- Gold recovers sharply on Friday but remains below $3,400.

- The technical outlook hints at a bullish tilt in the near term.

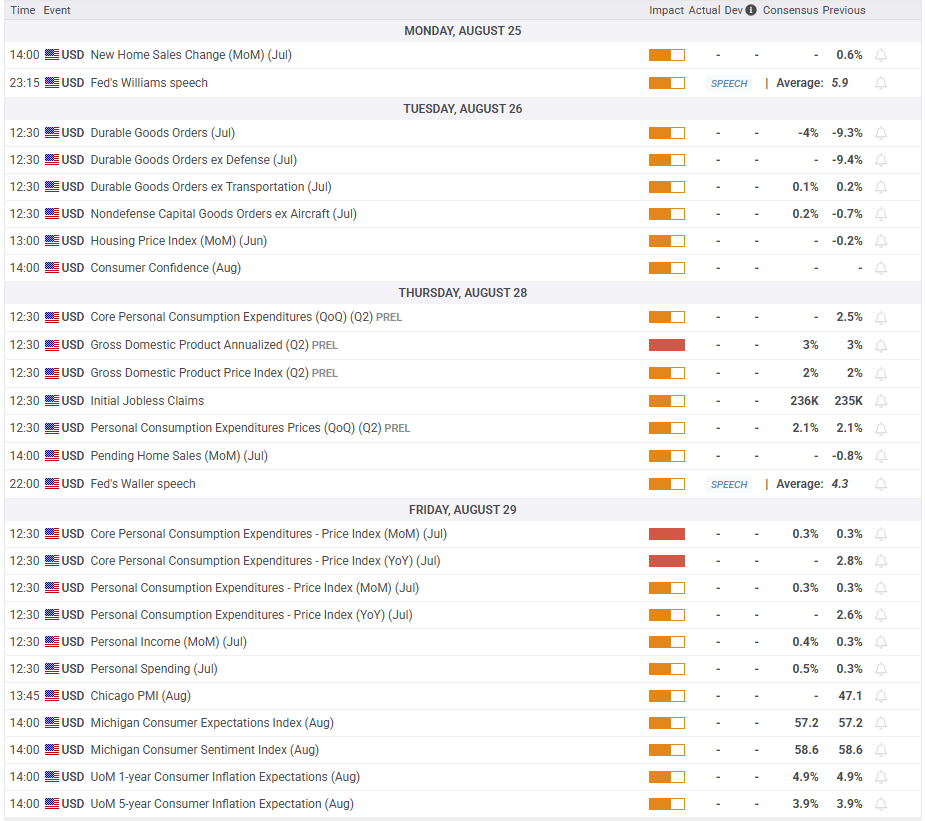

- The US economic calendar will feature high-tier data releases.

Gold (XAU/USD) gathered bullish momentum and climbed above $3,370 on Friday to end the week on a firm footing. High-impact economic data releases from the United States (US) will be watched closely, with investors reevaluating the Federal Reserve’s (Fed) policy outlook following Fed Chairman Jerome Powell’s remarks at the Jackson Hole Symposium.

Gold attracts buyers heading into the weekend

Easing geopolitical tensions made it difficult for Gold to find demand at the start of the week. Following US President Donald Trump’s meeting with Russian President Vladimir Putin on Friday, US special envoy Steve Witkoff said over the weekend that the sides agreed that the US will offer security guarantees to Ukraine. Late Monday, President Trump met with Ukrainian President Volodymyr Zelenskyy. After this event, US Secretary of State Marco Rubio confirmed that they will work with European allies and non-European countries on providing security guarantees for Ukraine and Zelenskyy noted that they are ready to meet with Putin next.

Meanwhile, the risk-averse market atmosphere helped Gold limit its losses in the first half of the week. On Wednesday, US President Trump revived his attacks on the Fed, calling on Fed Governor Lisa Cook to resign over alleged mortgage fraud. The decline seen in the US Treasury bond yields helped XAU/USD edge higher in the late American session midweek.

After rising nearly 1% on Wednesday, renewed USD strength made it difficult for XAU/USD to preserve its bullish momentum on Thursday. The USD benefited from the upbeat preliminary S&P Purchasing Managers’ Index (PMI) data for August and capped the pair’s upside. The Composite PMI improved to 55.4 in August from 55.1 in July, pointing to an ongoing expansion in the private sector’s economic activity at an accelerating pace.

Assessing the survey’s findings, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said that the rise in selling prices for goods and services hinted at an increase in consumer price inflation in the coming months. “Combined with the upturn in business activity and hiring, the rise in prices signaled by the survey puts the PMI data more into rate hiking, rather than cutting, territory according to the historical relationship between these economic indicators and FOMC policy changes,” Williamson added.

Gold remained under modest bearish pressure in the first half of the day on Friday but made a sharp U-turn in the American session to climb above $3,370. While speaking at the annual Jackson Hole Symposium, Fed Chair Jerome Powell announced that they will adopt a new policy framework of flexible inflation targeting and eliminate ‘makeup’ strategy for inflation. Additionally, Powell said that downside risks to the labor market were rising, while noting that it would be reasonable to expect that inflation effects of tariffs will be short-lived. These comments weighed on the USD and caused US T-bond yields to turn south heading into the weekend, fuelling a late rally in XAU/USD.

Key US macroeconomic data releases to drive price action

The economic calendar will feature several macroeconomic data releases from the US that could trigger short-term reactions in Gold.

On Tuesday, the Census Bureau will publish Durable Goods Orders data for July. Following the 9.3% decline recorded in June, markets expect Durable Goods Orders to fall by another 4% in July. A positive print could support the USD and cause XAU/USD to edge lower.

The Bureau of Economic Analysis (BEA) will release a revision to the second-quarter Gross Domestic Product (GDP) on Thursday. In its initial estimate, the BEA said that the US economy expanded at an annual rate of 3%. A downward revision could hurt the USD and help XAU/USD to recover, while a positive revision could have the opposite effect.

On Friday, the BEA will publish the Personal Consumption Expenditures (PCE) Price Index data, the Fed’s preferred gauge of inflation, for July. In case the monthly core PCE Price Index rises more than expected, investors might refrain from pricing in multiple Fed rate cuts this year. In this scenario, US Treasury bond yields could turn north and Gold could come under renewed bearish pressure. Conversely, a soft print is likely to support the precious metal heading into the weekend.

In the meantime, market participants will pay close attention to comments from Fed policymakers. Following the Jackson Hole Symposium, the CME FedWatch Tool shows that markets are pricing in about a 90% probability of a 25 bps rate cut in September. Although the market positioning suggests that the USD doesn’t have a lot of room left on the downside even if Fed officials confirm a rate reduction at the next meeting, the USD could still have a hard time finding demand, with investors positioning themselves for a policy shift toward steady easing in the last quarter of the year.

Gold technical analysis

The Relative Strength Index (RSI) indicator on the daily chart climbed above 50 and Gold cleared $3,350 on Friday, where the 20-day and the 50-day Simple Moving Averages (SMAs) are located, after fluctuating below that level throughout the week. These technical developments point to an increasing buyer interest.

On the upside, $3,400 (static level, round level) aligns as the next resistance level ahead of $3,430 (static level) and $3,500 (record high). Looking south, support levels could be spotted at $3,350 (20-day SMA, 50-day SMA), $3,315 (100-day SMA) and $3,285 (Fibonacci 23.6% retracement of the January-June uptrend).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.