This week saw the return of the US Dollar’s (USD) safe-haven momentum in markets. Following a brief period where the Greenback performed similarly to a regular alpha-adjusted asset, thanks to some sharp readjustments to market expectations for Federal Reserve (Fed) rate cuts and overall economic conditions in the US, the USD is once again benefiting from a souring news cycle. The post-tariff window is now opening into US datasets, and both investors and central bank policymakers are growing increasingly leery of potential economic fallout from the Trump administration’s constantly changing tariff strategies.

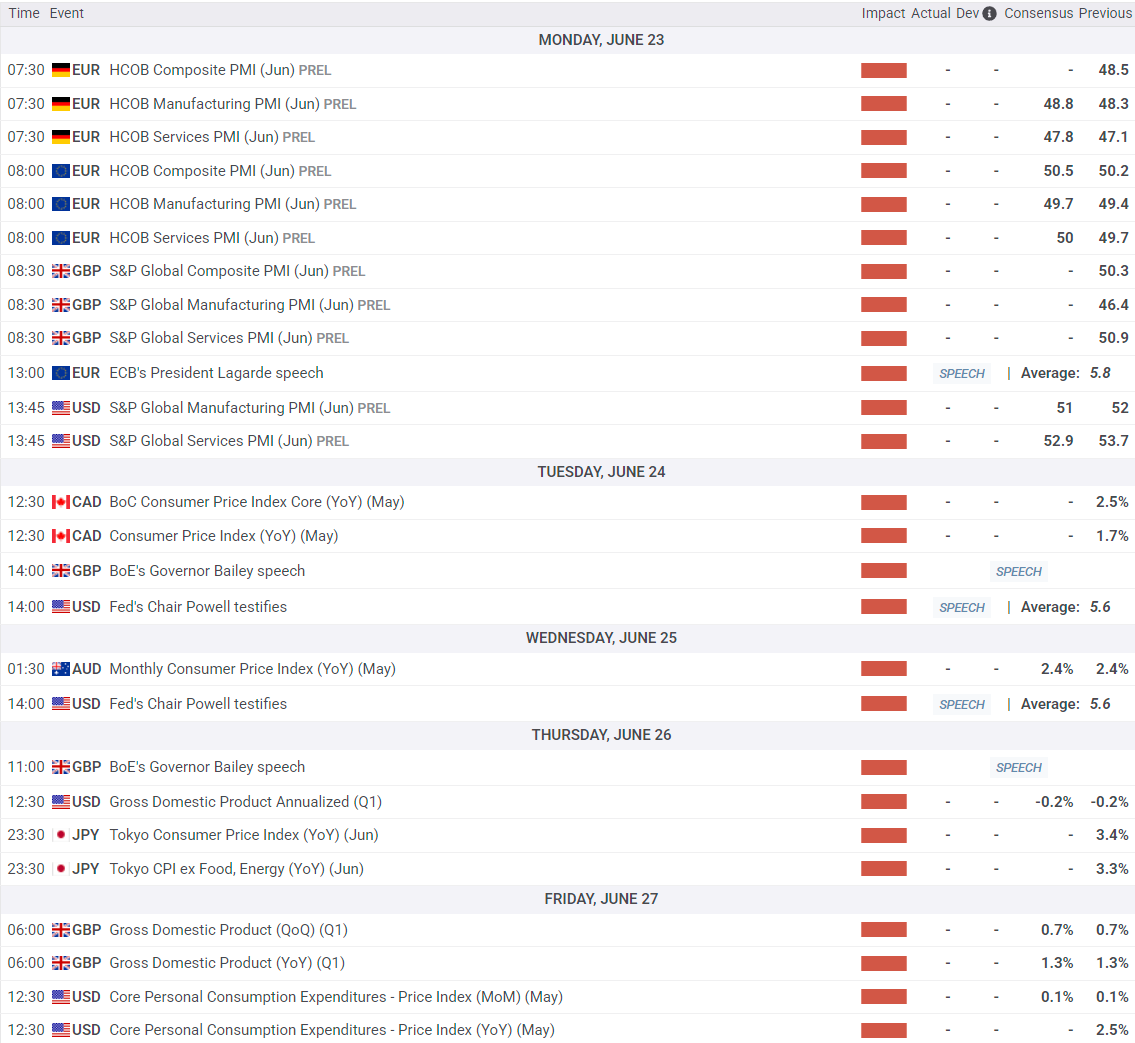

The US Dollar Index (USD) is going to be challenged on multiple fronts next week. Another round of S&P Global Purchasing Managers Index (PMI) figures are due early next week, and median market forecasts are broadly expecting a downturn in business sentiment. Fed Chair Jerome Powell will kick off his two-day testimony before congressional and Senate financial committees, putting significant pressure on the top Fed official to explain why the Fed is so concerned about policy uncertainty, but not worried enough about the economy to start slashing rates. May’s iteration of the Fed’s favored inflation metric, the Personal Consumption Expenditure Price Index (PCE), will also be released to markets next Friday.

The Canadian Dollar (CAD) snapped a win streak against the Greenback this week, losing ground week-to-week against the US Dollar for the first time in over a month. Loonie gains have been almost entirely at the behest of across-the-board USD weakness, and that trend may be drawing to a close as ongoing geopolitical tensions continue to hammer on investor risk appetite. The Israel-Iran conflict, which still shows no real signs of easing any time soon, is crimping market confidence in the Trump administration’s ability to actively manage external conflicts it insists on involving itself in. However, the overall upswing in Crude Oil markets on Middle East unrest has helped to trim the worst of the CAD’s near-term losses against the USD’s risk-off haven status. Canadian Consumer Price Index (CPI) inflation data is due next week, and a low print could be the ammunition the Bank of Canada (BoC) needs to resume cutting interest rates after snapping its seven-straight rate-cutting streak at its last meeting.

EUR/USD trimmed its recent bull run this week, churning near the 1.1500 handle throughout the week. Fiber traders don’t appear ready to outright sell the Euro (EUR) just yet, and the only data hurdle they’ll need to clear next week is German and pan-EU PMI figures due on Monday. The Euro has gained ground against the US Dollar on a monthly basis for five straight months, and is poised to chalk in a sixth bullish monthly period as long as Fiber bidders can keep the wheels on the bus for one more week.

Gold (XAU/USD) pared back some of its near-term gains this week, easing back below the 3,400.00 handle for the time being. Gold’s long-term bull run remains overall intact, gaining nearly 114% since the November 2022 low point near 1,550. The majority of those gains have come since the beginning of 2024, with XAU/USD gaining ground month-over-month for all but three of the last 16 straight calendar months.

Key data schedule next week

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.