The US Dollar (USD) grappled with slippery highs throughout this week, catching a bid on risk-off market flows fueled almost entirely by political headlines from the Trump administration and then slowly bleeding those gains away through the back half of the trading week. President Donald Trump continues to rail against the Federal Reserve’s (Fed) decision not to do what he wants on interest rates, even as he sits atop what is arguably the best-performing economy globally. Key inflation metrics, which include things like imported goods, sparked fresh tariff caution this week, while other inflation measures, which specifically exclude imported goods, still bolstered investor confidence.

PMIs, central banks, and tariff talk likely

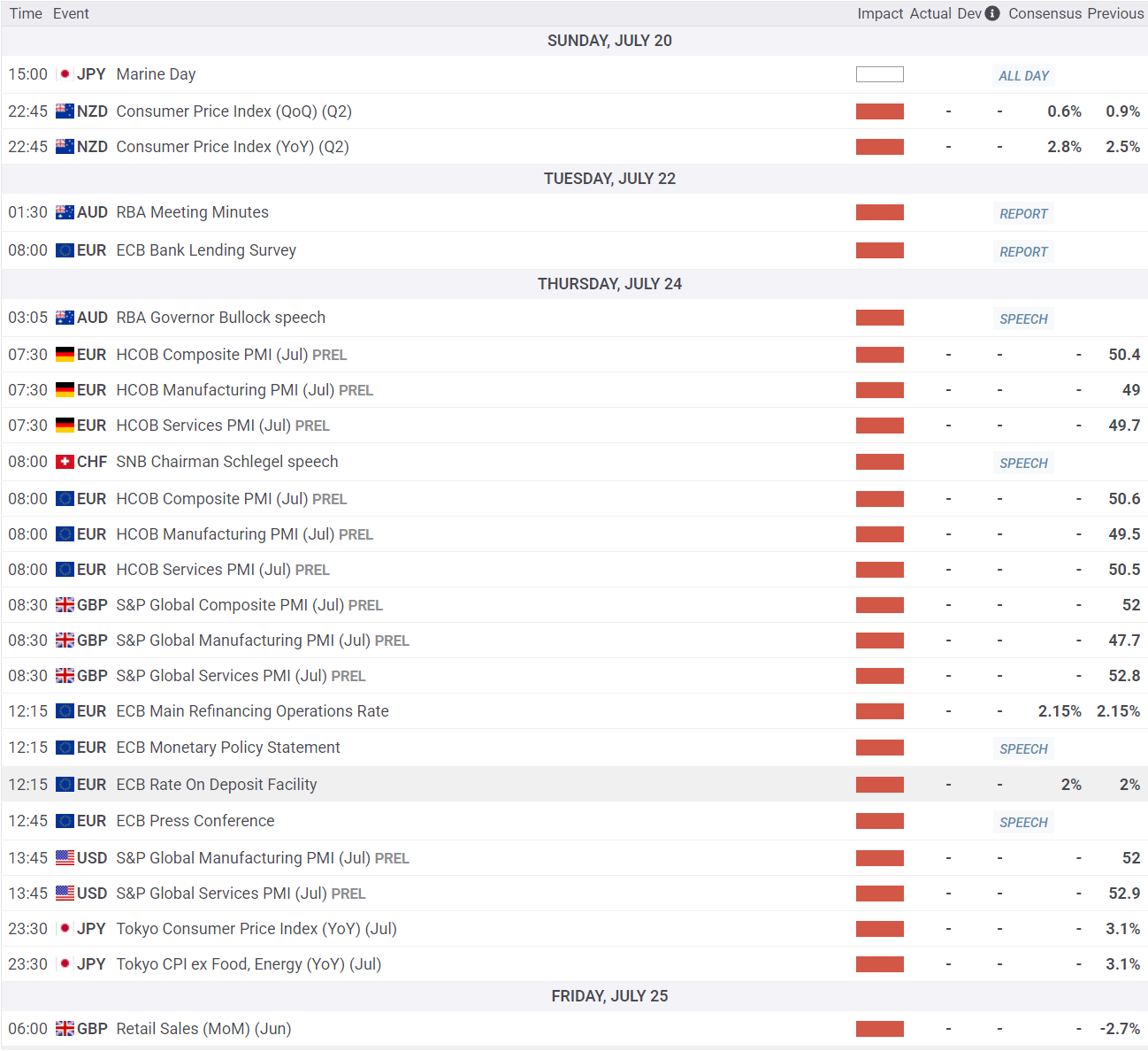

The US Dollar Index (DXY) flubbed a bullish reach for the 99.00 handle after running into resistance from the 50-day Exponential Moving Average (EMA) near 98.75. However, enough leftover topside momentum kept the DXY above the 98.00 level to wrap up the week. After a week of heavy-hitting yet positive-to-middling economic data, investors will be getting a bit of a breather on the economic data front. That is, until Thursday’s rolling release schedule of global Purchasing Managers Index (PMI) figures.

EUR/USD traders put a pin in losses this week, with the Euro (EUR) catching a technical bounce from the 1.1600 handle and ending Friday’s trading near where it started the week, chugging along near 1.1650. The latest European Central Bank (ECB) Bank Lending Survey will be publish on Tuesday, followed by a one-two punch of pan-EU PMI figures and the ECB’s latest rate call, both slated for Thursday. The ECB, still battling a lopsided economy and facing deep trade threats from the United States’ (US) constantly changing tariff proposals, is expected to keep its main refinancing operations rate at 2.15% and its overnight rate at 2.0%.

GBP/USD caught its own technical bounce, pinging a rising trendline drawn from multi-year lows in January. Cable is trapped in a chart squeeze between rising technical support and a flattening 50-day EMA near 1.3470, and Pound Sterling (GBP) bidders are going to need a little bit of help from Greenback sellers to muscle the pair back into the high side following a multi-week backslide.

USD/JPY has cracked the 200-day EMA at the 148.00 handle, crossing the key moving average for the first time since first falling below it back in February. Yen (JPY) traders continue to search for evidence that the Bank of Japan (BoJ) will accelerate interest rate hikes, and the BoJ continues to push back on expectations, despite inflation figures still holding above target levels in the long run. The latest round of Tokyo Consumer Price Index (CPI) inflation figures will release early next Friday, which last printed at 3.1% YoY.

AUD/USD caught its own technical bounce this week, rebounding off of the 50-day EMA just south of the 0.6500 handle. Aussie (AUD) traders will have the Reserve Bank of Australia’s (RBA) latest Meeting Minutes to look forward to, posting early on Monday, followed by another quiet week on the economic data docket. However, RBA Governor Michele Bullock will be speaking at a public event on Thursday, so Aussie traders can still hope to catch any hints on how the RBA is feeling about policy rates.

Key events coming up this week

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.