- USD/CAD attracts buyers for the third straight day amid a modest USD strength.

- Fed rate cut bets and US fiscal concerns cap the upside for the buck and the pair.

- Bullish Crude Oil prices underpin the Loonie and contribute to capping spot prices.

The USD/CAD pair prolongs its modest recovery for the third consecutive day and climbs to the 1.3725-1.3730 area, or a nearly one-week high during the first half of the European session on Tuesday. The move higher is sponsored by the emergence of some US Dollar (USD) buying, though it lacks bullish conviction and warrants caution before confirming that spot prices have formed a near-term bottom.

A stronger-than-expected US Nonfarm Payrolls (NFP) report released on Friday dampened hopes for imminent interest rate cuts by the Federal Reserve (Fed) this year. Furthermore, investors remain nervous and keenly await more details from US-China trade negotiations in London, which drives some safe-haven flows. This, in turn, lifts the USD Index (DXY), which tracks the Greenback against a basket of currencies, to over a one-week high and acts as a tailwind for the USD/CAD pair.

The USD, however, struggles to break through a trading range held over the past week or so and remains close to its lowest level since April 22 touched on Friday amid the growing acceptance that the Fed will lower borrowing costs in 2025. In fact, the CME Group’s FedWatch Tool indicates that traders are still pricing in a nearly 60% chance that the US central bank will cut interest rates at the September meeting. This, along with US fiscal concerns, caps the buck and the USD/CAD pair.

The Canadian Dollar (CAD), on the other hand, might continue to draw support from diminishing odds for more rate cuts by the Bank of Canada (BoC) and hopes that a US-Canada trade deal could happen before the G7 Summit on June 15. Furthermore, the recent rise in Crude Oil prices, to over a two-month high touched earlier today, could underpin the commodity-linked Loonie and contribute to keeping a lid on the USD/CAD pair, warranting some caution before positioning for further gains.

There isn’t any relevant market-moving economic data due for release on Tuesday, leaving spot prices at the mercy of USD and Oil price dynamics. Traders, however, might refrain from placing aggressive directional bets and opt to wait for more cues about the Fed’s rate-cut path. Hence, the focus will remain glued to the latest US consumer inflation figures – the Consumer Price Index (CPI) and the Producer Price Index (PPI) on Wednesday and Thursday, respectively. The crucial data will play a key role in influencing the USD demand and determining the near-term trajectory for the USD/CAD pair.

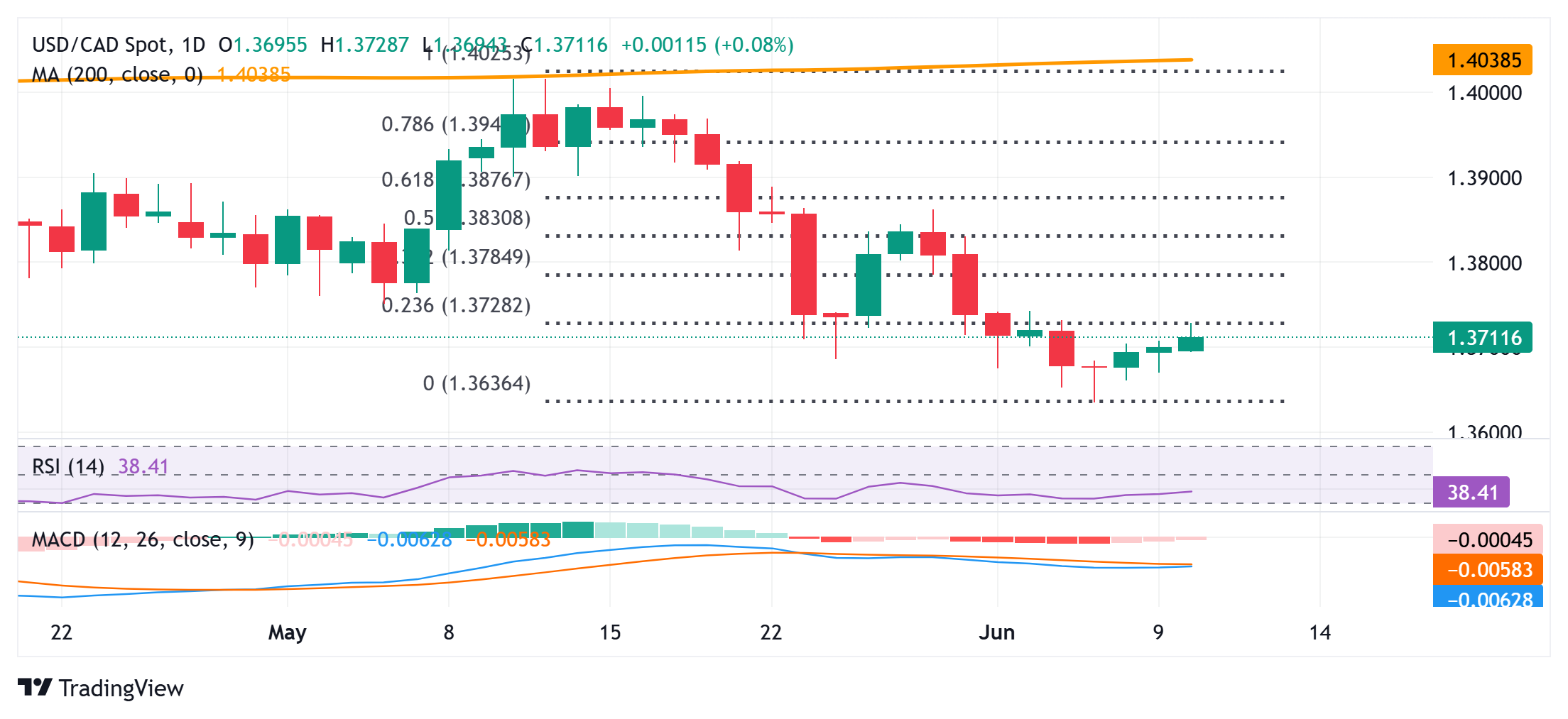

USD/CAD daily chart

Technical Outlook

The USD/CAD pair struggles to build on the momentum beyond the 23.6% Fibonacci retracement level of the recent rejection slide from the 1.4000 psychological mark, representing a technically significant 200-day Simple Moving Average (SMA). Adding to this, technical indicators on the daily chart are holding deep in negative territory and warrant caution for bullish traders.

However, some follow-through buying beyond the 1.3735-1.3740 hurdle might prompt some intraday short-covering and lift the USD/CAD pair to the 1.3780 region (38.2% Fibo. level) en route to the 1.3800 mark and the 1.3825-1.3830 supply zone. The latter nears the 50% Fibo. level and should act as a strong barrier, which if cleared should pave the way for a move towards the 1.3900 level.

On the flip side, weakness back below the 1.3700 mark could find some support near the 1.3670 horizontal zone ahead of the 1.3635 area, or the year-to-date-low touched last Thursday. Failure to defend the said support levels could turn the USD/CAD pair vulnerable to accelerate the fall below the 1.3600 round figure, towards the 1.3545 region and eventually to the 1.3500 psychological mark.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.