This week’s activity in the central bank’s universe is expected to show a generalised cautionary tone, as the Federal Reserve (Fed), the Bank of Japan (BoJ), the Bank of Canada (BoC), and the South African Reserve Bank (SARB) are all seen maintaining their policy rates at current levels. Once again, the impact of US tariffs on the broader outlook should stay as the exclusive driver behind the central banks’ decisions.

Federal Reserve (Fed) – 4.25%/4.50%

The Federal Reserve heads into its two-day policy meeting on July 30 with expectations firmly anchored: no move on rates. But beneath that still surface, a swirl of uncertainty continues to shape the central bank’s cautious stance.

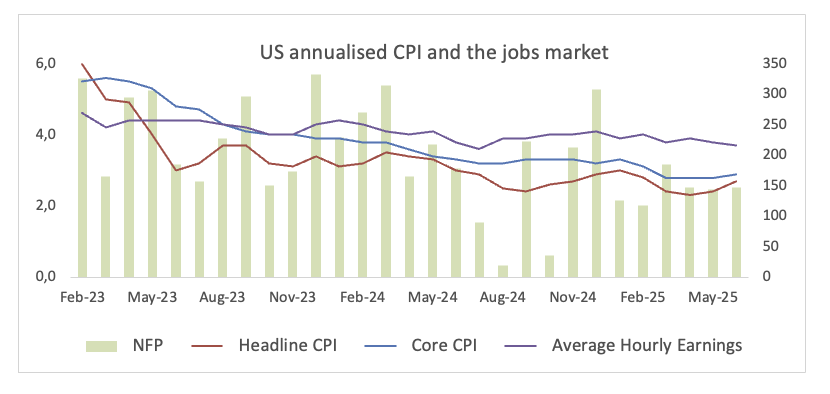

The economy has slowed down slightly, but not significantly enough to warrant immediate action. Trade tensions—particularly around tariffs—remain the most prominent risk in the Fed’s dashboard, even as political drama shifts from Capitol Hill budget battles to fresh headlines around the Trump–Powell dynamic.

Minutes from last month’s meeting revealed that most Fed officials saw rate cuts as likely appropriate later this year. Crucially, any inflationary pressures tied to tariffs were expected to be “temporary or modest.” That outlook gave policymakers little reason to adopt Trump’s preferred approach of deep rate cuts. No one around the table backed such an aggressive move, and several officials felt the current policy rate may already be hovering near the so-called neutral level—neither restricting nor stimulating the economy.

As for the inflation story, the Fed remains wary. The minutes flagged “considerable uncertainty” over how tariffs might feed into prices, but they also “underscored the lack of urgency to cut rates anytime soon.”

In the weeks since, the economic picture has shifted only slightly. The labour market is cooling, but not dramatically. Global risks persist. And there’s still little clarity on how much tariff-driven inflation is actually making its way into core data.

All the evidence suggests that the Fed will likely stay the course this week. Patience, not panic, remains the watchword.

Upcoming Decision: July 30

Consensus: Hold

FX Outlook: The Greenback continues to navigate the lower end of its multi-month range, although it seems to have met some decent contention in the 96.40-96.30 band, according to the US Dollar Index (DXY). While below its key 200-day SMA at 1043.41, further losses should remain well on the cards.

