- Hot US Producer Price Index revived concerns about tariff-related inflationary pressures.

- Central banks’ leaders will gather at Jackson Hole by the end of the week.

- EUR/USD resumed its advance and aims to revisit the year’s peak at 1.1830.

The EUR/USD pair advanced for a second consecutive week, trading as high as 1.1730 and settling nearby, above the 1.1700 threshold. The US Dollar (USD) revolved around inflation-related data, spiced with US President Donald Trump’s tariffs. As for the Euro (EUR), the shared currency showed few signs of life, with local data failing to impress market players.

US inflation and the Federal Reserve

The United States (US) released the July Consumer Price Index (CPI) on Tuesday, and the index boosted speculation that the Federal Reserve (Fed) will deliver an interest rate cut when it meets in September.

The figures were far from encouraging but fell short of worrisome: inflation, as measured by the change in the CPI, held steady at 2.7% on a yearly basis, below expectations of 2.8%. The core annual reading printed at 3.1%, up from the previous 2.9% and slightly higher than the anticipated 3%. On a monthly basis, the CPI was up by 0.2%, matching the forecast and below the 0.3% expected.

Speculative interest rushed to reinforce bets on a September cut, leading to risk-on moves across the FX board. The USD fell as Wall Street rallied. The impulse continued pretty much until Thursday, when the US unveiled a worrisome US Producer Price Index (PPI). Inflation at wholesale levels accelerated by far more than anticipated in July, as the PPI rose 3.3% on a yearly basis in July, much higher than the 2.4% recorded in June and well above the expected 2.5%. The core annual reading jumped to 3.7% from the previous 2.6%, above the anticipated advance to 2.9%.

The market sentiment flipped with PPI data, and the USD turned north as stocks fell, reflecting fresh concerns about mounting price pressures.

The Fed has paused its monetary policy tightening by the end of 2024, as policymakers fear President Trump’s widespread tariffs will result in higher inflation. The cautious approach from Chair Jerome Powell and co triggered Trump’s rage, who has not spared insults and threats on the Fed’s head. Nevertheless, policymakers stuck to their patient approach, although data have pointed to a resilient US economy.

Steady growth and a loosening labor market backed the case for lower rates, with the odds of a 25 basis points (bps) trim in September roughly at around 90%, but inflation-related data shook a bit that conviction. As the dust settled, speculative interest still believes the Fed will deliver a rate cut, but tariffs-related inflation hangs like a Damocles’ sword.

Tariffs, war and more

Indeed, tariffs have resulted in much lower than initially anticipated, and the impact on inflation will likely be less terrible than feared, but not completely null. Earlier in the week, Washington and Beijing announced another 90-day extension on their tariff truce to extend negotiations. At the time, the US charges 30% on China imports, while the Asian giant imposed a 10% levy on US imports, far below the 145% and 125% threatened earlier in the year.

Meanwhile, US President Trump and his Russian counterpart, Vladimir Putin, are meeting in Alaska to discuss a ceasefire in the ongoing war with Ukraine. Putin wants Kyiv to withdraw from a part of the Donbas region as part of a ceasefire deal. Still, Ukrainian President Volodymyr Zelenskyy has made it clear that it won’t give up on its territory.

Finally, the replacement of Chairman Jerome Powell, whose mandate ends in May 2026, has also made it to the front page. The White House unveiled a list of eleven potential candidates, but mid-week, US President Trump said the list has been reduced to just “three to four.”

“I think I’ll name it a little bit early – the new chairman,” Trump stated while speaking at the Kennedy Centre.

Earlier in the week, Trump said that, other than that, US Treasury Secretary Scott Bessent is out of the list. Bessent, in the meantime, hit the wires mid-week, stating a neutral interest rate would be 1.5% points lower than the current 4.25% – 4.50%. He also noted that he needs the next Fed Chair to “rationalise” the job, adding he believes there is room for a series of rate cuts.

Little data on the docket

The US Dollar maintained its tepid tone on Friday, following the release of mid-tier data. The country reported that Retail sales were up 0.5% in July, down from the 0.9% posted in June and meeting expectations. Industrial Production in the same period, however, contracted by 0.1%, worse than the no-change expected and the previous 0.4%. Finally, the preliminary estimate of the August Michigan Consumer Sentiment Index dropped to 58.6 from 61.7 in July, missing economists’ expectations of 62 and maintaining the USD pressured ahead of the weekly close.

