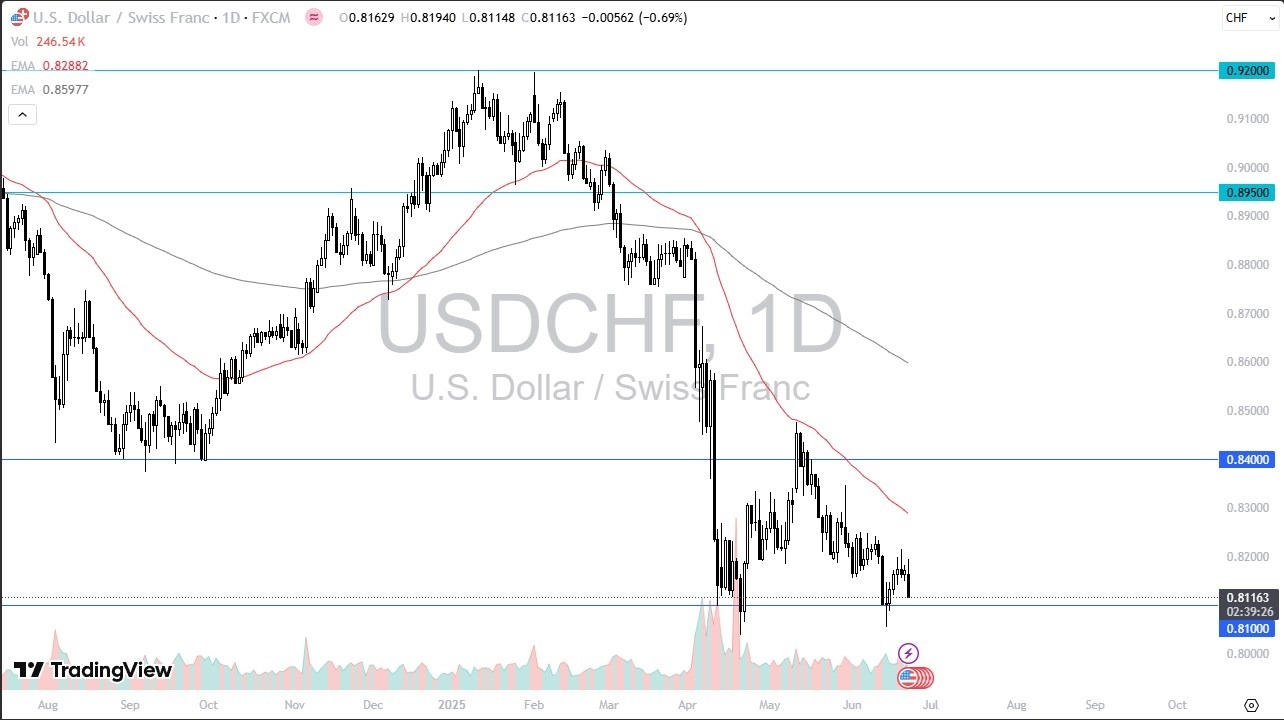

- The US dollar did initially rally against the Swiss franc during the trading session here on Monday but then collapsed as it looks like we continue to see a lot of problems.

- Ultimately, I think you have to be aware of the fact that the market is a very noisy place at the moment driven by geopolitical events and a lot of nonsense.

- So, with that being said, you have to understand that you need to be very cautious with your position sizing.

When I got up this morning, it looked like I was going to be a profitable trader in this position as I had been for the last couple of days. And now we’re getting close to my entry price. This shows just how fickle the market is. And it also shows you just how dangerous it can be because going frankly, this is a market that is typically pretty quiet.

We Are Moving Again

That being said, when you see the charts, the 0.81 level is an area that I’m very interested in due to the fact that it has offered pretty significant support a couple of times. So, with that being said, the market is one that I’m watching for some type of bounce. We’ll just have to see where that is at the moment.

If we get it and the 0.81 level, or if we have to drop a little further. I think that is really unlikely to be a scenario where we just turn around and completely change the trend. But I do think that we are in the process of trying to bottom. Bottoming of course is a process. It’s not an instantaneous thing. You do get paid to hang on to this position at the end of every night, though. So that is something to take into account.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.