- The US Dollar initially fell during the trading session on Tuesday but has recovered some of the losses as we continue to pay attention to various factors.

- During the trading session on Tuesday, the Chairman of the Federal Reserve testified in front of the US Congress, but we also had something more important happen, the Israelis and the Iranians agreed to a cease-fire.

- This has caused a bit of a ripple effect through multiple markets, not just the currency markets.

Technical Analysis

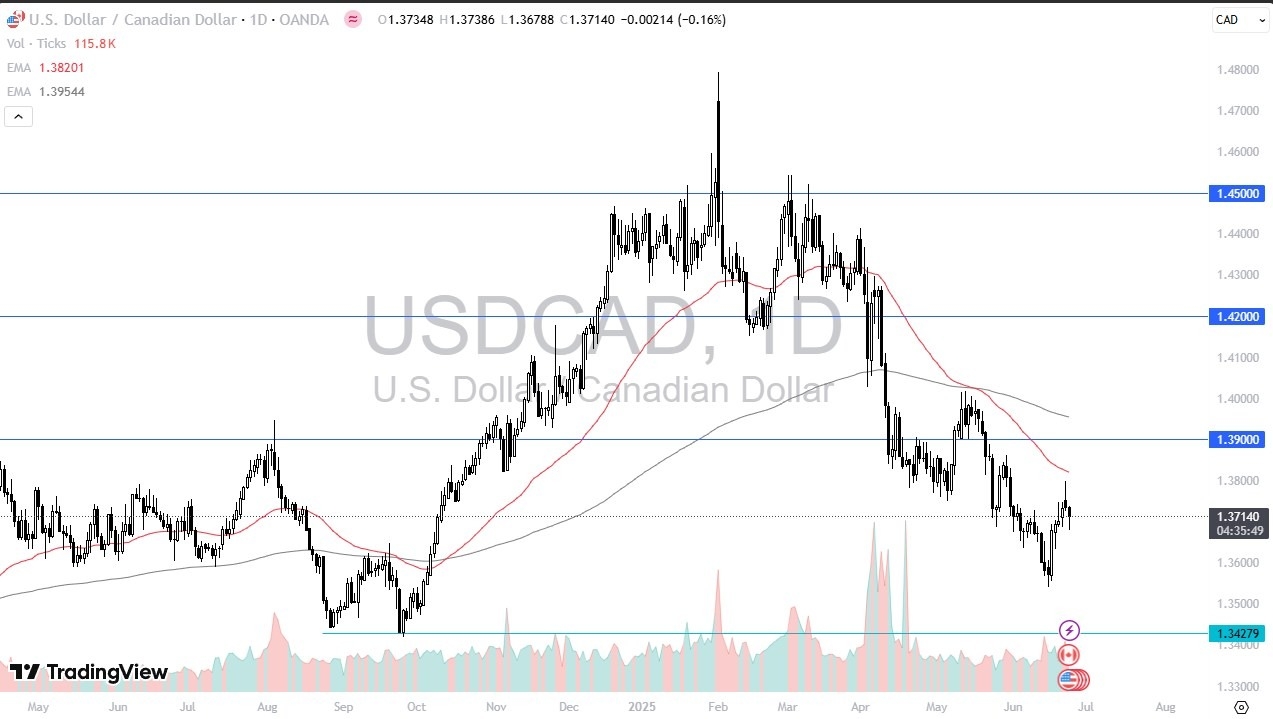

The technical analysis for this pair is a bit of a mess at the moment, due to the fact that the market has been so oversold, and now we have situations around the world that could drive people looking for safety, meaning the US dollar. At the same time, we also have the Canadian dollar being influenced by crude oil, but not necessarily in this pair. Remember, the United States produces quite a bit of oil now, so crude oil pricing doesn’t have the same influence here as it once did. However, there are a lot of questions out there when it comes to Canada and its future, as it is a bit of a “moving target.”

It is because of this that I think it is probably only a matter of time before we see the Canadian dollar starts to weaken, especially if we start to see trouble in the US economy as candidates in something like 85% of its exports into the United States, meaning that it is highly sensitive to what happens in the United States. The interest rate differential still favors the United States, and we have recently seen a nice rally. Whether or not that rally can continue remains to be seen, but somewhere around the 1.37 level we have a certain amount of magnetism for the markets. If we can break above 50 Day EMA at the 1.315 an area, then the market is likely to continue to go much higher.

Ready to trade our USD/CAD daily analysis and predictions? Check out the best currency exchange broker Canada for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.