Potential signal:

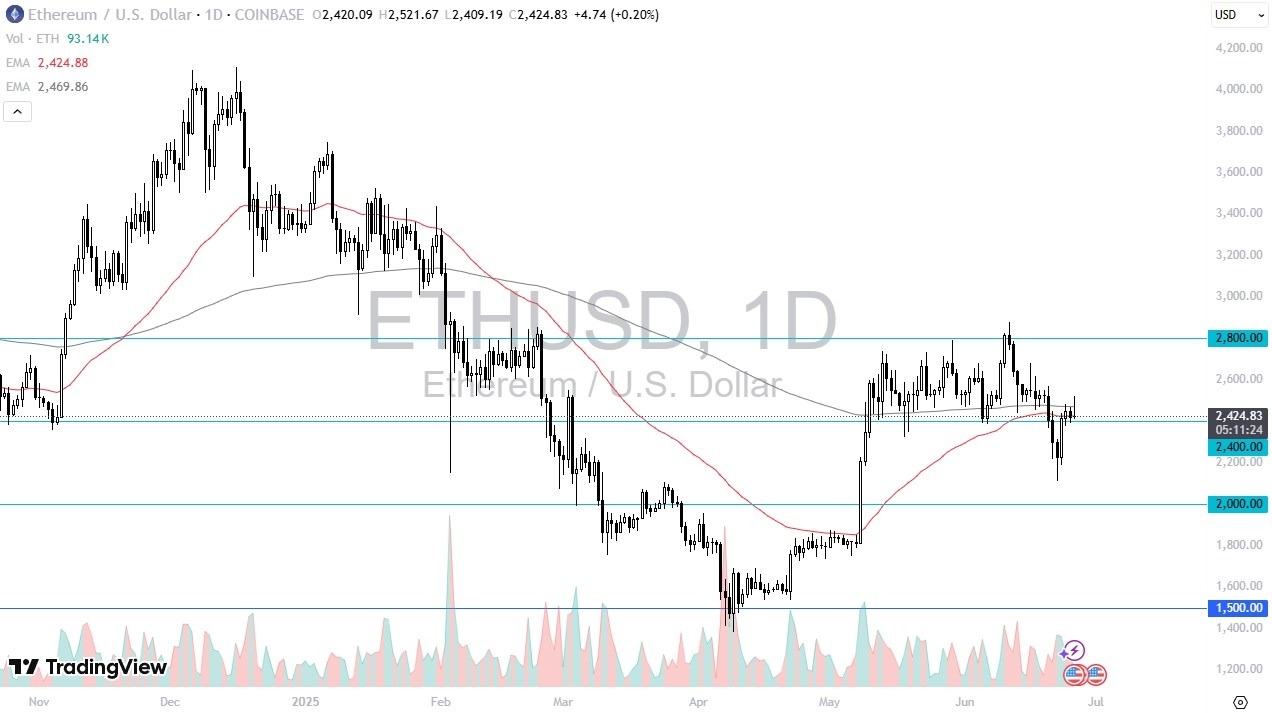

- If Ethereum breaks above $2525, and Bitcoin is positive, I am a buyer of this market, with a tight stop near the $2400 level.

The Ethereum initially did try to rally during the trading session on Thursday, breaking above the 200 Day EMA, but then found a lot of selling pressure a little later in the day.

If you been reading my analysis, you know that I look at Ethereum through the prism of the question “What is Bitcoin doing?”

With this being the case, it’s worth noting that Bitcoin has been somewhat stagnant, and while I do think that is a bullish sign considering that we had bounced so nicely over the last couple of days, it also has people questioning whether or not Ethereum can truly take off as well.

Technical Analysis

It’s worth noting that the technical analysis for this market is relatively flat at the moment, and we are sitting in an area of major interest. The $2400 level is an area that previously had been massive support, so it’s not a huge surprise to see that it could end up being a massive resistance area, especially now that we have the 50 Day EMA and the 200 Day EMA in the same neighborhood, especially as they are flat. With all that being said, this is a market that I think continues to see a lot of questions asked of momentum, but I think you will have to continue to watch and see what Bitcoin does to get a read on the entire crypto market.

If we can break above the $2580 level, then it’s likely that Ethereum will continue to grind to the upside, perhaps all the way to the $2800 level and I see a lot of resistance in that area, so ultimately, I think that could be our target. On the other hand, if we break down from here, the $2200 level comes into the picture offering support, but I would be a bit cautious about getting too aggressive in that area, because if we see a significant sell off, we may see follow through, especially if Bitcoin is struggling.

Ready to trade ETH/USD? Here’s a list of some of the best crypto brokers to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.