In a country where the public pension system, such as Social Security, may not be sufficient to maintain the standard of living of future retirees, it becomes crucial to take charge of one’s own Retirement Planning strategy.

Among the tools available, the Roth IRA, a form of Individual Retirement Account (IRA), stands out for its unique tax advantages. Still little-known to some, it can make all the difference to long-term savers.

What is a Roth IRA?

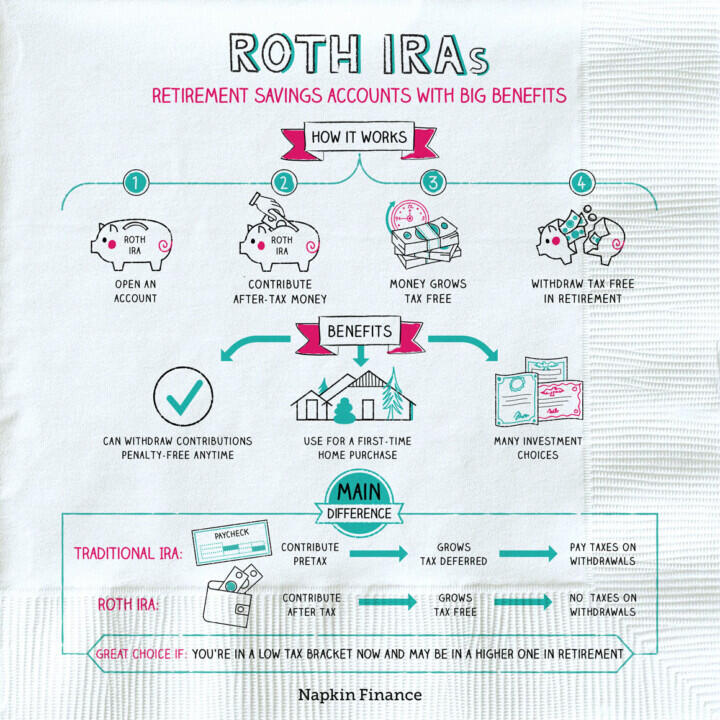

The Roth IRA is an Individual Retirement Account created in the United States in 1997. Unlike the Traditional IRA, which offers an immediate tax deduction, the Roth IRA works on the opposite principle: contributions are made with after-tax money, but withdrawals at retirement are entirely tax-free, under certain conditions.

In other words, you don’t benefit from tax advantages today, but you’re protected from taxes tomorrow. A major advantage in an environment where future tax hikes are a plausible scenario.

Who can contribute to a Roth IRA?

Any US taxpayer with earned income can contribute to a Roth IRA, but within certain limits. In 2025, the income limits for full contribution are:

- Less than $146,000 Modified Adjusted Gross Income (MAGI) for a single person

- Less than $230,000 for a married couple filing jointly

Above these thresholds, the contribution is progressively reduced until it becomes impossible.

The annual contribution ceiling in 2025 is $7,000 for those under 50, or $8,000 for those 50 and over, thanks to a “catch-up contribution” designed to make up for lost time.

What are the main advantages of a Roth IRA?

This individual retirement account boasts a number of unique advantages that can make a difference over the long term.

Tax-free withdrawal

This is the number-one advantage. If you wait until age 59 and a half and your Roth IRA is at least five years old, all your withdrawals are tax-free, including capital gains. That can mean thousands, even tens of thousands of dollars saved over a lifetime of investing.

No mandatory withdrawals

Unlike Traditional IRAs, Roth IRAs don’t require you to withdraw money at a set age. So you can let your savings grow for as long as you like, or even pass them on to your heirs.

Access to contributions at any time

You can withdraw your contributions (but not earnings) at any time, without penalty or tax. This makes it a more flexible retirement option than you might think, and sometimes it can be useful in an emergency.

Protection against rising taxes

From a long-term perspective, betting on a higher tax environment in the future can make the Roth IRA particularly attractive: you pay your taxes today, when they may be lower than they will be when you retire.

Who is the Roth IRA best suited for?

- Young workers, whose current income is modest but who anticipate a rise in their standard of living.

- Early career taxpayers who want to benefit from decades of tax-free growth.

- Those who want to diversify their tax exposure by combining a Roth IRA and a Traditional IRA or a 401(k).

- Retirees who want to pass on a tax-efficient legacy to their children.

Roth IRA and Social Security: A complementary duo

Social Security is often described as a pillar of American retirement, but it is generally not sufficient to cover all needs.

On average, it replaces around 40% of pre-retirement income, according to the Social Security Administration, a figure insufficient to maintain a comfortable standard of living.

The Roth IRA complements this, enabling savers to build a personal, tax-advantaged reserve to add to their public income.

Best of all, unlike other retirement incomes, Roth IRA withdrawals are not taken into account when calculating Social Security benefit taxation. A crucial point for avoiding tax cascading.

Key points to remember about the Roth IRA

The Roth IRA offers several major advantages for those wishing to prepare proactively for retirement.

Its main advantage is that withdrawals at retirement are tax-free, provided certain age and holding period rules are respected.

Unlike a Traditional IRA or 401(k), there is no Requested Minimum Distribution (RMD), giving savers greater long-term management freedom.

Another often-underestimated advantage is the ability to withdraw contributions at any time, without penalty or tax, making the Roth IRA more flexible than it seems.

It’s also an excellent asset transfer tool, as funds can be bequeathed to heirs tax-free on gains, in many situations.

But the Roth IRA is not without conditions. Contributions are not tax-deductible, which means you pay the tax today only to get a break later.

In addition, there are income ceilings above which the contribution becomes partial or impossible. And to take full advantage of the tax benefits, withdrawals must comply with strict conditions, particularly with regard to age (59 years and a half) and holding period (at least five years).

Finally, although highly advantageous, the Roth IRA requires long-term planning. It is aimed above all at savers capable of foregoing an immediate tax advantage in favor of a potentially much greater future benefit.

IRAs FAQs

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.