- During the trading session on Monday, we had initially seen the US dollar spiked higher against the Japanese yen, as traders started to weigh the idea of a potential “risk off” type of environment due to the Americans bombing the Iranian nuclear sites.

- However, it looks like traders have had a bit of time to think about things that may not be as concerned as they were at the open.

Ceiling Above?

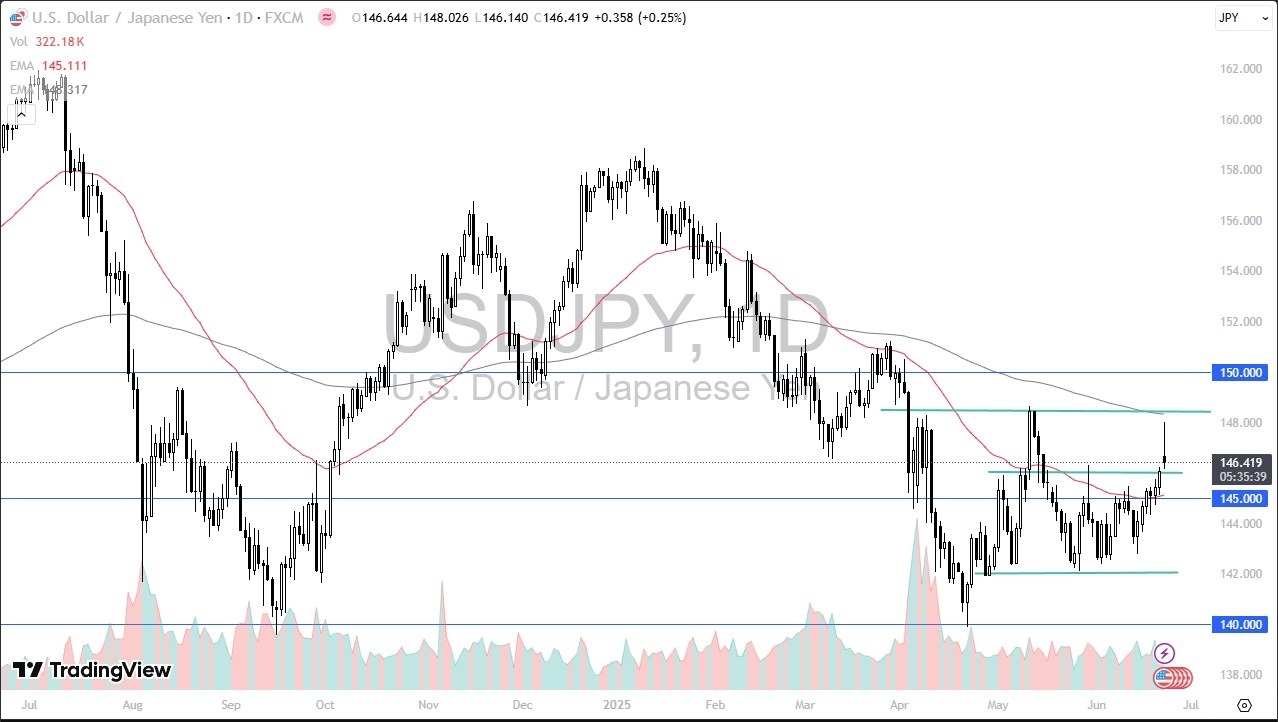

At this point in time, we have to ask whether or not there is a ceiling above, as the ¥148 level is an area that has caused resistance previously, and we have the 200 Day EMA hanging around in the same region. Because of this, I think you have a situation where it would take a lot to get above there, and the concern that we had over the weekend with the airstrike probably wasn’t enough to sustainably cause panic in the market.

Nonetheless, the Japanese yen has a lot of problems in and of itself, as the Bank of Japan has a major problem with the Japanese Government Bond markets, as there have been several days where there were no bids or buyers. Because of this, the Japanese yen is still a currency that I’m not a huge fan of, although of course in a panic we could see people running to it.

All things being equal, this is a market that will continue to be very noisy, but that’s nothing new for the Japanese yen. The ¥146 level is an area that has been important multiple times, so the question now is whether or not it will hold as support? That is a level that I would be watching the most right now, as it could determine whether or not we truly fall apart, or if we start to build another range in this market.

Want to trade our USD/JPY forex analysis and predictions? Here’s a list of forex brokers in Japan to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.