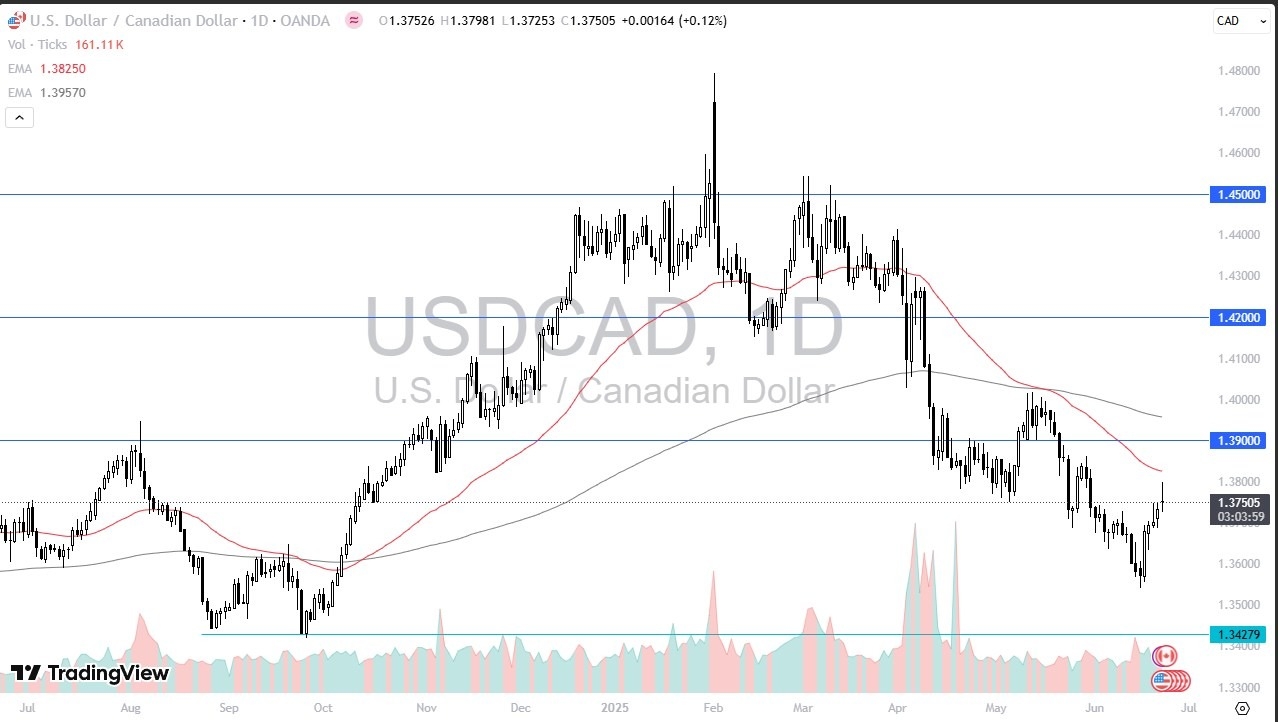

- The market was rather noisy during the trading session on Monday as we continue to see traders react to headlines coming out of the Middle East and a whole plethora of things.

- We saw the US dollar strengthen pretty significantly during the day as traders ran towards safety.

- It strengthened against the Canadian dollar as well, only to give up those gains just shy of the 1.38 level.

This is an area that I think will continue to be important, but if we can break above that 50 day EMA, the US dollar then goes looking to the 1.39 level. The 200 day EMA sits just above there and is dropping so it might be difficult.

On a Break Lower

If we break down from here, it’s possible that we could drop down to the 1.3550 level again. But ultimately, this is a market that to me looks like it’s in the middle of trying to figure out where it wants to be longer term. With that, I think you have to recognize that these potential bottoms of these are typically very noisy and there are a lot of false breakouts.

Nonetheless, we are seeing an attempt at least to push the dollar higher from an area that quite frankly, you might have expected a little bit of a reaction. It’s really not until we break above that 50 day EMA though I think momentum comes into the market. I still like getting paid at the end of every day holding US dollars against Canadian dollars but want to see how that plays out. The geopolitics and the latest headline of course continues to have dramatic effects in all markets and this one won’t be any different. Regardless of what you do, I would keep my position size reasonable.

Ready to trade our USD/CAD daily analysis and forecasts? Here’s a list of the best Forex Trading platform in Canada to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.