Across the pond, the Eurozone calendar also offered mid-tier figures. Germany published the August ZEW Survey on Economic Sentiment, which fell by more than anticipated in the month. The German index printed at 34.7, down from the previous 52.7 and below the 40 anticipated. For the EU, the index dropped from 36.1 in July to 25.1. Finally, the assessment of the current situation in Germany was down to -68.6 after posting -59.5 in the previous month.

Germany also confirmed that the July Harmonized Index of Consumer Prices (HICP) rose at an annualized pace of 1.8% in July, as previously estimated.

The Eurozone published a revision of the Q2 Gross Domestic Product (GDP), which matched the previous estimate and showed the economy grew a modest 0.1% in the three months to June. Also, Industrial Production in the bloc contracted by 1.3% on a monthly basis in June, worse than the 1.1% advance posted in May or the 1% decline anticipated.

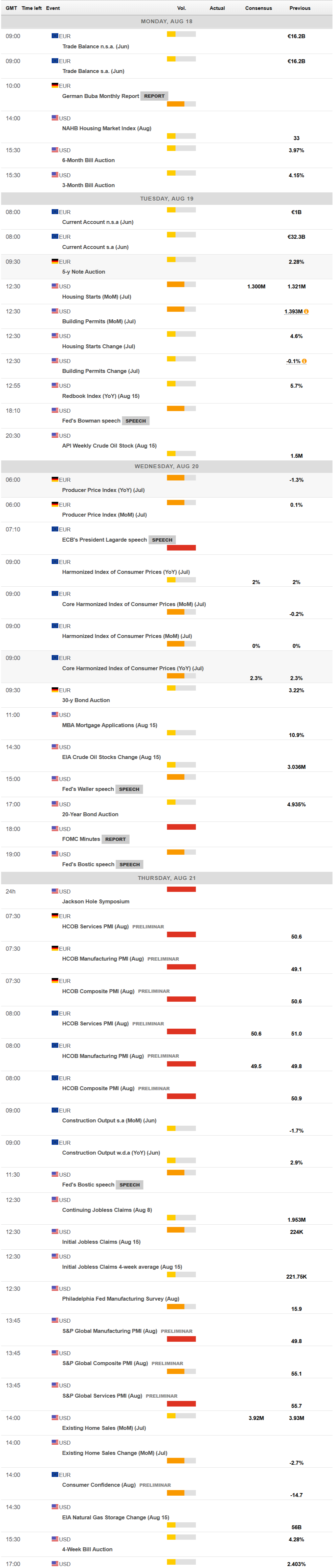

In the upcoming days, there’s not much to worry about until Wednesday, when the European Central Bank (ECB) President, Christine Lagarde, will hit the wires and the Federal Open Market Committee (FOMC) will release the Minutes of the latest Fed meeting.

On Thursday, the Hamburg Commercial Bank and S&P Global will release the preliminary estimates of the August Purchasing Managers’ Index (PMI) for most major economies. The focus will also be on the Jackson Hole Symposium, where representatives from multiple central banks will gather. This year’s theme is “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.” Fed Chairman Powell will be on the wires on Friday, while ECB President Lagarde will take the stage on Saturday.

EUR/USD technical outlook

From a technical point of view, the long-term picture for the EUR/USD pair is bullish, given technical readings in the weekly chart. The pair posted a higher high and a higher low while extending its advance above a firmly bullish 20 Simple Moving Average (SMA). The 100 and 200 SMAs lack directional strength, but remain far below the shorter one. Technical indicators, in the meantime, have resumed their advances within positive levels, in line with another leg north.

The daily chart shows that EUR/USD stands at the upper end of its latest range, also hinting at a bullish extension. A flat 20 SMA provides support at around 1.1630, while the longer moving averages retain their bullish slopes below the shorter one. At the same time, the Momentum indicator crossed its midline into positive levels almost vertically, while the Relative Strength Index (RSI) indicator ticked north and currently stands at around 56, supportive of a bullish breakout.

Beyond the mentioned 1.1730 weekly high, the pair could easily add 100 pips and revisit the year peak at 1.1830. Further gains expose the 1.1900 mark, en route to the 1.1960 region. Below the 1.1630 area, the pair may fall towards the weekly low at 1.1590. Additional losses could see the pair extending its slide towards 1.1470, a strong static support area.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Next release: Wed Sep 17, 2025 18:00

Frequency: Irregular

Consensus: –

Previous: 4.5%

Source: Federal Reserve

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.