When we think of saving for the future, we often think of opening a traditional savings account. Simple, accessible and secure, it seems to be the ideal tool for putting money aside.

However, when the aim is to prepare for retirement, this type of investment quickly reaches its limits.

In contrast, Individual Retirement Accounts (IRAs), and Roth IRAs in particular, offer major tax advantages that make them far more effective tools for building long-term savings.

At a time when the future of the Social Security system is uncertain and longevity is on the rise, it is becoming essential to make the right choices when it comes to retirement planning.

Savings account: A useful but limited tool

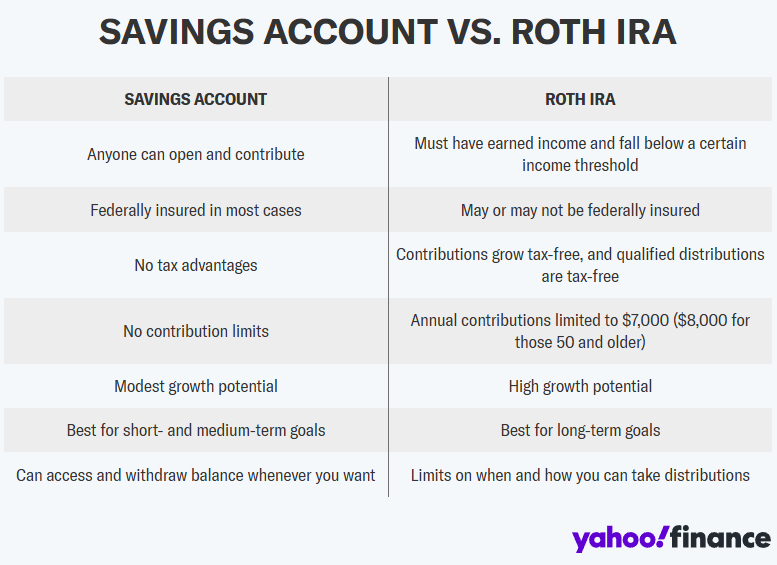

A savings account is designed to meet short-term or medium-term needs. It allows you to invest cash in complete security, with rapid access to funds in the event of unforeseen circumstances.

The high-yield versions offered by some online banks today offer more attractive interest rates, but these returns remain modest overall and, above all, fully taxable.

Every dollar of interest earned on a savings account is considered income and must be declared for tax purposes.

What’s more, savings accounts neither offer any special tax advantages nor long-term growth prospects. Over 20 or 30 years, they barely beat inflation.

In other words, placing all your retirement savings in a savings account is tantamount to guaranteeing the security of your capital, but at the price of a gradual impoverishment of your purchasing power.

IRA: A tool designed for long-term growth

Individual Retirement Accounts (IRAs), and Roth IRAs in particular, are designed to optimize long-term savings for retirement. Their main advantage lies in their tax treatment.

Unlike a savings account, profits generated in a Roth IRA, whether interest, dividends or capital gains, are not taxed, provided certain conditions are met, including having held the account for at least five years and being 59 and a half years of age or older at the time of withdrawal.

This mechanism allows savings to grow tax-free for years, which makes a huge difference over the long term.

What’s more, qualified withdrawals are totally tax-free, including on gains, boosting the overall profitability of the investment.

This is a tax advantage that neither a savings account nor even an ordinary securities account can offer.

An encouraging but restricted tax framework

The Roth IRA is not, however, accessible to everyone, nor is it without limits. To contribute in 2025, you must have earned income and not exceed a certain threshold ($150,000 for singles, $236,000 for married couples filing jointly).

In addition, contribution ceilings are limited to $7,000 per year, or $8,000 for people aged 50 and over, thanks to the “catch-up contribution” rule.

These ceilings may seem modest, but they help establish a regular savings discipline, and their long-term impact, combined with untaxed growth, is considerable.

Finally, unlike Traditional IRAs or 401(k)s, the Roth IRA does not impose Required Minimum Distributions (RMDs) at a certain age.

This means savers can let their capital grow for as long as they like, and even pass it on to their heirs under advantageous tax conditions.

Savings account or IRA: Why choose?

In reality, these two tools are not in direct competition: they are complementary. A savings account remains important for building up a precautionary reserve that can be accessed at any time, particularly in emergencies or for short-term projects.

But when it comes to building solid, tax-optimized retirement savings, the Roth IRA is hard to beat.

One option is to use the savings account as a security base and the Roth IRA as a growth vehicle, maximizing contributions each year.

It’s this combination of liquidity and performance, short-term and long-term, security and tax advantages, that makes it possible to build a comprehensive and sustainable financial strategy.

IRAs FAQs

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.