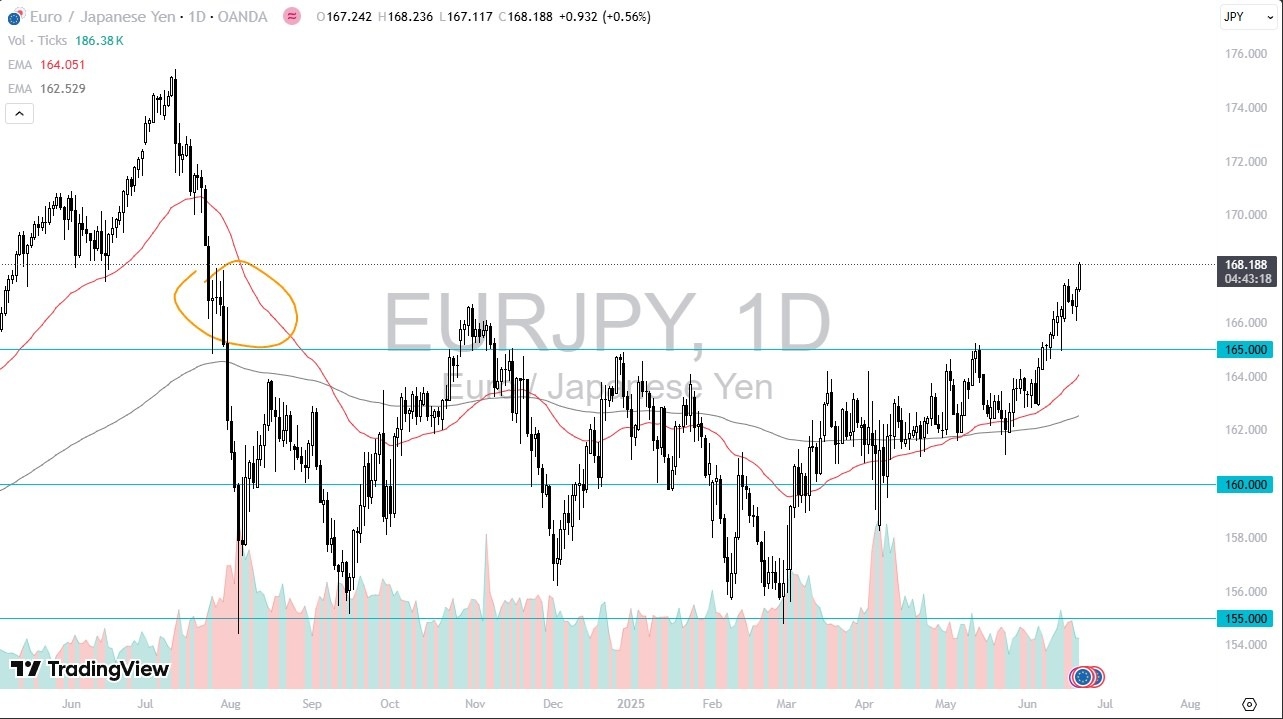

- The Euro has had a very strong session against the Japanese Yen, and we are now clearing a major hurdle as we are seeing Japanese Yen weakness across the board.

- It’s interesting because I’m hearing people on some of the financial channels talk about how the Japanese Yen should strengthen quite drastically.

- But what they are glossing over is the fact that nobody is buying Japanese debt. That’s a major issue. So, if the Bank of Japan does in fact, tighten monetary policy, like I’m starting to hear people talk about, there is a cost to that.

- It is probably wiping out their domestic banking system because the Japanese banks hold so much of this debt that nobody is bidding for.

So, you either let the debt go to massive losses in the banking sector or you have to buy it yourself if you’re the Bank of Japan. History tells us they tend to buy it themselves and therefore I think that’s part of what’s going on because even the US dollar is starting to tear up the Japanese yen at this point. Now that we have cleared the 168 yen level, I do think that we are free to go higher, probably as high as 172 yen.

It Will Be Noisy

But it doesn’t necessarily mean that we get there in a straight line. This is also a risk on move as it were, but I think this probably has more to do with the yen itself, at least at the moment. If we pull back, the 165 yen level would be your floor. And although it is 300 points away as I record this, I understand that you’re going to need a lot of pips as far as a stop loss is concerned in order to absorb the potential volatility here.

Markets have been extraordinarily volatile due to basically everything that’s going on in the world. So that translates to smaller sizes and to positions and larger ranges of stop losses. It’s the only thing you can control. With this, think short-term pullbacks continue to be buying opportunities and I do think we will go higher.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.