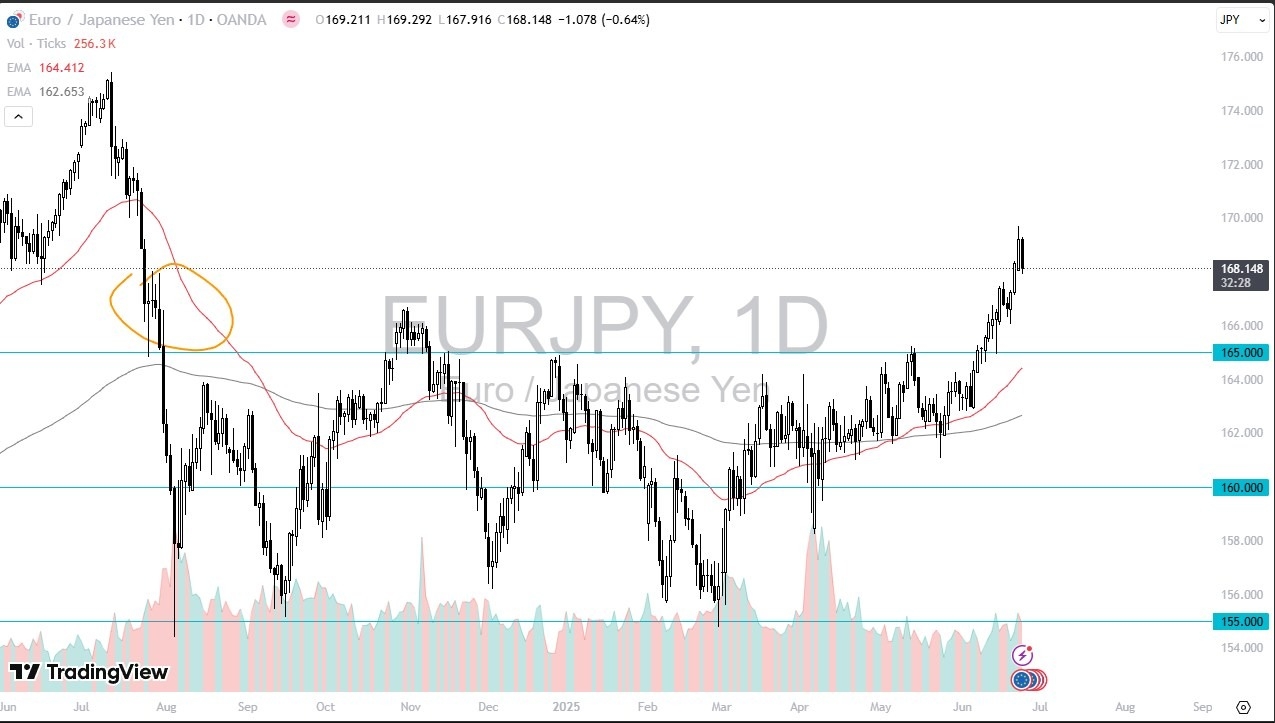

- The Euro has fallen pretty significantly against the Japanese yen during the trading session on Tuesday as we continue to see a lot of noisy behavior.

- I think ultimately this is a situation where traders have to understand the fact that this is a very risk appetite sensitive pair.

- Keep in mind that the Euro is considered to be much riskier than the Japanese yen.

Therefore, if we have a sudden “risk off” move, typically this pair will fall. You do get paid to hang on to this via swap. And I think we are going to continue to see buyers willing to jump in because of this fact.

And in fact, given the fact that we are right at the previous consolidation area, somewhere in this general vicinity, I think you will start to see buyers jumping back in. I have no interest shorting the euro against the Japanese yen anytime soon, at least not until we break down below the 165 yen level, which is over three handles away. To the upside, the 170 yen level is an area that could cause a little bit of resistance, but quite frankly, we have broken above a major resistance barrier. And now I think we will eventually find ourselves much higher that where we are now.

The Longer Term Target Could Be Much Higher

Eventually, we may find ourselves all the way up at the 175 yen region. All things being equal, this is a market that I think continues to be very noisy, but this pullback I think opens up the possibility of offering a little bit of value, which is exactly what this pair has needed over the last couple of weeks. So, with this, I’m bullish. I’m either waiting for a bounce or a break to the upside.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.