Bank of Japan (BoJ) – 0.50%

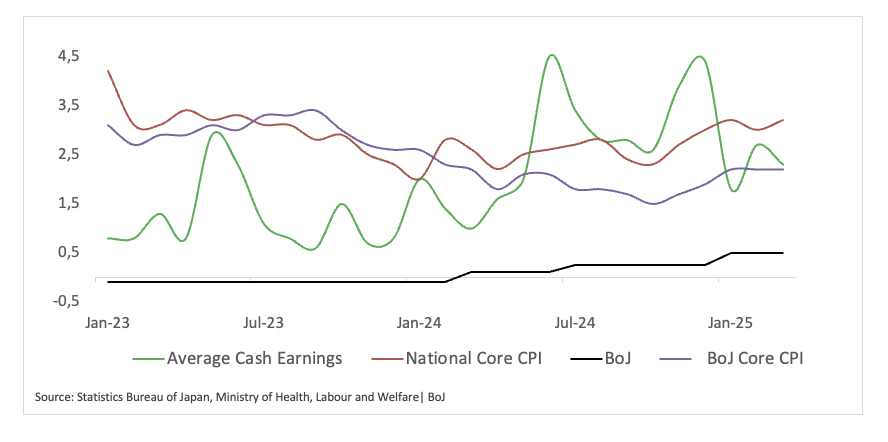

Even as inflation remains above the BoJ’s target and steady wage gains from major employers fuel hopes of a sustained uptrend, dark clouds from US tariffs still loom close.

That fog, however, may be beginning to dissipate.

That said, the newly announced US-Japan trade deal has helped mitigate some of the uncertainty that had been weighing on sentiment and policy expectations since the beginning of the year. In its wake, central bank officials may begin laying the groundwork for a gradual return to rate hikes—if not in immediate action, then at least in tone.

Deputy Governor Shinichi Uchida’s recent comments have been widely read as a first step in that direction. He said the trade deal had increased the likelihood that Japan could achieve the BoJ’s 2% inflation target on a durable basis—a necessary precondition for tightening. He also stressed the importance of adjusting policy in response to both upside and downside risks, highlighting rising food costs as a fresh source of inflationary pressure.

Uchida’s more constructive remarks stand in contrast to Governor Kazuo Ueda’s tone back in May, when he warned that uncertainty surrounding the BoJ’s baseline scenario was “higher than in the past,” mainly due to tariff-related risks.

This week’s meeting may not deliver a dramatic policy shift, but investors and economists alike will be listening closely for any softening in the BoJ’s language—particularly around inflation, external risks, and the timing of future moves. If the tone tilts more upbeat, it could mark the start of a slow but deliberate recalibration.

Upcoming Decision: July 31

Consensus: Hold

FX Outlook: USD/JPY has embarked on a recovery path following July’s floor around 142.70, largely responding to the renewed depreciation of the Japanese yen, particularly in light of the recently announced US-Japan trade deal and the generalised progress observed on the trade front. In the longer term, unless the BoJ signals a clear shift toward an imminent rate hike, the Japanese currency is likely to remain under selling pressure.

Bank of Canada (BoC) – 2.75%

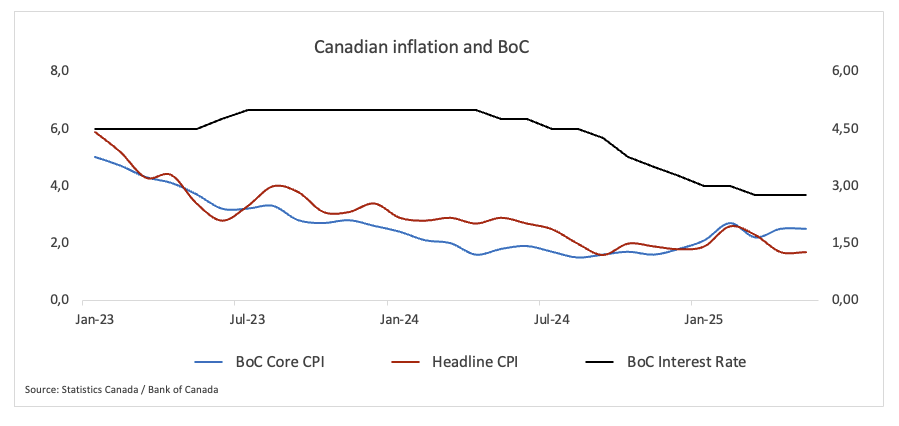

In describing the economy as “softer, but not sharply weaker,” the BoC hinted it sees enough slack to justify standing pat—for now—without risking a sharp drop-off in demand. But officials haven’t ruled out further easing. If trade-related headwinds intensify, the bank may consider another cut.

Inflation, however, has thrown a curveball. June’s headline CPI edged up to 1.9%, confounding expectations of a further decline. The central bank acknowledged the “unexpected firmness in recent inflation data,” pointing in particular to the knock-on effects of rising input costs—especially those linked to tariffs. The BoC appears focused on whether these producer price pressures bleed into consumer inflation and if expectations begin to drift upward. That’s a key signal the bank will be watching to guard against any reacceleration of price growth.

Trade remains the wild card. Uncertainty around US policy looms large, and the BoC has made it clear that June’s pause was anything but business as usual. The Governing Council is using the window to absorb more detail from a broader data set—not just headline inflation, but business sentiment, export trends, and household consumption.

That cautious tone echoes remarks made earlier by Deputy Governor Sharon Kozicki, who suggested that, given the current trade landscape, it was more prudent to keep the policy rate within the bank’s estimated neutral range. In her view, that would offer the best starting point for navigating what remains an unusually murky outlook.

For now, the BoC appears content to hold its ground—but with fingers firmly on the pulse of incoming data.

Upcoming Decision: July 30

Consensus: Hold

FX Outlook: The Canadian Dollar (CAD) has given away part of its strong gains recorded since February, leading USD/CAD to meet support in the 1.3540 zone and then embark on a consolidative range with gains capped by the 1.3800 barrier. Looking at the broader picture, the current weakness is expected to persist as long as the pair trades below its 200-day SMA at 1.4039

South African Reserve Bank (SARB) – 7.25%

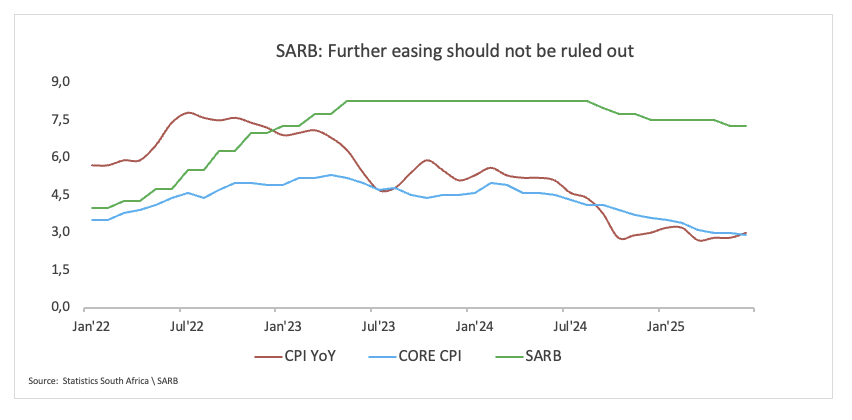

The SARB heads into this week’s policy meeting with something it hasn’t had in months: clear breathing room. June’s inflation data came in well below expectations, offering the strongest case yet for a potential rate cut.

On the latter, headline CPI rose just 3.0% YoY, while core inflation fell to 2.9% from a year earlier, its lowest reading since April 2021.

Still around inflation, a joint review by the SARB and the National Treasury is nearing completion and could soon usher in a new era of stricter inflation targeting, potentially setting the goal at a firm 3%. Under such a regime, the central bank’s own projections suggest the repo rate could fall to 7.00% by the end of 2025, rather than holding at 7.25% as currently forecast in its base case.

Markets are already leaning further. Money-market pricing reflects growing confidence in a dovish turn, building in close to 50 basis points of easing over the next 12 months, with rates seen bottoming near 6.75%.

Although the SARB has been cautious in recent months, citing global volatility, currency risks, and uncertain oil prices, June’s inflation print could potentially shift the balance. Whether the Bank chooses to act now or waits for further confirmation, the message from the data is clear: the window for rate cuts is wide open.

Upcoming Decision: July 31

Consensus: Hold

FX Outlook: The South African Rand (ZAR) has surrendered some of its recent gains in the last couple of days. Indeed, USD/ZAR gathered some upside impulse and rebounded from the area of yearly troughs around 17.5000, apparently on its way to revisit the July peaks near the 18.0000 barrier. The pair’s outlook remains bearish as long as it navigates beneath its key 200-day SMA around 18.1900.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.